Lithium producer Pilbara Minerals [ASX:PLS] released its September quarterly report on Tuesday (25/10/2022), reporting a ‘substantial $783.7 million in the quarter-end cash balance to $1.38 billion.’

PLS shares were flat on the announcement, however, they are up 100% in the past six months:

Source: Tradingview.com

Pilbara Minerals’ September Quarterly

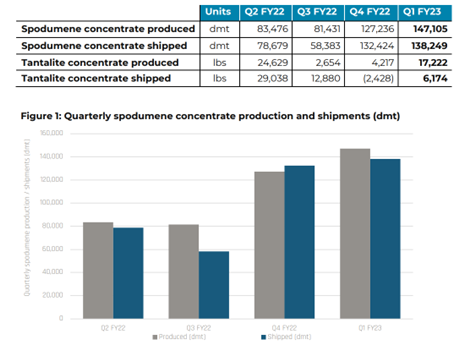

Pilbara reported a 16% increase in production on a quarter-on-quarter basis, moving up from 127,236 dmt produced by the end of June’s quarter to 147,105 dmt by September’s end.

PLS shipped 138,249 dmt of spodumene concentrate (an increase on 132,424 dmt shipped in the June quarter) and achieved a new ‘shipping milestone’ by reaching the one million tonne mark of total shipped spodumene concentrate to date.

Pilbara reported that the average realised sales price in the quarter was US$4,266/dmt SC5.3 basis (CIF China), which ‘equates to a reference price of US$4,813/dmt on an SC6.01 basis (CIF China) when adjusted pro-rata for lithia content.’

That’s compared with US$4,267/dmt realised last quarter.

Pilbara reported customer sales of $1.037 billion in the quarter, associated with the sale of 138,249 dmt of spodumene concentrate and 45,041 dmt of middlings product.

PLS did report higher costs during the quarter, citing labour shortages in Western Australia and supply chain disruptions:

‘As noted in the Company’s ASX release dated 22 August 2022, costs for the Quarter continued to be higher due to elevated strip ratios to support a substantial investment in mining activities, the impact of labour shortages in the WA mining sector (including the impact of COVID-19), supply chain disruptions and general inflationary cost pressures. Including freight and royalty costs4, the unit operating cost for the Quarter was US$767/dmt (CIF China), being A$1,122/dmt at a quarterly average AUD:USD exchange rate of 0.6836 (June Quarter Pilgan Plant only: US$780/dmt; A$1,092/dmt at an average quarterly AUD:USD exchange rate of 0.7146).’

Source: PLS

Lithium stocks and the green future

The International Energy Agency (IEA) states demand for lithium will increase sixfold to 500 kilotonnes by 2030 and will need 50 more mines to cater for the incoming wave.

UBS and Macquarie have also been expressing concerns over increasing demand and current production channels not yet forecast to meet demand.

Unsurprisingly, lithium stocks have been the talk of the ASX in 2021, with eight of the top 10 best-performing stocks on the All Ords being in the lithium sector.

Even with the ongoing push, escalating prices, and government support, lithium stocks entered a correction this year.

The easy money has clearly been made.

So do any overlooked lithium stocks remain on the ASX?

According to our recent Money Morning research report, yes.

Discover three overlooked lithium stocks here.

Regards,

Kiryll Prakapenka,

For Money Morning