In today’s Money Morning…right now they couldn’t be more wrong…housing leads the economic bounce…bye-bye banks…and more…

Say what you will about the Australian property market, but it is undeniably resilient.

The fact that prices barely budged amidst a global pandemic and our first recession in 30 years is a testament to their strength. Casting doubt on all the naysayers who have constantly called it a debt-fuelled time bomb.

That hasn’t stopped them from trying though…

Earlier this week an article from Jim Rickards’ Crash Speculator was shared around our office. A piece that delved into the history of our housing market:

‘Since 1990, the average Australian house price has surged twelve-fold, to more than A$600,000. Today, interbank lending rates are just 0.1%.

‘Housing is now such a lopsided part of Australia’s economy that it sparked a political backlash. Compared to the better-diversified U.S. economy’s housing bubble that peaked in early 2007, housing has a far stronger influence on the Australian economy.’

Now, I have a great deal of respect for Jim Rickards, and those who work for him. Even if I don’t always agree with their conclusions.

As you may have guessed, this particular article is once again calling for a bust in our property market. Relying on the same old logic argument of growing debt, unsustainable prices, and weakening demand.

And they may eventually be right, but right now they couldn’t be more wrong…

Three Innovative Fintech Stocks to Watch Now. Discover more.

Housing leads the economic bounce

As the AFR reported yesterday, Australians are feeling optimistic.

