In August 2008, the late great US economist Mason Gaffney published a paper called, ‘THE GREAT CRASH OF 2008’.

In it, he unlocked the underlying causes of the 2008 financial crisis within the context of the 18-year cycle.

Here’s a little of the introduction:

‘This crash is The Big One; it has the signs of becoming a Category 5.

‘How do we know?

‘We’ve “been there and done that” so many times before, roughly every 18 years over the last 800 or more.

‘Major wars and, rarely, plagues have broken the rhythm, along with the little ice age, reformation and counter-reformation, political revolutions and reactions, the rise of nation-states, the enclosure movement, the age of exploration, massive European imports of stolen American gold, the scientific and industrial revolutions, the Crusades, Mongol and Turkish invasions, and other upheavals….

‘Yet, the endogenous cycle keeps returning, as soon as we find peace, and economic life returns to its even tenors.

‘What President Warren Harding famously called “normalcy” soon evolved into another boom and a shocking bust, as so often before.

‘Calm and routine prosperity has never been man’s lot for long: it somehow leads to its own downfall, cycle after cycle…’

The paper has many nuggets of gold buried within the research.

It’s a landmark piece of writing and a must-read for every student of the real estate cycle.

But amid the commentary, Gaffney noted the following:

‘Modern Georgists enter this period of danger and opportunity in relatively good shape. Several have outstanding scorecards calling the current crash.

‘These include

- ‘Fred Foldvary (2007, The Depression of 2008);

- ‘Fred Harrison (2005, Boom/Bust);

- ‘Michael Hudson (2006, “Guide to the Coming Real Estate Collapse”, Harper’s, May) and,

- ‘Bryan Kavanagh (2007, Unlocking the Riches of Oz).

‘Each has a slightly different take on it, but they all saw it coming and stuck their necks out, far out, to forecast it in print.….

‘These Georgists who foretold this crash deserve a hearing, in preference to those who failed, and certainly to those who still deny it…’

For Gaffney to mention those names within his paper is high praise indeed.

Mason (or Mase as he was known to his mates) was one of the most prominent Georgist economists that lived.

Former Professor of Economics at UC Riverside from 1976–2015, he sadly passed away during the pandemic at the age of 96 — left behind a monumental body of work.

Numerous books, articles, and research papers, including The Corruption of Economics (a must-read co-authored by Fred Harrison) and After the Crash: Designing a Depression-Free Economy.

He was, of course, also an expert on the drivers behind the 18-year real estate cycle (you can read more about Gaffney’s work here).

As mentioned by Gaffney, the Georgists who forecasted the crash certainly deserve a hearing.

However, the mainstream media never gives voice to the economists with a solid record of forecasting the booms and busts in the economy.

They’re considered mavericks in their profession.

It’s still thought impossible to accurately forecast future recessions by the powers that hold influence over monetary and fiscal policy.

Notably, only a few weeks ago, the MSM was broadcasting news that ‘experts’ were warning of at least a 20% peak-to-trough fall in the national median — and buyers were running scared.

|

|

| Source: News.com.au |

Now the advice in the mainstream is to get in quick before prices take off!

|

|

| Source: 7 News |

‘Victorian home buyers are being warned to get in quick before property prices begin to rise again — real estate experts say a perfect storm of factors means that is now a small window of opportunity to snap up a bargain…’

You have to smile.

Are we facing a boom or bust?

We’re fully expecting another surge into the peak of 2026, based on the study of cycles that have repeated themselves (in the same pattern and same sequence) for centuries.

A boom in both price and building.

Get ready for it.

One thing you can be sure of is that the MSM won’t forewarn you in advance of the crash into 2028.

Point being, you’ll never get accurate information watching the news.

Mentioned in Mason’s paper are researchers you should take note of.

Let’s briefly run through who they are.

Fred Harrison

You may already be familiar with Fred’s vast body of research.

He has given many interviews for Cycles, Trends & Forecasts subscribers over the last year or so.

He forecasted the recession of 1991 — eight years before it happened. And the great financial recession of 2008 in 1997 — 11 years before it happened.

