The latest ABS data shows building approvals rose 18.5% in December (seasonally adjusted).

It’s a sharp U-turn after three months of falls.

ABS head of construction statistics Daniel Rossi said, ‘the result was driven by a number of large apartment developments approved in New South Wales and Victoria’.

We can expect more of this throughout 2023/24.

In fact, I’d go so far as to say we’re on the brink of a building boom.

And that’s exactly what we would expect as we approach the final few years of the cycle — leading into the peak around 2026.

I addressed some of the reasons for an inevitable uptick in building activity in last week’s Land Cycle Investor.

‘2023 is set to be the “year of migration”.

‘Net overseas migration is already rocketing back toward record levels. But those figures are being led mostly by students…

‘…40,000 university students are scrambling to make it back to Australia in time for the new semester.

‘It comes after the Chinese government announced a ‘snap ban’ on recognising online degrees obtained from foreign institutions.

‘Therefore, thanks to Chinese policy, things are about to get very tight in inner-city markets.

‘…Simply put, there’s nowhere for the incoming migrants to live…’

Despite inflation, rising costs of living, and increased borrowing costs — the established housing market is in dire straits.

There’s not enough stock on the market for sale or rent.

If folk can turn their heads away from the doom and gloom ‘propertycrash’ headlines that are still hitting the news, they’d see the dynamics in the property market have already started to change due to this.

In fact, early indicators show the balance could be starting to tip back in favour of vendors.

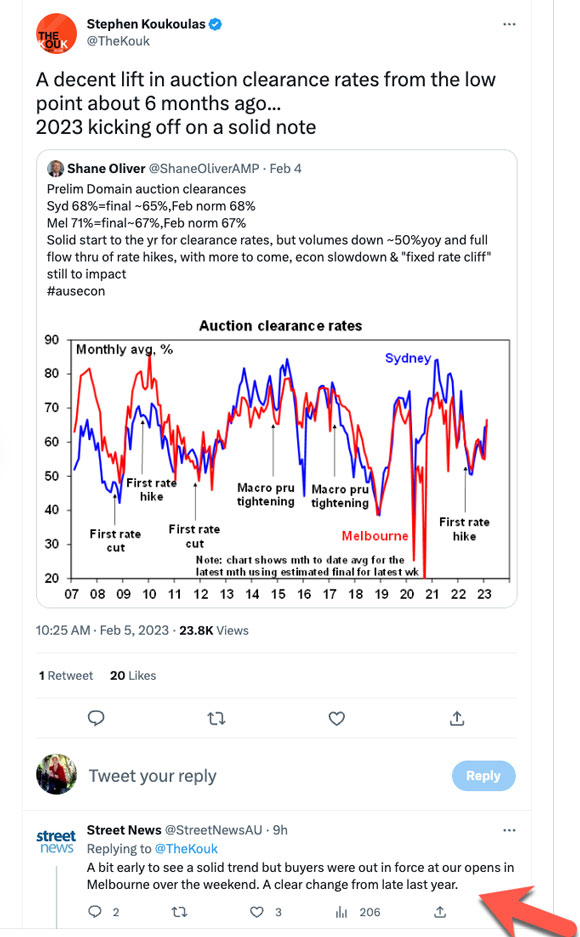

Clearance rates have ticked up (albeit in low volumes) over the last couple of weeks. And stories are circulating showing that crowds of buyers are queueing to go through open homes in some regions.

A stark change from where we were mid-2022.

From the Daily Telegraph:

|

|

| Source: Daily Telegraph |

‘Agents reported multiple listings with more than 50 groups of would-be buyers going through the doors, including a Glebe townhouse that attracted 80 groups and a Petersham house with 60 groups.

‘Thirty groups at a single inspection is generally considered within the industry to be an excellent turnout.

‘Most attendees were understood to have started their search for a new home this year.

‘It comes as PropTrack data showed buyers have been grappling with a shortage of new listings this year, with the scarce supply of ready-to-move into properties funnelling buyers to the same properties…’

And…

|

|

| Source: Twitter |

We’ve seen similar conditions before with low stock, but it’s never been this tight in the rental market.

Vacancy rates are at record lows.

That means local governments are under tremendous pressure to fast-track larger developments.

With yields still rising strong, 2023 will likely see the investor market increasing on the back of it — with large numbers eyeing the apartment market.

There’s already an early indication.

From News Corp:

|

|

| Source: News Corp |

‘Fashion icon Robby Ingham of the famous Ingham chicken family has achieved a rare feat in today’s property market — all the apartments in his $60m new development sold out in five hours.

