The Qantas Airways Ltd [ASX:QAN] share price is rising today despite an FY21 underlying loss before tax of $1.83 billion as the market senses a recovery.

A $12 billion revenue impact from COVID in FY21 was not enough to sour investor sentiment.

At time of writing, the QAN share price was up 3.5%, trading for $5.04 a share.

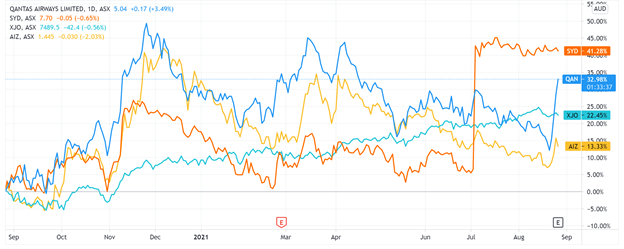

Highlighting the forward-looking nature of the market, QAN has gained 32% over the last 12 months, outperforming the ASX 200 by 10%.

Qantas FY21 highlights

QAN’s statutory loss before tax — which includes one-off costs such as redundancies and aircraft write downs — came to $2.35 billion for the full year.

The airline attributed a $16 billion total revenue loss to COVID as international borders were closed and domestic travel was limited.

Qantas did say that due to periods of open domestic borders in the second half of the year, it saw ‘significant cash generation by Qantas and Jetstar’.

This cash generation eased net debt from $6.4 billion in February 2021 to $5.9 billion by the end of June.

The group’s underlying EBITDA stood at $410 million, which was in line with the guidance provided in May.

Statutory Net Free Cash Flow stood at $267 million in 2H21.

QAN ended the year with total liquidity of $3.8 billion, which it said can provide a buffer against uncertainty.

In positive news, the company’s freight segment delivered a ‘record performance’, offsetting QAN’s cost of idling international operations.

Qantas Group CEO Alan Joyce said:

‘This loss shows the impact that a full year of closed international borders and more than 330 days of domestic travel restrictions had on the national carrier.

‘The trading conditions have frankly been diabolical.’

Qantas Domestic

- Revenue dropped from $4.6 billion in FY20 to $2.7 billion in FY21.

- Underlying EBITDA stood at $159 million, a drop from $907 million in FY20.

- Underlying EBIT loss of a whopping $590 million.

- Seat Factor dropped from 75.9% in FY20 to 58.3% in FY21.

Qantas International (including freight)

- Revenue dropped from $6.0 billion in FY20 to $1.5 billion in FY21.

- Underlying EBITDA at $117 million, a drop from $846 million in FY20.

- Underlying EBIT loss of $575 million.

Qantas Loyalty

- Revenue dropped from $1.2 billion in FY20 to $984 million in FY21.

- Cash Contributions of $1 billion from $1.2 billion.

- Underlying EBIT of $272 million, a drop from $341 million.

- Operating Margins slightly dropped from 27.9% to 27.6%.

- QFF members increased from 13.4 million to 13.6 million.

What’s next for the QAN share price?

The market’s reaction to QAN’s results — which saw QAN shares rise inversely to the airliner’s losses — mirrored the market’s reaction to Sydney Airport Holdings Pty Ltd’s [ASX:SYD] half-year results last week.

As we covered then, SYD’s revenue dropped 33%, leading to a $97.4 million loss.

But despite the tough results, the SYD share price barely budged.

The market’s reaction to results from Qantas and Sydney Airport indicate the losses did not surprise investors.

With Australia’s ongoing effort to contain the Delta COVID variant, the market has likely already factored in the ongoing impact of border and travel restrictions on QAN shares.

But, as I mentioned last week, the real question for interested investors is how much of QAN’s recovery is already baked in the price.

Qantas noted today that:

‘Vaccination rates are expected to reach 70 per cent of the eligible population during November, enabling domestic lockdowns and border restrictions to be steadily eased.’

The step up in the country’s vaccination rates is a positive for Qantas.

After all, the airline boasts a large share of the domestic market.

If November sees border closures lifting, we could also see a related lift in QAN’s domestic revenue.

Furthermore, the company said that its recovery plan is expected to deliver an additional $200 million of cost benefits in FY22.

Qantas is an iconic Australian business.

But its sustained losses due to the pandemic may make some investors wary amid the ongoing uncertainty stirred by coronavirus.

There are stocks whose profitability is not contingent on governmental responses to the pandemic.

Stocks that are still largely unheralded but possess ideas so new they can disrupt whole industries.

Seven of these stocks were just recently profiled and analysed by our market analyst Murray Dawes in his latest report.

If you’re interested, you can read Murray’s report here.

Regards,

Kiryll Prakapenka

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here