In 1997, he wrote in his book, The Chaos Makers:

‘By 2007 Britain and most of the other industrially advanced economies will be in the throes of frenzied activity in the land market…land prices will be near their 18-year peak…on the verge of the collapse that will presage the global depression of 2010.’

In 2015, on his website, he forecasted a ‘mid-cycle crash’ for 2019–20.

Fred Harrison’s track record is unsurpassed.

Fred Foldvary

Fred Foldvary passed away on 5 June 2021 at the age of 75.

He was a researcher and author on public finance, governance, ethical philosophy, and land economics, as well as an avid supporter of the teachings of Henry George.

He taught at a number of universities throughout his career, including Santa Clara University in California from 1974–94 and the University of California, Berkeley.

Fred studied the cycle as it applied to the US market back to the 1800s.

You can browse through some of his many papers and magazine articles here.

Foldvary is renowned for going on record in the American Journal of Economics and Sociology in 1997 and predicting the exact timing of the 2008 economic recession — 11 years in advance!

In 2007, just prior to the downturn, he repeated that prediction in an interview.

He was asked why he still felt it would happen while the economy looked ‘so God damn good!’.

Michael Hudson

Michael Hudson is a US economist, academic, and researcher best known for his contributions to the field of heterodox economics.

His most notable contribution to mainstream economics came in his prediction of the 2008 financial crisis.

He had been warning for years prior to the crisis that the housing market was in a bubble and that the widespread use of subprime mortgages was unsustainable.

He also argued that the excessive use of debt and financialisation of the economy was creating a dangerous situation that could lead to a major recession.

The article Mason mentions in his paper ‘The New Road to Serfdom — An illustrated guide to the coming real estate collapse’ written before the 2008 GFC in 2007 is another must-read.

Here’s an excerpt:

‘Never before have so many Americans gone so deeply into debt so willingly. Housing prices have swollen to the point that we’ve taken to calling a mortgage — by far the largest debt most of us will ever incur — an “investment.” Sure, the thinking goes, $100,000 borrowed today will cost more than $200,000 to pay back over the next thirty years, but land, which they are not making any more of, will appreciate even faster. In the odd logic of the real estate bubble, debt has come to equal wealth…’

Bryan Kavanagh

The last name mentioned by Gaffney is our very own Bryan Kavanagh.

If you’re on Twitter, you may have seen some of Bryan’s tweets under the handle @bryankav123.

Bryan is a long-standing member of Prosper Australia’s executive committee (the longest-running Henry George association in the world).

He’s a retired real estate valuer and resident expert on both the 18-year real estate cycle and the Kondratieff wave.

Bryan worked in the Australian Taxation Office in Melbourne in 1971 and the Commonwealth Bank of Australia in 1989 before co-founding a private valuation practice in 1997 and retiring in 2013.

He’s also the Kavanagh/Putland Index (KP Index) co-creator alongside Dr Gavin Putland (who was a Member, Department of Electrical and Computer Engineering, at the University of Queensland, 1995–97, a Senior Research Officer Qatar University 1999–2003, and Research Officer for Prosper Australia from 2002–13).

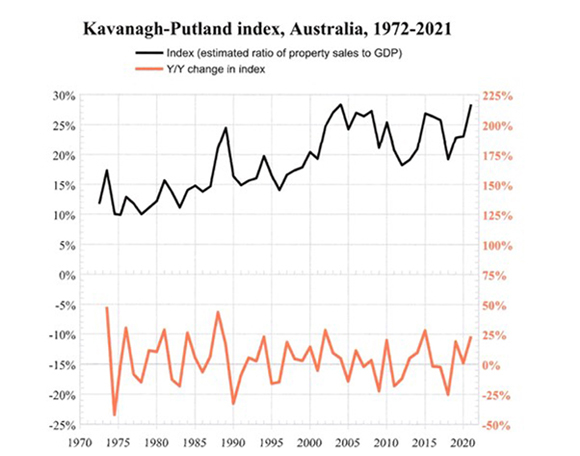

Here’s a copy of the index:

|

|

| Source: Prosper Australia |

It has proven to be a very reliable indicator of economic recessions some 12–18 months in advance.

It’s not an index that shows whether real estate prices are going up or down.

