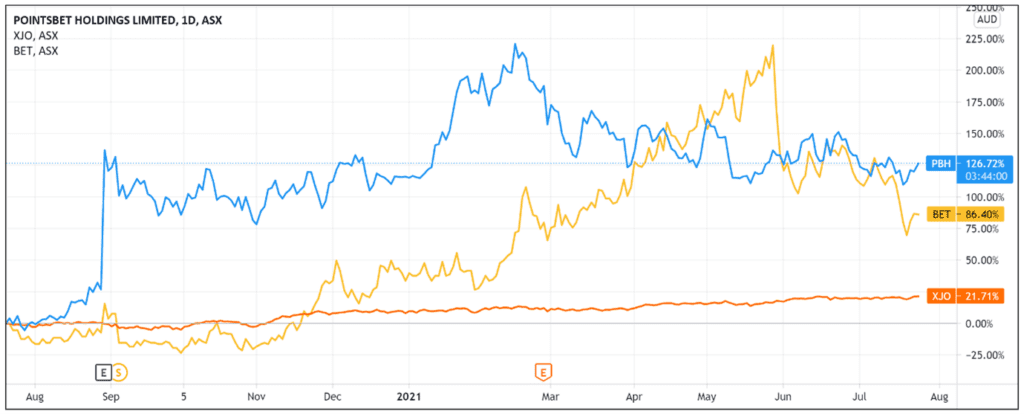

The PointsBet Holdings Ltd [ASX:PBH] obtained authorisation to start iGaming operations in New Jersey, with PBH’s share price rising 5% in early trade.

PointsBet gained approval from the New Jersey Department of Gaming (NJDGE) to operate in the state and has already launched its proprietary iGaming platform there.

Although down from its 52-week high of $18.13, the PBH share price is still up 115% over the last 12 months.

PointsBet expands into US$3.5-billion-a-year industry

PointsBet succeeded in launching its second iGaming operation in the US today, following its inaugural iGaming launch in Michigan back in May.

As we reported then, iGaming captures any activity involving betting online.

That could mean betting on all sorts of live events or game outcomes, and is carried out through sports betting, online casino gambling, and other games like poker and blackjack.

PointsBet thinks iGaming has the potential to ‘represent a significantly larger opportunity than sports wagering.’

Why did PointsBet choose New Jersey as its next iGaming expansion target?

Because according to figures cited by the company, New Jersey’s iGaming revenues grew at a compound annual growth rate (CAGR) of 25% between 2014 and 2018.

But that rate has accelerated since.

In 2019 revenues grew 62%, and in 2020 they grew 101%.

This acceleration likely informed PointsBet’s view that this segment can offer more growth than the more mature sports-wagering segment.

Highlighting the potential further, PBH reported that US iGaming revenues reached nearly US$900 million in the June 2021 quarter alone.

If you were to annualise it, this would equate to revenues worth more than US$3.5 billion per year.

PBH pursues Arizona betting market

Today’s announcement comes after PointsBet partnered with Cliff Casino Hotel earlier this week to pursue access to the online sports betting market in Arizona.

The agreement will see the parties work towards a ‘first skin’ licence to operate online sports betting in the state via PointsBet’s mobile app and website platforms pending final licensure.

Goldman Sachs was upbeat on the news, reiterating their buy rating and sticking with a price target of $17.20 per PBH share.

A $17.20 price target represents a potential 35% upside based on PointsBet’s current share price.

Goldman saw the Cliff Casino Hotel partnership as ‘another incremental positive for PBH following its recent market access agreement in the state of Maryland and positioning for the Canadian sports betting market.’

The broker concluded that the addition of Maryland gives PointsBet ‘direct market access to 16 states in the US (18 including untethered states), placing it on track for its target of being operational in 18 US states by the end of CY22.’

If you’re excited by technology, algorithms, and proprietary machine learning programs, then I think you might also enjoy reading our free report on new small-cap fintech stocks.

The report will go through three innovative Aussie fintech stocks with exciting growth potential. Check it out if you’re interested.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here