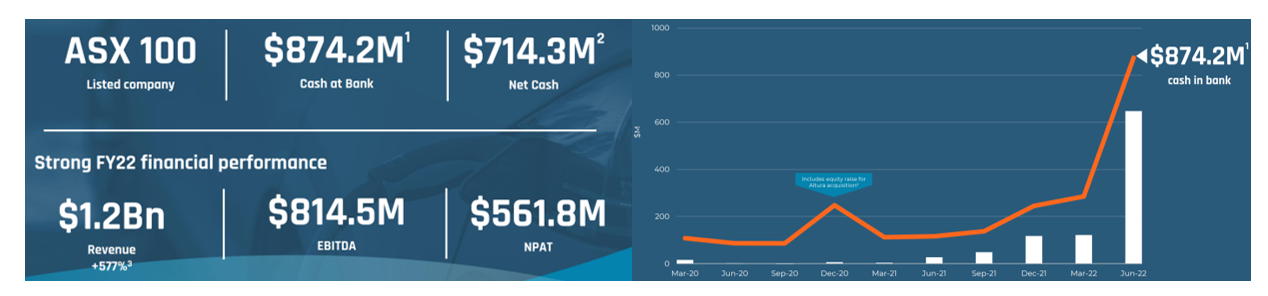

Lithium producer Pilbara Minerals [ASX:PLS] posted an inaugural full-year profit of $561.8 million on revenue of $1.2 billion.

Pilbara said the record performance was driven by ‘strong lithium raw materials demand conditions’.

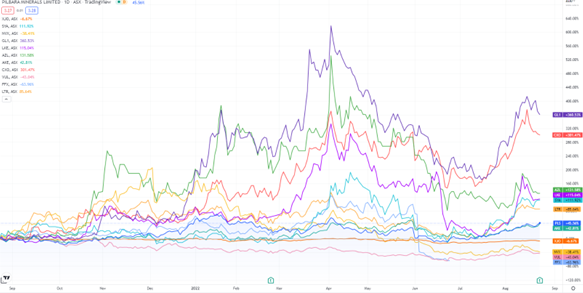

While PLS shares rose on Tuesday, bucking the wider performance of the ASX 200, the lithium stock is still down 7% year-to-date.

The year’s earlier frenzy in the lithium sector resulted in plenty of growth and future profits already being baked into stock prices:

www.TradingView.com

Pilbara’s inaugural profit

Pilbara’s FY22 highlights:

- ‘361,035 dry metric tonnes (dmt) of spodumene concentrate shipped, representing a 28% increase from FY2021 (281,440 dmt shipped)

- ‘Strong demand conditions underpinned a 577% increase in sales revenue to $1.2Bn (FY2021: $175.8M)

- ‘Increased realised selling price of US$2,382/dmt (CIF China basis) delivers a substantial increase in gross margin to $853.5M (FY2021: $46.2M)

- ‘Positive EBITDA of $814.5M, before depreciation and amortisation costs of $44.9M, tax expense of $163.2M, net financing costs of $6.9M, and a non-cash expense for the fair value movement in the deferred share consideration related to the Altura acquisition of $37.2M (FY2021: EBITDA of $21.4M)

- ‘Statutory net profit after tax of $561.8M (FY2021: statutory loss of $51.4M) after recognising a tax expense of $163.2M

- ‘30 June 2022 cash balance of $874.2M2, inclusive of $282.4M of irrevocable bank letters of credit for shipments completed before 30 June 2022

- ‘Year-end net cash position of $714.3M2, inclusive of $282.4M of irrevocable bank letters of credit for shipments completed before 30 June 2022’

Pilbara did flag cost pressures, which saw unit operating costs (FOB Port Hedland and excluding royalties) for its key Pilgan plant rise from $431 to $555 per dmt.

PLS pointed to mining industry labour shortages, lingering COVID-19 impacts, and increasing inflation as key contributors.

Source: PLS

Pilbara’s CEO Dale Henderson commented on 2022’s results:

‘FY2022 has been an incredible year for Pilbara Minerals, with our Pilgangoora Operation capitalising on the surging demand for lithium raw materials that we have experienced over the course of the year.

‘The fact that we have achieved such a strong profit result despite the significant headwinds of COVID-19, the WA mining industry’s labour and supply shortages and rapid cost inflation is testament to the outstanding efforts of our employees and contracting partners, and I would like to sincerely thank them for their hard work.’

Pilbara sees exciting future ahead

Pilbara was well-placed to take advantage of rising lithium prices as an expanding producer.

Its inaugural full-year profit was evidence of that.

But can the strong market conditions last? And can Pilbara maintain profitability at lower prices?

Henderson was upbeat and said he was excited for Pilbara’s future:

‘The business is in an enviable position, supplying product into a burgeoning growth market with a clear pathway for further production growth off a performing operating base. Further, chemicals participation with our downstream JV with POSCO and our midstream project provides another extension of value creation for our shareholders. A very exciting future lies ahead for our business and our shareholders.’

Overlooked ASX lithium stocks

Lithium stocks have been the talk of the ASX in 2021, with eight of the top 10 best-performing stocks on the All Ords being in the lithium sector.

Such interest inevitably led to the sector overheating…and lithium stocks entered a correction this year.

Even Pilbara is down year-to-date despite growing sales and profits.

The easy money has clearly been made.

So do any overlooked lithium stocks remain on the ASX?

According to our recent Money Morning research report, yes. Access the free research report on three overlooked lithium stocks here.

Regards,

Kiryll Prakapenka