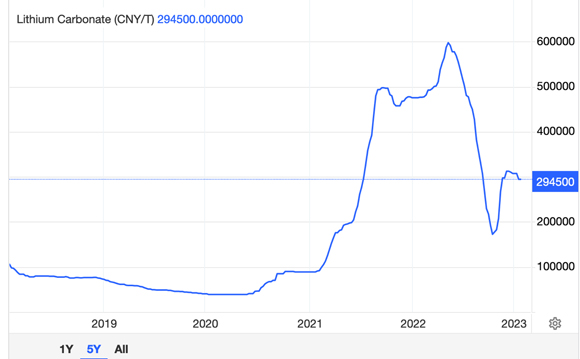

As you’ve probably heard, lithium prices went on quite a run in 2021 and 2022.

This was mainly on the back of electric vehicle (EV) growth. We saw auto and battery makers in a frenzy to secure supply with almost every carmaker either working on or bringing EVs to market.

It’s been a more subdued story this year.

Lithium prices fell off a cliff, as you can see below, although prices have somewhat recovered since May.

|

|

| Source: Trading Economics |

A slowdown in China along with fears of a recession are all behind the drop. That, as well as the fact that more lithium supply keeps hitting the market.

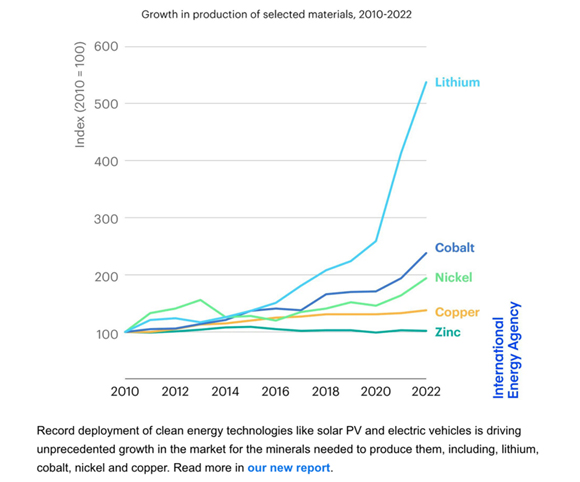

Lithium production has close to tripled in the period between 2017—2022 as you can see below:

|

|

| Source: International Energy Agency |

The recent decrease in lithium prices showed clearly in the books of lithium miner Pilbara Minerals [ASX:PLS], who released its quarterly results yesterday…

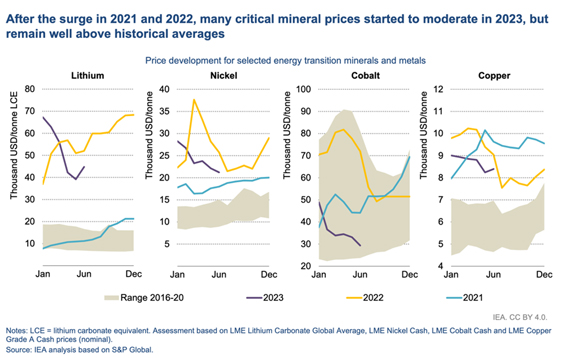

Lithium prices remain historically high

Yesterday, Pilbara said that they were selling spodumene concentrate at US$3256 a tonne in the June quarter, a 33% drop from the US$4,840 it was fetching last quarter.

Even with the decrease in prices, it’s been a fantastic year for the company. The company reported a 238% increase in revenues for the full year to reach $4 billion.

As manager Dale Henderson put it:

‘We were an early mover and that was tough, but that has now flipped into the most incredible opportunity.

‘There are massive moves afoot around energy transition, of which of course lithium is a key enabler. We’re looking to develop and expand as rapidly as we can to make the most of the market.’

One of the reasons for the increase in revenues was that the company was able to counter-dropping prices with more production.

The other was that while prices for lithium have gone down dramatically since last year, the company was still selling the tonne of lithium way higher than what they were selling it for in 2022 at an average of US$2,382 a tonne.

The truth is that lithium prices remain well above their historic average.

That’s not just the case for lithium, but also copper and nickel as the IEA points out in their 2023 Critical Minerals Market Review report:

|

|

| Source: International Energy Agency |

Cashed-up miners keep pouring money into this sector

It’s no secret that countries continue to install solar panels, windmills and produce EVs at a faster-than-expected pace.

We are still in the middle of an energy crisis with Europe hoarding solar panels and countries looking to diversify their energy options and lower their power bills.

At the centre of all this is critical minerals.

Demand is still growing fast. And we are seeing large rates of growth in critical minerals and lithium in particular.

In the last five years, the market for critical minerals doubled in size to US$320 according to the IEA. Investment in the sector has seen a 30% increase in the last year, with lithium companies ramping up their investment spending by 50%.

Of course, more supply coming online means lower prices in the future.

But there are still a lot of challenges to get there and supply is looking pretty unstable in this space, in particular as demand keeps growing.

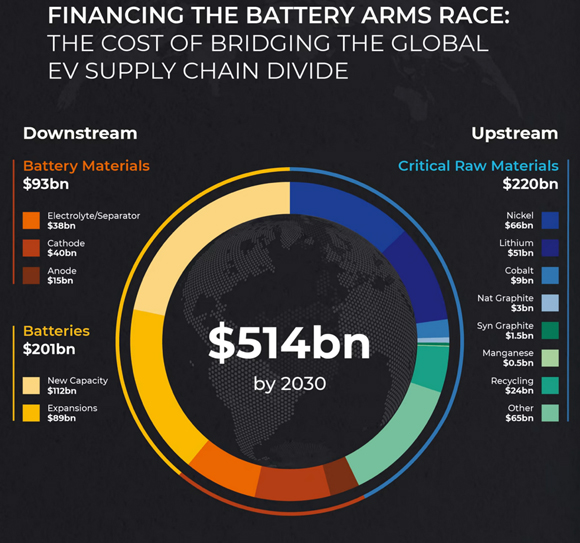

Governments are still intent on decarbonizing the economy, carmakers keep pledging to make more EVs, and there’s a push to create battery supply chains outside of China.

Whatever the case, there’s going to be a lot of money pouring into the critical minerals sector.

Benchmark Minerals estimates the battery industry needs at least US$514 billion in investment across the supply chain to meet demand in 2030, and US$920 billion by 2035.

|

|

| Source: Benchmark Minerals |

Not only to mine more quantities of critical minerals out of the ground, but also to build up downstream capabilities to produce battery-ready materials.

It won’t be a smooth ride, but to me the direction is clear. We are going to need lots of critical minerals for the energy transition

To be clear, not every mining stock will be a winner and stock selection will be key.

One idea to play this is to look at the research of colleague and commodities expert, James Cooper. He’s been scouring the market for opportunities in the critical minerals mining sector.

You can find more about his Diggers and Drillers newsletter here.

All the best,

|

Selva Freigedo,

Editor, Fat Tail Commodities