‘Mums and dads from the lower north shore buying for their kids pounced on the $2.1m designer one-bedders while eastern suburbs downsizers and investors paid up to $4.5m for luxurious 103sqm two-bedders all one level.

‘The doors of the sales suite opened at 9am and all of the apartments being sold off-the-plan — built by early 2025 — were gone by 1pm.

‘A lot missed out — Stewart had 95 appointments booked…’

I’m not sure how many kids are lucky enough to win the parent lottery to receive a $2.1 million designer one-bedder. But still, tight rental conditions are pushing more ‘mums and dads’ to become buyers — particularly in Brisbane, where conditions are tightest.

From ABC News:

‘Chris Foster said his daughter decided to ditch student accommodation in the hope of securing a better deal elsewhere.

‘Since December, they have attended about 35 apartment inspections and been repeatedly knocked back by real estate agents.

‘The situation got so dire, Mr Foster said he seriously considered buying an apartment instead….

“We did get to the point where we were offering rent six months in advance, and all sorts of stuff to try and secure it,” Mr Foster said.

“We inspected a couple of properties where we saw well over 100 couples going into see that property — there’s one that I’m sure had north of 200 people that were having a look at it.”

“We are still considering buying a property … and that’s mainly because of the lack of rentals that are out there.”’

These are the dynamics that will put a floor under the market and prevent further sharp downturns in median prices through 2023.

The other thing we’re monitoring at this point in the cycle are announcements of the regional and world’s ‘tallest’ buildings being constructed.

Opening dates ranging 2025–27 — right at the peak of the cycle — just as we would expect.

Some of the mixed-use (office and residential) towers included in the list are:

- (UK) Brum’s Octagon, Birmingham’s tallest building — due for completion in 2025.

- (UK) Manchester’s tallest building boasting 71 storeys, a top-floor restaurant, and a sky pool — due for completion in 2025.

- (Melbourne, Australia) Beulah International to build Australia’s tallest building in Southbank — due for completion in 2027.

- (Florida, USA) The Waldorf Astoria, Miami’s first supertall tower at 319.7 metres tall — due for completion in 2026.

- (Toronto, Canada) The Forma Skyscrapers, designed by Frank Gehry. Once complete, they will be the two tallest buildings in Toronto — due for completion in 2028.

- (Bangkok, Thailand) One Bangkok, a 436.1 million mixed-use tower and part of the largest holistically integrated district in the heart of Bangkok — due for completion in 2025.

- (Jeddah, Saudi Arabia) The next world’s tallest building. Once completed, it will be more than 1000 metres tall. Construction started in 2013. It was due for completion at the mid-cycle (2020), but due to financial difficulties — completion is possible at the end of this cycle, likely around 2028.

Of course, regular readers will already know that the world’s tallest residential structures — and those that break country records — are a reliable indicator for timing the mid-cycle or end-of-cycle recessions.

I wrote about this extensively in Cycles, Trends and Forecasts. You can sign up by clicking here.

Note: You cannot accurately time the exact peak of the cycle from these buildings.

But historically, without exception, the tallest buildings will open when the economy is already in — or entering — recession.

A rundown of some of the most notorious skyscrapers and their opening dates demonstrates the point:

- The New York World Building and Manhattan Life Insurance Building — opened during the 1890’s recession.

- 40 Wall St, the Chrysler Building, and the Empire State Building — all opened during the 1930’s recession.

- The Twin Towers and Sears (or Willis) Tower — opened during the early 1970’s recession.

- Petronas Towers — opened during the Asian Financial Crisis of 1997.

- Burj Khalifa — opened during the depth of the 2008–2010 recession.

Finally, I joined Dr Cameron Murray on his latest podcast this week.

Dr Murray is a Postdoctoral Research Fellow in the Henry Halloran Trust at The University of Sydney.

He’s also the author of the excellent book Game of Mates and the second edition of that book, Rigged.

(These are the books you need to study if you want to uncover the tricks of Australia’s super-rich. Namely, rent-seeking!)

After all, this is why we have a land cycle, a commodity cycle, a credit cycle, and, ultimately, a volatile business cycle.

Australia’s economy is built around it.

More than 80% of today’s wealthiest Australians have made their fortunes speculating on property, mining, banking, superannuation, and finance — gaining favourable property rezonings, planning law exemptions, mining concessions, labour law exemptions, and credit creation powers.

If you want to free yourself from wage slavery, you have to learn the game of Monopoly as they have.

In this week’s podcast, we discuss Property investing, cycles, and the legacy of Henry George.

You can tune in here!

I hope you enjoy the conversation as much as I did.

Sincerely,

|

Catherine Cashmore,

Editor, Land Cycle Investor