At time of writing the share price of Piedmont Lithium Ltd [ASX:PLL] is up 10%, trading at 40.5 cents.

You can see some key levels for the PLL share price on the chart below:

Source: tradingview.com

For now, the PLL share price seems to have bounced strongly off of the 27.5-cent mark. We look at the announcement that has it moving upwards.

Expanded drilling program helps PLL share price move higher

Here are the key details from today’s announcement:

- More than double the current number of drilling rigs (three more for a total of five)

- 25,000 more metres

- Resource update on track for Q12021

So depending on what the expanded drilling program finds, there is a potential catalyst out there for the PLL share price.

The initial hype around PLL was due in part due to an early announcement of a sales agreement with EV giant Tesla Inc [NASDAQ:TSLA].

Outlook for PLL share price

I suspect a Biden win in the US presidential race may be a long-term benefit for the company.

The US is increasingly looking to secure its resource supply chains.

This to go with the view that the lithium price bottom is in, at least as far as Canaccord Genuity is concerned.

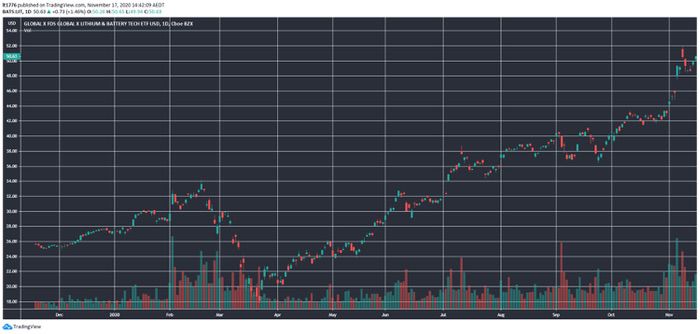

I’ve noticed some big volume spikes of late on the chart for The Global X Lithium & Battery Tech ETF [LIT]:

Source: tradingview.com

LIT is in a steady uptrend, perhaps a leading indicator that investors think lithium and battery tech is back on the agenda in a big way.

We talk about LIT and three lithium stocks in this free report.

One of which has a special exposure to the European market, which is proving to be the EV epicentre.

It’s an intriguing lithium prospect, to be sure.

Regards,

Lachlann Tierney

For Money Morning

Comments