Shares of leading Australian airline Qantas Airways [ASX:QAN] spiked 10% on Thursday (13/10/2022), expecting a 1H23 underlying net profit before tax of $1.2–1.3 billion.

Qantas said ‘strong travel demand’ accelerated its recovery, with operational performance improving.

QAN shares are up 10% year to date but are flat over the past 12 months:

Source: tradingview.com

Qantas’ 1H23 update

Qantas hit pre-COVID service levels in the first half of October as travel demand continues to rebound following the pandemic embargo.

Domestic travel is particularly strong.

Revenue intakes for domestic leisure travel have risen to 130% of pre-COVID levels. Revenue for business purposes has rebounded to 100%.

However, domestic performance wasn’t without its hiccups.

Jetstar had a bad September when six of its 11 wide-body aircraft went out of service simultaneously.

QAN blamed lightning strikes, a bird strike, runway debris, and global supply chain snarls. The grounded aircraft have since returned to service, with Jetstar’s domestic and international performance ‘stabilised significantly in October’.

The strength of travel demand is accelerating QAN’s business recovery following five consecutive halves of heavy losses, which in aggregate totalled $7 billion.

For 1H23, however, Qantas expects underlying profit before tax to be $1.2–1.3 billion.

Qantas is also anticipating net debt to fall to $3.2–3.4 billion by the end of 2022.

The forecasted debt position sits below QAN’s minimum target range of $3.9 billion.

And Qantas Loyalty is expecting to post ‘record earnings’ for the first half. The segment is expected to reach its FY23 EBIT target of $425–450 million.

The airline has decided to use another $200 million for funding operational implications, battling high sick leave requests and buffering against supply chain delays.

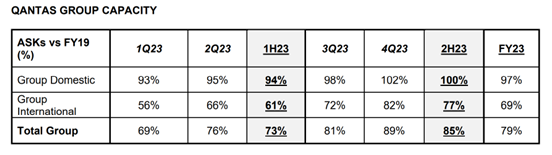

With pandemic woes mostly behind them, Group International capacity is anticipated to surpass 60% of pre-pandemic levels.

Qantas’ CEO Alan Joyce commented:

‘Qantas’ operations are largely back to the standards people expect, and Jetstar’s performance has improved significantly in the past few weeks and will keep getting better with the extra investments we’re making.

‘The fact our financial recovery has accelerated means we can invest more in rewarding our employees, who are doing an amazing job. We’ll spend an additional $40 million a year on permanent pay increases for our people on top of the $200 million in cash and share bonuses we’ve announced for our people.’

Source: QAN

Qantas’ Forecast

Qantas did warn that the wider operating environment ‘remains complex’. QAN said high fuel prices, high inflation, and rising interest rates are ‘impacting on consumer confidence’.

Despite this, the airline thinks people are prioritising travel:

‘Robust demand indicates that people are prioritising spending on travel above other categories, which supports the Group’s ability to fully recover higher fuel costs through fares.’

QAN’s fuel costs are now 75% higher than pre-COVID, but the airline is offsetting this with higher fares.

Five inflation-busting stocks

Qantas and its customers aren’t the only ones dealing with higher fuel costs and higher inflation.

The malaise is widespread.

Few are immune to inflationary pressures.

Households and businesses all over are feeling the pinch.

But some businesses are better placed to deal with inflation than others.

In fact, some stocks might even be ‘inflation busters’ in the current environment.

Our team has recently put together a research report on our five top dividend stocks.

Regards,

Kiryll Prakapenka,

For The Daily Reckoning Australia