The Qantas Airways Ltd [ASX:QAN] share price edged 1% higher today following a market update regarding the airline’s recovery.

Qantas, heavily impacted by travel restrictions in 2020, saw its share price drop as low as $2.36 in March 2020.

But with Australia suppressing local transmission and beginning to roll out vaccines, QAN shares are on the rebound, currently trading at $5.23 per share.

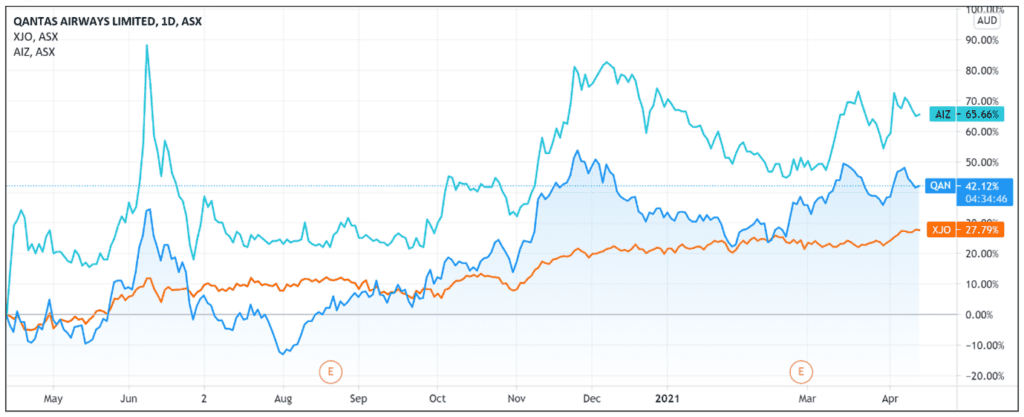

Year-to-date, the Qantas share price is up 7% and up 45% over the last 12 months.

Source: Tradingview.com

Qantas upgrades domestic capacity to 90%

Today Qantas revealed its domestic capacity would hit 90% of its pre-COVID levels in Q4 FY21, bolstered by strong leisure demand and recovery in corporate business travel.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

The airline previously expected to reach 80% capacity.

Just 25% of the carrier’s aircraft were active at the height of the national lockdown in 2020.

The company stated that growing domestic demand and the opening of a two-way travel bubble with New Zealand are ‘helping keep the Qantas Group’s recovery on track.’

Qantas now expects Jetstar to ‘exceed 100 per cent due to strong leisure demand’.

The domestic recovery means that all Qantas and Jetstar domestic crew are now back at work.

This follows last month’s news that Qantas’ international crew will receive a $500 a week wage payment until October under the federal government’s $1.2 billion aviation tourism support scheme.

As a refresher, we covered the support package here.

Uptick in domestic travel demand

As part of today’s announcement, Qantas shared key figures on the impact restrictions had on its bottom line.

The lockdowns during the usually busy Christmas and New Year travel period cost Qantas about $400 million in lost earnings for FY21.

And the recent Brisbane lockdown on the eve of Easter travel period cost the airline a further $29 million in lost earnings for FY21.

However, Qantas believes the current environment is ‘characterised by extremely strong leisure demand’.

QAN attributed the demand spike to the aforementioned federal support package and also to the return of the ‘majority of corporate and small to medium business travel’.

The airline’s upgraded estimate of over 90% of its pre-COVID domestic capacity for 4Q FY21 depends on there being no ‘significant border closures’.

Qantas expects domestic capacity growth to continue in FY22, forecasting Jetstar to reach 120% of pre-COVID levels and Qantas to be at 107%.

Virgin Australia expanding fleet to ramp-up domestic capacity

Qantas’s update follows Virgin Australia Holdings Ltd [ASX:VAH] announcing that 10 leased Boeing Co BA 737 planes will return to its fleet as Virgin seeks to reach more than 80% of pre-COVID domestic capacity by mid-June.

Virgin Australia — now owned by Bain Capital — entered voluntary administration last year and sent many of its 737 planes back to lessors.

Virgin Australia chief executive Jayne Hrdlicka commented that ‘more aircraft means more flying, and with easing travel restrictions, there are more opportunities to further support domestic tourism and the nation’s economic recovery from COVID-19.’

The airline did suspend the sale of most New Zealand services until 31 October despite a two-way travel bubble between Australia and New Zealand opening on 19 April.

Virgin explained it wishes to first secure its position in the domestic market.

QAN share price outlook

Just before COVID restrictions hit international travel last year, QAN shares were trading at all-time highs, reaching as high as $7.30 in November 20219.

Can QAN shares scale those heights again and how long will it take?

Qantas noted that its short-term strategy is to generate positive cash flow rather than returning to pre-COVID profit margins.

QAN explained this means the ‘positive impact on FY21 earnings from this increased activity will be relatively small.’

On the other hand, the airline expects the low fares to continue stoking demand.

While QAN’s domestic recovery is gaining speed, the full resumption of international travel will likely play a big role in QAN’s long-term share price performance.

At this moment, it is unclear exactly when international travel will resume.

The Sydney Morning Herald reported that Health Minister Greg Hunt even suggested at a news conference on Tuesday that international border closures could last much longer and ‘stay in place even if the entire population had been vaccinated against the coronavirus.’

Qantas noted that some of its aircraft operating international flights like the Airbus A330s and Jetstar 787-8s have not resumed flying.

Its entire A380 fleet is still in ‘long-term storage’.

The airline is maintaining flexibility to ‘bring forward, push back or stagger the resumption of our international flights to align with any updates to the Australian Government’s COVID-19 vaccine rollout or approach to international travel.’

Buoyed by Qantas’ domestic performance, investors will now likely turn their attention to macro factors impacting the airline’s grounded international fleet.

If you’re looking for undervalued stocks and seeking out real value in this environment, I’d recommend checking out Greg Canavan’s Life at Zero presentation.

He outlines how persistent low rates can flush cash into the market and the ways in which you can invest based on this.

It’s an insightful analysis of a potential future ‘cash panic’ and I highly recommend listening to what he has to say.

Regards,

Lachlann Tierney

For Money Morning

P.S: Promising Small-Cap Stocks: Market expert Ryan Clarkson-Ledward reveals why these four undervalued stocks could potentially soar in 2021. Click here to learn more.