Shares in US-focused lithium developer Piedmont Lithium Ltd [ASX:PLL] have sunk today on the back of the company commencing its definitive feasibility study at its project in North Carolina, US.

PLL’s share price rocketed at the end of September when the company announced it had entered into a sales agreement with Tesla Inc [NASDAQ:TSLA].

Source: Tradingview.com

The PLL share price has since cooled, as you can see in the chart above, though it seems to have found a level firmly above the one it had been trading at for the majority of the year.

At the time of writing the PLL share price is down 5.90% to trade at 36.5 cents per share.

What’s caused the drop?

Today PLL announced it had awarded the definitive feasibility study (DFS) for its planned spodumene concentrate operations in North Carolina to a combined team including Primero Group and Marshall Miller.

The DFS will target production of 160,000 tonnes per year quarry and spodumene concentrate, as well as co-products including quartz and feldspar.

PLL said it expects the DFS to be completed by mid-2021 and will pursue an investment decision for the concentrate operations shortly after.

PLL president and CEO Keith Phillips said:

‘We will launch the DFS for our chemical operations in quarter one of 2021 and will be positioned to begin construction in mid-2021, which should be ideal timing given the vast demand for lithium hydroxide we expect beginning in the 2022-2023 time period.’

As for the share price drop today, well there are a couple things to consider:

One; PLL just expanded its drilling program by 25,000 meters at its project, so perhaps investors were expecting higher tonnage per annum.

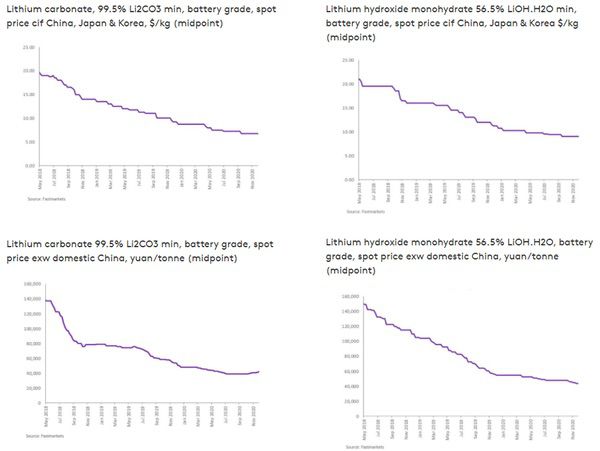

Two; the price of lithium is currently at its lowest point in five years and lithium hydroxide isn’t fairing much better, see below.

Source: Fastmarkets.com

Lithium price could return

Though currently depressed, we could soon see a return in the lithium price.

As I’ve mentioned previously the lithium price is looking like it has bottomed out.

If we take a broader view, the Global X Lithium & Battery Tech ETF [LIT] shows a strong upwards trend, perhaps indicating investors think lithium and battery tech is on its way back in.

Source: Tradingview.com

If you’re interested in knowing more about what might be in store for lithium investing, we talk about LIT and three lithium stocks in this free report. One of which has a special exposure to the European market, which is proving to be the EV epicentre.

Regards,

Lachlann Tierney,

For Money Morning

Comments