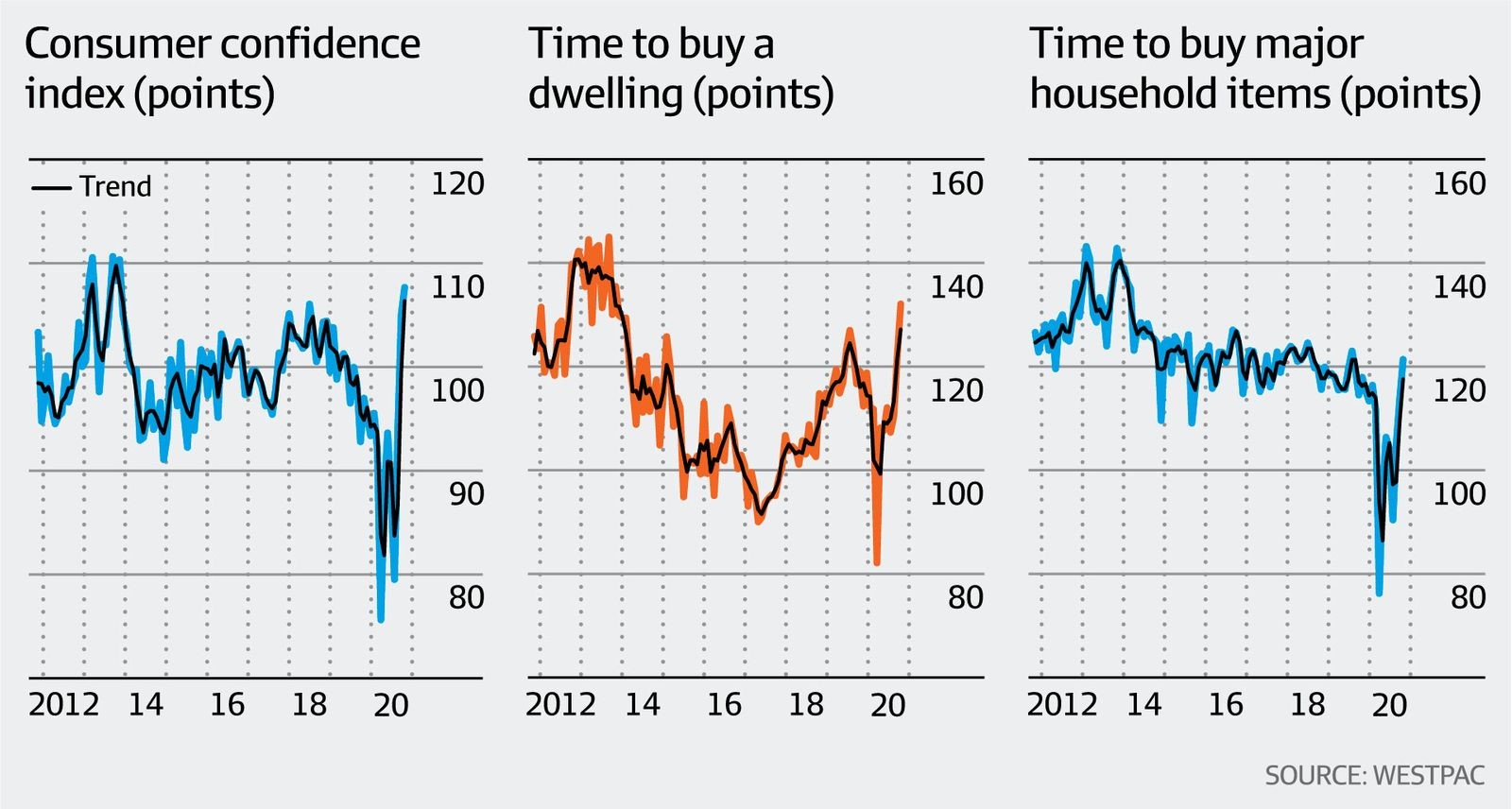

Consumer confidence and property buying intentions have spiked to levels not seen in years. Triggering the largest recorded rises ever seen. Bringing us back to late 2013/early 2014 levels of confidence.

Take a look for yourself:

|

|

| Source: Australian Financial Review/Westpac |

As you can see from the first two graphs, the indices are flying. Suggesting that the worst may be over for our pandemic-led downturn. And, more importantly, that the property market may be the key to getting our economy back on track.

Obviously, a big reason for this surge in potential property buying is because of interest rates. Which are now sitting at the lowest level ever of 0.1%. With Dr Lowe all but confirming they will stay low for quite some time to come.

For that reason, it seems like a once in a lifetime opportunity.

A chance for people to take their chances at seizing the Australian dream of home ownership.

So, naturally, this should be good news for the banks as well right?

With property demand on the up, loans should follow suit. A scenario that one would think would return the Big Four to the days of record profits and growth once more.

Well, I’m certainly not holding my breath.

Bye-bye banks

We learnt earlier this week that Commonwealth Bank of Australia [ASX:CBA] added $5.6 billion worth of new loans to its books for the September quarter. Setting a blistering pace compared to its peers.

Not to mention improvements across a variety of other areas.

But it wasn’t enough to offset a 16% slide in their cash profit year-on-year. A result that, in the bank’s own words, was due to lower interest rates and more competition.

That’s without even getting to the issue of bad loans and possible defaults, either. An issue that is steadily being rectified but is still lingering as a possible threat to the banks’ bottom line.

My point is, despite all the progress the bank has made, it isn’t reaping any of the reward. A situation that is no anomaly. Because as AFR even put it:

‘No matter how well a bank executes and competes, growth will be hard to find.’

We are simply entering new territory for the lending industry. One that revolves around tighter margins, and an increasingly diverse competition. And not just from the traditional banks either…

No, as my Money Morning co-editors and I have long said: the banks are under siege.

It is the fintech sector — with its streamlined services and low overheads — that will be the real winner. Companies that are rapidly moving into the lending sector.

Last year, for example, roughly 21% of all fintechs had a focus on lending. Today, that figure has jumped up to 29%!

Making it a close second to the leading focus of ‘payments, wallets, and supply chain’. Which currently accounts for 30% of the fintech scene — including all the ‘buy now, pay later’ (BNPL) providers.

So, it may only be a matter of time before we see a fintech loan provider do what BNPL has done to credit cards, for example. Providing a more popular and lower-cost alternative for consumers.

Personally, I believe it is already happening. With the rise of fintech lenders like MoneyMe Ltd [ASX:MME], Money3 Corporation Ltd [ASX:MNY], Wisr Ltd [ASX:WZR], and QuickFee Ltd [ASX:QFE] — just to name a few.

Because while they may not have the size or history of a traditional bank, they are far more promising. Able to use digital platforms to provide faster and cheaper lending services that can extract more value from the thinner margins.

In a low interest rate world, the lender with the least costs wins. And the banks with their ageing systems, obsolete branches, and grandfathered services will not be able to compete.

Instead, I firmly believe that this new breed of lenders will be the real winners of this property bounce. Even if it is short lived.

After all, until I see it with my own eyes — it is hard to bet against our local property market.

But it is far easier to bet against an ailing banking system that is in need of an overhaul.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Discover three innovative Aussie fintech stocks with exciting growth potential. Download your free report now.

Comments