The Piedmont Lithium Ltd [ASX:PLL] share price is down 1.1% today after PLL updated its mineral resources estimate for its lithium project in North Carolina.

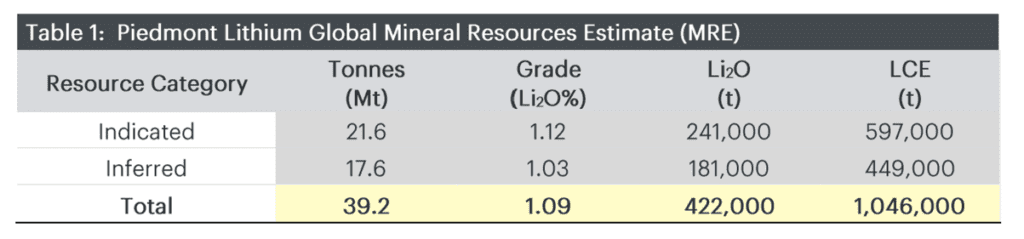

The lithium hydroxide producer today announced that it has increased its total mineral resource estimate (MRE) to 39.2 Mt at 1.09% Li2O.

Piedmont stated that the updated resource base will inform the scoping study update scheduled for May 2021.

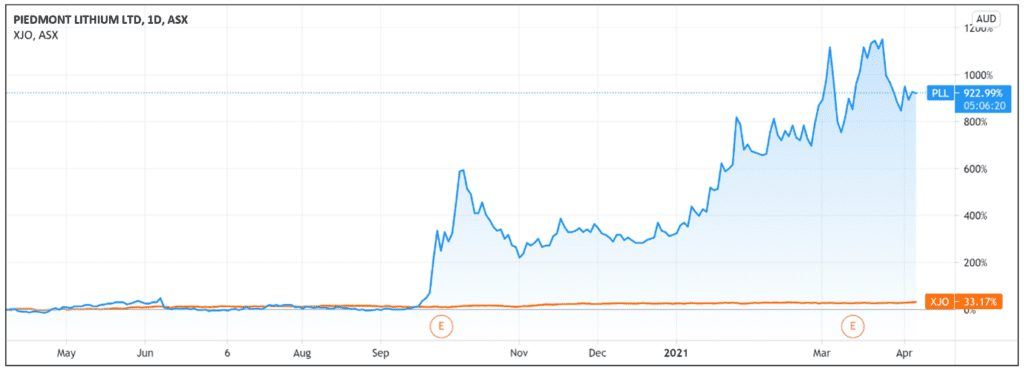

Piedmont’s share price is up 140% YTD and up a significant 890% over the last 12 months.

Piedmont Lithium updates its global mineral resources estimate

Piedmont revealed that 55% of its MRE is currently classified in the Indicated category.

Three Ways to Invest in the Renewable Energy Boom

Resources in the Indicated category have tonnage and grade computed from information like that used for resources in the Measured category but the sites for inspection, sampling and measurement are further apart or potentially less adequately spaced.

Although lower than resources in the Measured category, the degree of assurance for resources in the Indicated category are high enough to assume continuity between points of observation.

According to Piedmont Lithium President and Chief Executive Officer Keith D Phillips:

‘Increasing the scale of our North Carolina mineral resource to 39.2 Mt at 1.09% Li2O establishes our asset as one of the largest spodumene resources in North America – and the only one in the United States.’

Piedmont’s busy March

Today’s update follows Piedmont appointing a chief operating officer last Wednesday.

David Klanecky will serve as Piedmont’s executive vice president and chief operating officer.

From 2013–21, Mr Klanecky worked in senior management roles at Albemarle Corporation, which Reuters described as the ‘world’s top lithium producer.’

Most recently, Mr Klanecky served as Albermarle’s Vice President, Lithium Operations, APAC/EU.

Mr Klanecky will be tasked with implementing the company’s integrated US-based lithium chemicals business while also developing PLL’s operational capabilities.

The senior appointment follows Piedmont raising $159 million from its US public offering two weeks ago.

The company stated the proceeds will go towards funding its lithium project’s feasibility studies, test work, permitting, exploration drilling, mineral resource estimates updates, and land consolidation.

Piedmont will allocate some of the equity raise to fund strategic investments in Sayona Mining and Sayona Quebec.

Piedmont Lithium outlook

While a 40% increase in lithium resources may seem like good news, the market’s reaction was tepid.

What are some possible explanations?

For one, 45% of Piedmont’s updated mineral resources estimate is currently in the Inferred category, which will require further sampling and measurements.

Investors may therefore have taken a ‘wait and see’ approach to today’s announcement in that regard.

Further, investors may have noticed the qualified language of Piedmont CEO Keith D Phillips when he stated that the ‘expanded resource offers the potential for increased annual lithium production, something we will evaluate as we prepare our updated Scoping Study for release next month.’

Investors may be waiting for that scoping study next month before making any significant investment decisions concerning PLL’s shares.

Lithium stocks are on a lot of investors’ minds right now. But with news items coming out almost daily, it is hard to keep up and know where to look for lithium investment ideas.

I think this free report on ASX lithium stocks is a great place for anyone who wants further information and ideas.

Regards,

Lachlann Tierney,

For Money Morning

Comments