Rather, it focuses on the total value of transactions for both commercial and residential (basically monitoring people’s ability to access credit and buy).

The index charts the ratio of the total value of Australian real estate sales to GDP.

It is called an ‘index’ rather than a ‘ratio’ because it is based on a varying sample. (The data is correlated from a range of different sources as specified here.)

To explain what the index pictures in simple terms, think of it as the more dollars we pour into land speculation, the less we have to spend on the productive sectors of the economy.

When land prices are booming, and the total value of transactions are increasing, the seeds of destruction are being sown into the fabric of the economy, laying the turf for a looming recession as soon as the boom culminates, and buyers stop spending.

Especially in a country where the financial system is choreographed around the property industry, and so many businesses are dependent on the so-called ‘wealth effect’ that results from people leveraging debt against rising real estate values.

It is this that provides a better indication of the overall health and long-term direction of the economy — rather than median price data or auction clearance rates that dominate the mainstream media.

The KP Index is a valuable leading indicator to identify when the recessions (mid-cycle and end-of-cycle recessions) will occur. And for this reason, you’ll probably never see it spoken of publicly.

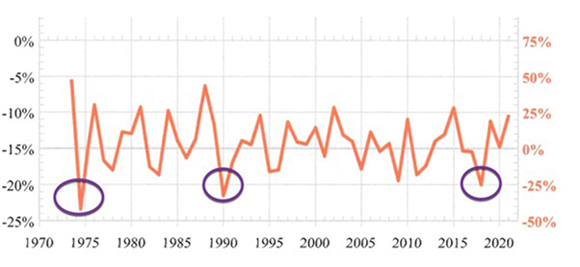

The KP Index shows that recessions usually occur within 12–18 months of the year-on-year index declining by 25% or more (noted from the right-hand axis):

|

|

| Source: Prosper Australia (Edited by Catherine Cashmore) |

You can see it did this before the end-of-cycle recessions in the 1970s and 1990s.

It did so again in mid-2018, pointing toward recession at the end of 2019 and the beginning of 2020 — the mid-cycle.

It’s this that allowed Bryan to not only accurately call the 2008 real estate collapse but also the 2020 mid-cycle recession a year in advance — as published in MacroBusiness in January 2019 (see below).

Thus, earning him an honorary mention in Mason Gaffney’s paper:

‘Real estate cycle expert Bryan Kavanagh says turnover and price declines in Sydney and Melbourne during 2018 indicate an economic recession in the 2019-20 financial year.

‘The 2018 “Kavanagh-Putland Index”, released today, shows the total value of Australian real estate sales to GDP.

‘Mr Kavanagh said the $50 billion pumped into markets by the Rudd-Swan government in 2008-09 to forestall the 2008 real estate bubble-burst of the USA and Europe “had simply kicked the can down the road for a greater financial correction”.

‘“Led by the residential sector, Australian real estate markets have been in bubble territory since 1996, and the 2018 K-P Index update shows the correction is imminent”, Mr Kavanagh said.

“The Kavanagh-Putland Index demonstrates that recessions usually ensue within 12 months of the year-on-year index declining by more than 25% – and it did this during 2018.”

‘… “Australians have been doing what the tax system has encouraged them to do: to invest in real estate, because their increase in real estate wealth tends to dwarf the wages they’re able to earn”, Mr Kavanagh said.’

Published in MacroBusiness in 2019

This PowerPoint presentation, put together by Bryan Kavanagh, demonstrates not only how the index charts the history of the excessive booms and busts of the last three real estate cycles (spanning from the recession in the early 1970s to the 2008 collapse) as well as the forewarning of the 2020 mid-cycle recession.

It also shows how a change of government is inevitable when the recession hits.

Bryan Kavanagh and Dr Gavin Putland have just updated the index over the last week.

This is a significant update, for if the year-on-year data declined by 25% or more, we could be looking at an early peak to the cycle — no more than 18 months away.

I shared the updated chart with Cycles, Trends & Forecasts subscribers yesterday, so can’t share it here just yet…

For a detailed look at this update, as well as exclusive access to insider information on how you can take advantage of the real estate cycle on the stock market and property markets — consider signing up to Cycles, Trends & Forecasts today!

Best Wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor