The PointsBet Holdings Ltd [ASX:PBH] share price is on the rise as PBH launches online sports betting in West Virginia.

PBH shares are currently trading at $11.43, up 2.70%.

Over the course of 12 months, the PBH stock price has seen some ups and downs but is still up 100%.

PointsBet Launches in West Virginia

PointsBet checked another state off its list.

The company today announced it is expanding operations to the US state of West Virginia.

PBH’s wholly owned subsidiary PointsBet West Virginia LLC successfully secured regulatory approval from the West Virginia Lottery Commission.

West Virginia becomes the seventh operational state for PointsBet’s premium sports betting product after today’s official launch.

This was followed by successful launches in New Jersey, Iowa, Indiana, Illinois, Colorado and Michigan.

PointsBet also has a hand in iGaming in New Jersey and Michigan.

Johnny Aitken, PointsBet US CEO, was optimistic about the future of this company:

‘As always, PointsBet will provide this passionate, sports-loving community with a fast and reliable online sports betting product across every customer touchpoint.

‘We are thrilled to now introduce West Virginian sports bettors to the competitive advantages PointsBet possesses in owning our technology end-to-end, such as our speed and ease of use as well as a deep slate of betting options for every NFL, NBA, MLB, NHL, WNBA, and PGA TOUR contest.’

PointsBet has appointed Aonghus Mulvihill as Vice President of Global Sportsbook Trading.

Mulvihill has nearly 15 years’ experience in international sports betting.

He will oversee PointsBet’s global team of sports analysts, devising and implementing the company’s trading risk management strategy and trading product development.

PBH raises $215.1 million

Today’s expansion update comes after PBH successfully completed a placement raising.

PointsBet raised $215.1 million at $10 per share. This placement was heavily backed by Australian, international, and existing and new institutional shareholders.

The placement price reflects an 8.1% discount to the theoretical ex-entitlement price of $10.88.

A total of 21,506,682 shares were issued.

The new shares were issued on an ex-entitlement basis and ranked equally with all existing shares from the date of issue.

PointsBet’s Managing Director and Group CEO, Sam Swanell, was impressed by the outcome:

‘We are very pleased with the level of support we have received from our existing shareholders and other new institutional investors for the offer.

‘We see the success of the placement element of our offer as a clear endorsement of PointsBet’s long term strategy.’

PBH share price outlook

The official launch of online sports betting in West Virginia backed by raising $215.1 million through institutional placement helped PBH reverse a recent downtrend.

While the stock is down 5% in the last month, PBH has rebounded 18% in the last week.

That said, the company is still underperforming the ASX 200 benchmark by 15% year to date.

Now, what could help PointsBet sustain this week’s momentum is its plan to launch its proprietary online casino product in West Virginia by the end of the 2021 calendar year.

Of course, this will be subject to necessary licensure.

The company’s steady progress in launching its services in America could attract bullish investors who think PBH has plenty of growth left.

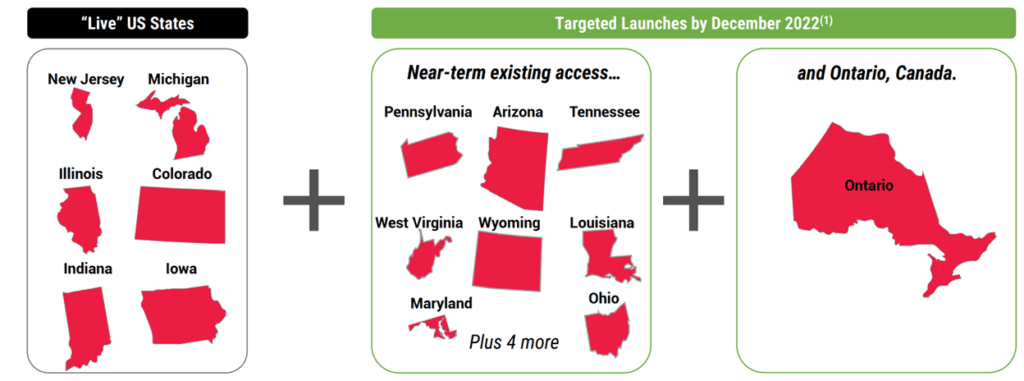

For instance, PBH management flagged a ‘strong pipeline of growth’ in CY22, expecting to launch in 12 US states as well as Ontario, Canada.

All up, the company aims to be operational in 18 US states and Ontario by the end of CY22.

Source: Company presentation

So, bullish investors may see room in this rollout schedule for PBH shares to rise.

Now, with strong AI technology on the backend, PointsBet offers all traditional fixed-odds markets, including sports, racing and other spread betting where wins or losses aren’t fixed but instead depend on how correct the bet is.

AI is an emerging technology with the potential to disrupt plenty of industries and set companies powered by AI apart.

So if you’re interested in AI stocks, I suggest checking out this free AI report.

Regards,

Lachlann Tierney,

For Money Morning

PS: The Next Afterpay? Discover three promising Aussie fintechs that are currently trading below $1. Click here to learn more.