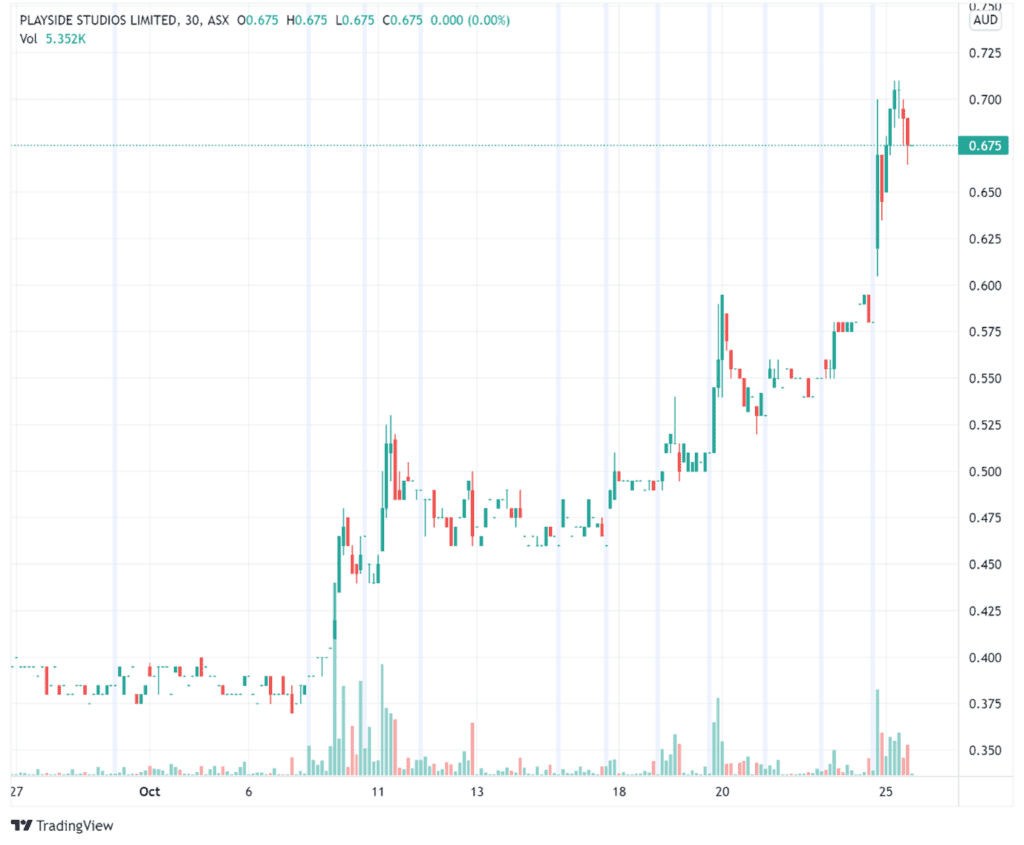

The Playside Studios Ltd [ASX:PLY] share price is up 17% on the back of strong revenue growth in the September quarter.

Playside, the Melbourne-based video game developer, shared its quarterly activities and cash flow report with the market today. Aside from good-looking numbers, the market may also be responding positively to the exciting news of Playside’s recent acquisition.

At time of writing, the stock was exchanging hands for 68 cents a share.

Today, we’ll take a closer look at Playside’s performance and reveal our outlook on the company’s shares in more detail…

What’s behind the surge?

Earlier in morning trade, the PLY stock reached a 52-week high of 70 cents, representing a 20.6% jump. This is clearly a reaction to Playside’s quarterly update this morning.

A key highlight for the games company was a record $4.04 million of revenue over the first quarter of FY22. It’s the best quarter the company has ever seen.

Looking at the prior quarterly revenue of $2.7 million (ending 30 September), investors can see the company is posting a 22% quarter-on-quarter increase — a stellar growth trajectory leading into the new year.

Notably, this number is also 227% more revenue than the amount reported for the same quarter last financial year.

There was other good news too…

Playside has signed an agreement to launch a new PC game, Age of Darkness: Final Stand. The partner is the award-winning publisher Team17. This strategic relationship could potentially see plenty of growth ahead for both companies, depending on how the PC game is received.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

A play worth playing?

For Playside to stay relevant into the years ahead, management will need to keep on top of what can be an unpredictable and highly-competitive industry. There are constantly new and exciting games emerging in the market, and gaming veterans will always have a smorgasbord of entertainment choices at their fingertips.

But if a game gets a reputation, loyalist players can cement the company’s success for years into the future.

Luckily for Playside, several more announcements revealed in today’s update suggest the developer has a fighting chance.

The business has extended and expanded its agreement with Facebook Inc’s Facebook Technologies (a wise partnership with yet another tech giant). The contract has been extended for another six months, during which time Playside will produce between 10 and 16 mini-games.

The company is also expecting to launch five more titles this year, including a new title for the Dumb Ways to Die franchise. The company bought this franchise from Metro Trains Melbourne earlier in the month.

Initially born from a 2012 campaign to promote rail safety, the franchise went viral. It includes six ‘freemium’ mobile titles, which are free to download but offer users the opportunity to make in-game purchases.

Playside also have access to merchandise, trademarks, and social media accounts, plus other valuable digital assets. Notably, Playside’s videos on the franchise’s TikTok account have attracted more than 7.8 million views and brought in nearly 350,000 new followers.

What’s next for the Playside share price?

Given that Playside’s recently-launched titles are all performing well, bullish investors are likely inferring PLY’s upcoming titles will enjoy similar success.

High levels of engagement on TikTok are exciting to see and are a good indicator of the momentum that could potentially lay ahead for Playside. But again, the gaming industry is highly competitive.

Before considering Playside, it may be wise to pay close attention to the company’s history, financials, long-term performance, and other important data.

In the meantime, there’s something else I urge you to look into…

My colleague, small-cap expert Ryan Clarkson-Ledward, has found four little-known stocks on the ASX that could potentially fly high in the next 12 months.

The media has barely paid any attention to these companies, but one glance at his report shows any single one of these undervalued stocks could shoot up in price.

If you’re keen to get the details, you can check out free Ryan’s Report here

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here