Company results are coming in thick and fast now. We’re in for a monster week.

You might end up with the same conclusion as me: the Australian economy isn’t as bad as the mainstream press make it out to be.

Take advertisers oOh!media [ASX:OML] and Seven West Media [ASX:SWM], for example.

Both have held the line on releasing their latest updates and show that advertising spending is pretty robust, all things considered.

The Weekend Australian quoted a guy from investment bank UBS as saying that earnings ‘beats’ outnumber the misses 3-to-1 so far.

However, what’s absent is any buying pressure to rerate stocks higher.

The bar is very high right now. I think there are simply too many macro concerns around Ukraine, energy, inflation, and interest rates to get bullish short term.

Here’s one idea when momentum and sentiment aren’t around: focus on companies with great assets.

One example, to me at least, is Stockland Corp [ASX:SGP]. This is Australia’s biggest residential property developer.

I spent some time digging around its annual report over the weekend.

Sales for the financial year just gone were solid.

The next six months look a touch weak in terms of new sales and enquiries, but there’s enough already on the books to keep it busy.

Industrial and logistics are firing, but the commercial office component of their business is still under pressure from the COVID shift.

Broadly, you and I know that the property cycle is in a bit of a trough. That’s not the same as a cataclysmic crash.

The good times will come again…and Stockland is in prime position to cash in when it does.

How so?

Its landbank is huge: 75,000 lots! That’s more than 10 years of supply at its current annual sale rate.

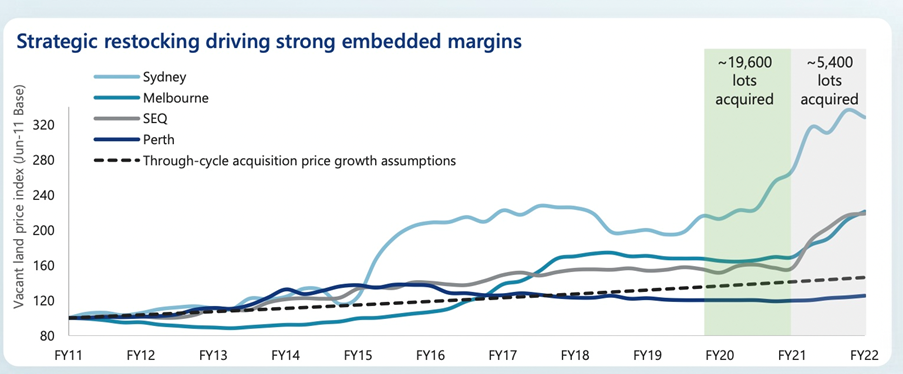

Also, check out the graph the company included in its report, showing the land value moves on its recently acquired NSW, Queensland, and Victorian sites:

|

|

| Source: Stockland |

That land is a competitive advantage.

And what’s this?

Already, I’ve seen a commentator at The Australian call for the new Labor Government to put out another first home buyer grant because its share of new sales is falling. Investors are now driving the market.

I don’t doubt some form of first home buyer stimulus will appear from state or federal governments. The political and economic cycles practically guarantee it, to my mind.

We can’t time that, even if I’m right. But buying Stockland during the current weakness looks like a reasonable idea on a 2–3-year time frame, with dividend income in the meantime.

I don’t expect the price to do much for the next six months, so keep an eye on it. The company expects sales to skew to the second half anyway.

We can keep an eye on housing and interest rate developments to ensure the basic thesis is on track.

In my service, Australian Small-Cap Investigator, I’m urging my subscribers to buy two small companies in this same sector.

The property sell-off in the last 12 months has been brutal, and, I think, way overdone.

Picking them up now positions you for the next upswing.

And the market looks like it’s already turning…

Consider the following from the Australian Financial Review this morning:

‘Auction volumes picked up for a second week across Australia’s east coast-dominated residential property market and the proportion of homes sold hit a 12-week high, signalling the important spring selling season has begun.’

Real estate expert Catherine Cashmore also tells me things are holding up on the ground reasonably strong.

Catherine was at an auction on Saturday and this place sold for more than $100k over the reserve, with seven bidders.

That doesn’t sound like a crash to me.

For those of you in the share market, every month, I do a special ‘Top 5 Stocks to Buy’ release from the Australian Small-Cap Investigator buy list.

As I write this, one of those stocks is up 9% after releasing its latest results and announcing a buyback (the general market is down).

Two of the other stocks for August relate to the real estate market. These are longer-term ideas.

Doesn’t practically every investment book tell you to be contrarian to get a shot at the best values?

It doesn’t always work, but the bias to rising property prices here is so strong I think it’s a fantastic bet.

I’m not suggesting anything I’m not doing with my own money either.

Go here to get subscribe to Australian Small-Cap Investigator with a 30-day money-back guarantee.

My latest issue is due to go out this week!

Regards,

|

Callum Newman,

Editor, The Daily Reckoning Australia