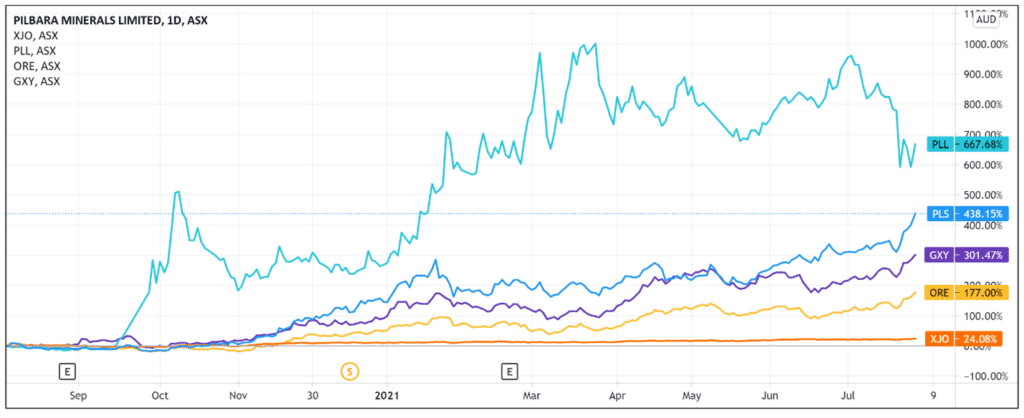

The Pilbara Minerals Ltd [ASX:PLS] share price is closed 7.63% up on Monday following a successful online auction and a court resolution.

And the PLS stock continued its rise today, reaching an all-time high of $1.97 per share in early trade, up 3.3%.

This comes after Pilbara Minerals reported strong production and record shipment figures in its June quarter results released last week.

Pilbara share price reinstated

On 27 July, the Pilbara Minerals share price was suspended after the company failed to disclose the issuing of 2,000,000 ordinary fully paid shares on 25 June upon the exercise of unlisted options.

The lithium stock was placed into a trading halt pending an application to the Supreme Court of Western Australia.

The application aimed to seek orders in relation to Pilbara Minerals’ inadvertent failure to lodge a cleansing notice within the prescribed five-day period after the issue of shares on 25 June.

However, the suspension of trading in PLS shares was lifted late last Friday after the court made orders sought by the company.

The court ordered that:

‘a) the period of five business days in which to lodge the cleansing notice be extended to 28 July 2021; and

- b) the cleansing notice that the Company released on 28 July 2021 be deemed to take effect as if it had been lodged on 25 June 2021.’

Pilbara’s inaugural online BMX auction

The successful court order was not the only piece of good news Pilbara announced yesterday.

The lithium stock also provided an update on its inaugural Battery Material Exchange (BMX) auction.

A total of 17 bidders participated and strong interest was shown.

During the three-hour auction window, parties placed a total of 62 online bids ranging from US$700/dmt to US$1,250/dmt FOB Port Hedland for a ‘spot’ 10,000 dmt cargo (SC 5.5%) of spodumene concentrate from the Pilgangoora operation.

Pilbara accepted the most attractive bid of US$1,250/dmt FOB Port Hedland.

The successful bidder is now required to enter into a sales contract with Pilbara ‘in the coming days’, which also requires a letter of credit to be presented.

PLS expects ship loading in the latter part of August.

The company concluded the auction results were ‘very supportive’ of its objective to ‘access a broad range of buyers’ via the new BMX sales channel.

Pilbara Minerals and the future of lithium

Pilbara’s official reinstatement and swift resolution of the cleansing notice issue has likely assuaged investor concerns.

Relieved of the uncertainty surrounding the court application, investors bid up PLS shares once trading resumed.

But the market may also have been encouraged by Pilbara’s inaugural auction and its potential.

After all, the demand for lithium is rising.

In April, the International Energy Agency said the number of electric vehicles worldwide will rise to 145 million by 2030, up from only 10 million at the end of 2020.

The trend is shifting towards electric vehicles and lithium will play a crucial role.

So bullish investors may also be excited by the potential of Pilbara leveraging the auction process to find the best price for its product in a hot market.

Now, if you are interested in reading more about the lithium industry and lithium stocks, I suggest checking out our free 2021 lithium stocks report.

It outlines the resurging industry and profiles a few lithium stocks with the potential to capitalise on the renewed demand for the white metal.

You can download your free copy of the report here.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report