The Pilbara Minerals Ltd [ASX:PLS] successfully held its second lithium digital auction via the Battery Material Exchange (BMX).

Pilbara said it intends to accept the highest bid of US$2,240/dmt (SC5.5, FOB Port Hedland basis) for the intended 8,000dmt cargo.

PLS share price is currently trading at $2.52 per share, up 11.50%.

Pilbara’s recent developments as well as a lithium resurgence have seen the PLS stock gain 680% over the last 12 months.

Pilbara conducts second BMX auction

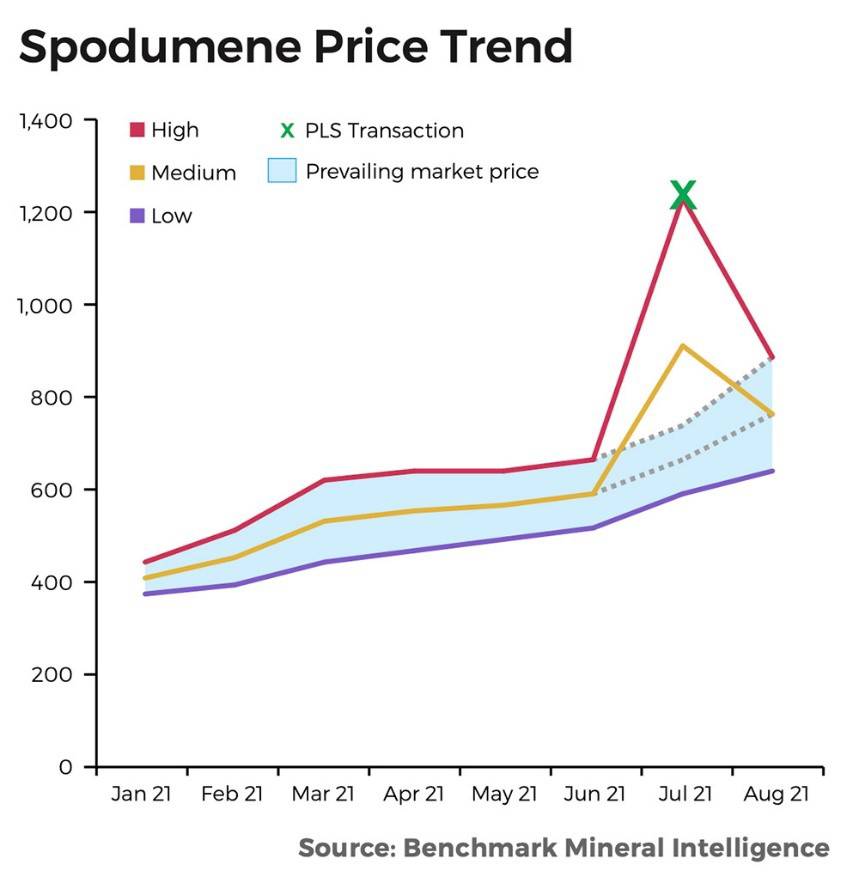

In July, Pilbara hosted its inaugural online auction of spodumene concentrate via its BMX platform.

That auction was a bidding war between 17 bidders, who in total ended up placing 62 online bids ranging from US$700/DMT to US$1,250/DMT FOB Port Hedland.

Well, the second auction carried over the strong interest of the first…with one major difference.

The in-demand spodumene concentrate fetched a substantially higher price.

PLS said today it intends to accept the highest bid of US$2,240/DMT (SC5.5, FOB Port Hedland basis) for the intended 8,000dmt cargo.

Pilbara said that on a pro-rata basis inclusive of freight costs, this is equivalent to a price of USD$2,500/DMT (SC6.0, CIF China basis).

Basically, during the time between the auctions, the price effectively doubled.

According to the auction terms, the bidder is now required to enter a sales contract with Pilbara in the coming days.

Ship loading is expected in November.

In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report

Source: Benchmark Mineral Intelligence

Source: Benchmark Mineral Intelligence

What next for the Pilbara Minerals Share Price?

With the results of the second BMX auction, Pilbara is optimistic, noting:

‘Given the strong margins yielded through the BMX trading platform to date, Pilbara Minerals expects to channel more concentrate sales through the platform, including concentrate generated from the recommencement of the Ngungaju processing plant.’

PLS also recently upgraded its mineral resource at its Pilgangoora Tantalum-Lithium Project.

The company’s measured and indicated resource is now standing at 210.2 million tonnes at a grading of 1.17% lithium oxide, containing 2.46Mt of lithium oxide and 47.7 million pounds of tantalum pentoxide.

All these developments reflect the positive steps the company is taking to position itself for growing demand.

And the demand is growing.

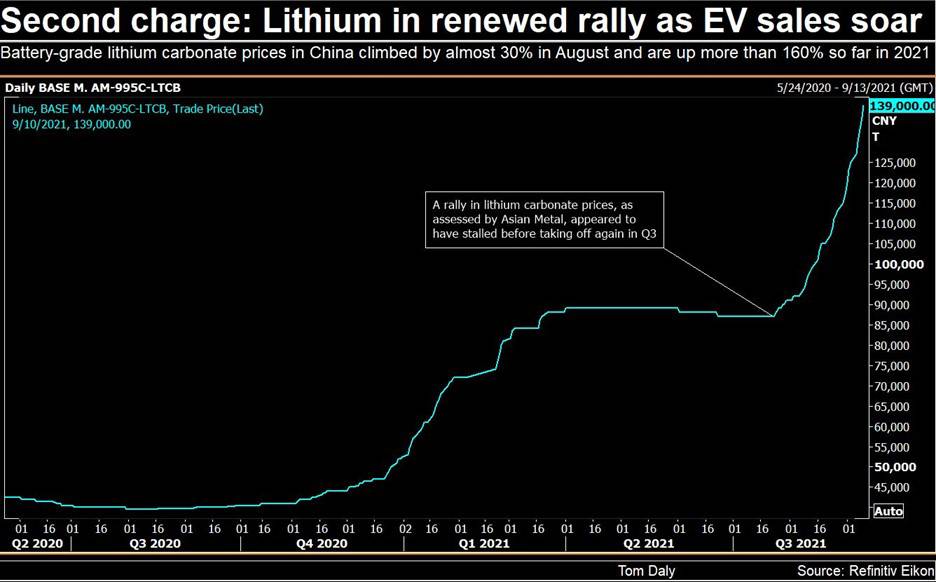

Yesterday, Reuters reported that lithium prices jumped to their highest level in more than three years thanks to an uptick in EV sales.

Analysts reiterate that more investment in lithium production is needed if future EV supply chain needs are to be met.

We are witnessing a paradigm shift in the energy sector as environmental conscientiousness spurs adoption of green energy.

Now, while Churchill said never to let a good crisis go to waste, we should also hasten not to waste a paradigm shift of the magnitude presented by clean energy.

So, if you want more resources on this topic — and more interesting investing ideas — I suggest checking out this lithium report from our energy expert.

Coincidentally, this report also evaluates three promising ASX lithium stocks.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here