Diversified property group GPT [ASX:GPT] posted operational highlights for the March quarter and claimed some wins despite widespread concerns buffeting many sectors as rates continue to rise.

GPT was dropping its share price by nearly 1% in early morning trade, trading for around $4.39, but it did move up slightly as the day wore on.

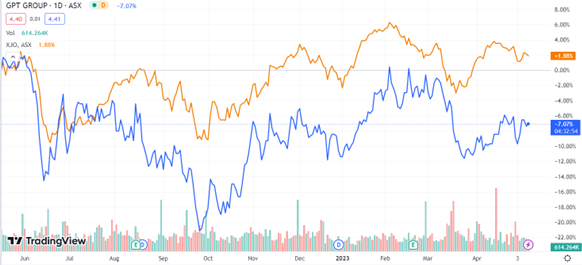

By mid-morning, the property investment fund’s own stock had increased by 5% so far in 2023, yet still traded lower than the wider market’s average by around 9%:

Source: TradingView

GPT’s March quarter operations

GPT owns a portfolio of assets worth $26.9 billion. Today, the group wished to update its shareholders on the progress in leveraging that portfolio as the economy moves out of COVID-19 pressures, yet more firmly into a highly inflationary environment.

GPT CEO Bob Johnston revealed that the group has not been as badly affected as others in the harsh environment, with the group maintaining 97.6% occupancy across its diversified portfolio.

He also stated the group remains on track to deliver on its earnings and distribution guidance for 2023.

Funds from operations went up by 11.9% to $620 million, and distributions per security climbed by 7.8% to 25 cents.

Funds under management also increased by 44% to $19.1 billion, and the Australian Bureau of Statistics (ABS) retail sales growth for the three months to 31 March were up by 6.4% year-on-year.

The company says these results show a resilient retail environment, particularly with the return of students and office workers to the CBD continuing to drive sales momentum.

GPT continues to expect to deliver 2023 operational funds of approximately 31.3 cents per security and a distribution of 25.0 cents per security.

Mr Johnson reflected:

‘We continue to see good momentum across our Retail portfolio, with high occupancy and sales productivity driving performance. While elevated interest rates and inflationary pressures are expected to moderate retail sales growth over the course of 2023, GPT’s portfolio is well placed given positive leasing demand and structured rental increases.

‘The office market remains challenging, with elevated vacancy and relatively subdued leasing demand, however we continue to see the flight to quality as a driver of new leasing activity and Office portfolio occupancy has been maintained at 88% during the period.’

Macro outlook for GPT and wider markets

While GPT did admit to rising competition and ongoing challenges in the wake of COVID-19, it will be curious to see how the macro environment effects its business in coming months.

After all, there are other incoming factors at play. Although GPT has not yet been hit by them, that might be about to change.

Headlines have been thrown around the Australian budget today and how it doesn’t seem to work in favour for the RBA getting interest rates down.

The government has made a lot from gas, oil and energy taxes, but a lot of that revenue has gone to spending in the economy. This only adds to inflationary pressure and makes it more difficult for the RBA to stop raising rates.

Yesterday, the ABS also released retail sales data, and it showed that retail volumes fell by 0.6% in the March quarter and 0.3% December quarter — the largest fall in retail sales volumes since 2009 (apart from COVID).

People are definitely spending less, and this will have a ripple effect in all industries.

Are you prepared for the big economic shift?

The change is all around us: on supermarket shelves, in closing banks, soaring prices, shrinking packaging, and gaps in the workforce.

Jim Rickards, one of the world’s top financial and geopolitical analysts, has joined the dots nobody else has.

Australia is going to be looking very different very soon, and so will everyday life…

If you want to know how you can prepare for the biggest geoeconomic shift of our lifetime, and get an explanation from Jim Rickards himself, click here to learn more.

Regards,

Mahlia Stewart

For The Daily Reckoning Australia