The Piedmont Lithium Inc [ASX:PLL] share price fell 20% yesterday after a Reuters report found the company is yet to apply for a state mining permit before rebounding today.

PLL shares plunged 21% yesterday before trading in the lithium stock was halted at the request of the company as it sought time to respond to an ASX price query.

Piedmont responded today, wishing to address ‘misunderstandings in recent media reports’ regarding its development timeline.

With the trading halt lifted, the market — somewhat calmed by the company’s response — sent PLL shares up 14% in early trade.

Piedmont shares were exchanging hands for 68.5 cents prior to yesterday’s halt. The last time PLL shares traded below 70 cents was in early March this year.

At the time of writing, Piedmont is trading for 78 cents a share.

‘Put the cart before the horse’

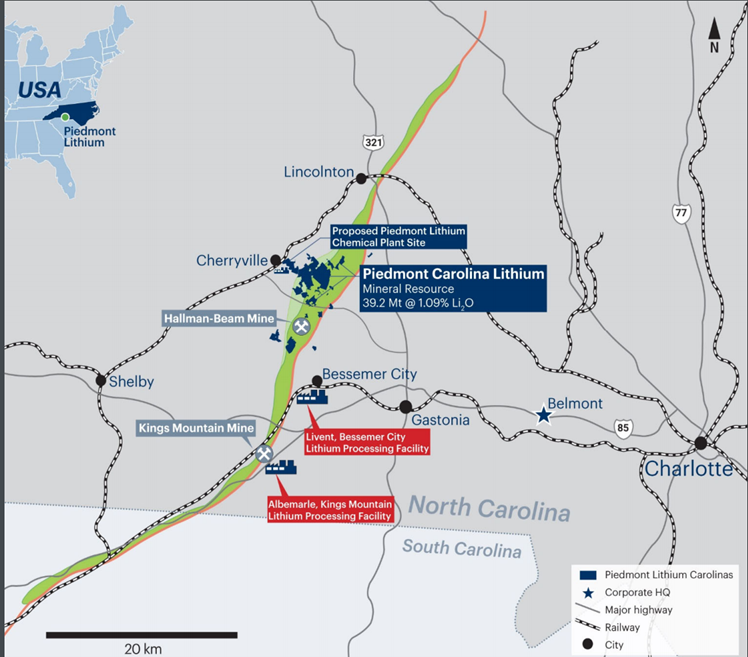

Last year, Piedmont signed a widely-reported deal to supply Tesla with lithium extracted from Piedmont’s deposits in North Carolina, US.

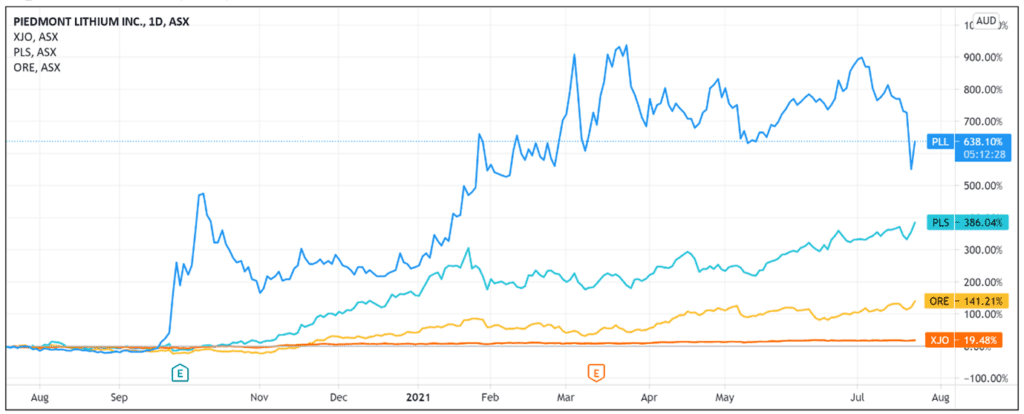

The news was enough to send the PLL share price soaring.

However, Reuters published an article yesterday indicating Piedmont has not applied for a state mining permit or a necessary zoning variance in Gaston County.

Gaston County, in North Carolina, is the proposed site of Piedmont’s lithium mining operation.

Per Reuters, five of the seven county board commissioners in charge of zoning approvals said they ‘may block or delay the project because Piedmont has not told them what levels of dust, noise, and vibrations will occur.’

The chair of the board went so far as to tell Reuters Piedmont has ‘sort of put the proverbial cart before the horse.’

‘Why in the world would they make this deal with Tesla before they even have approval for the mine?’

Permit promises

Per Reuters, Piedmont first told investors it expected to obtain necessary permits by the end of 2019.

For instance, in a September 2018 quarterly, the company said that during the quarter it had already ‘commenced permitting on the Project for all federal, state and local permits, which is targeted for completion in 2019.’

Per Reuters, Piedmont said it was ‘not aware’ of any reason why Gaston County would not approve zoning changes.

Then in December 2019, Piedmont said it expected to receive local zoning approval before the end of June 2020.

The company attributed the delays in part to weak lithium prices.

Finally, after the mentioned delays, Piedmont Lithium leaders made their first public presentation — postponed in March — during the Gaston County commissioner meeting on 20 July.

Gaston County’s local paper, The Gaston Gazette, reported earlier this month that locals opposed to Piedmont’s plans for the region planned to ‘fill the meeting chambers with opposition to the project.’

Piedmont pleads its case

On Tuesday night, Piedmont management presented before the Gaston County commissioners, making its case for the US$840 million open-pit mine lithium extraction project in the county.

The presentation was meant to happen in March, but Commissioner Chad Brown told WCNC Charlotte that PLL cancelled that meeting.

‘The only way we can get them to come and present is to tell them that we’re frustrated. Then, they started listening,’ said Commissioner Brown.

And Commissioner Keigher thought Piedmont had ‘gone about this about as bad as any company that tried to move into our county.’

While not posted on the ASX, Piedmont did post the slide deck of its presentation on its website, titled ‘Gaston County and Piedmont Lithium: Building a Powerful Partnership’.

In that presentation, PLL said Gaston County is the cradle of the lithium industry, with ‘virtually all the world’s lithium coming from Gaston County from the 1950s to the 1990s.’

The county resides in the Carolina Tin Spodumene Belt, which is one of the world’s largest — and the only American — spodumene resource, Piedmont stated.

Piedmont argued the proposed Gaston Country project will be the ‘world’s most sustainable lithium project.’

Attempting to assuage locals’ concerns, the company outlined its plans to economise water usage, minimise emissions and noise, as well as protect air quality.

Piedmont ended its pitch by highlighting what Gaston County residents stand to gain: 500-plus jobs with Piedmont at an average salary of over US$90,000 per year, with ‘100s of jobs created by and for neighbouring businesses.’

The average salary of the adjacent jobs created by Piedmont’s presence was not specified.

For reference, the United States Census Bureau estimates the population of Gaston County to be 224,529, with a per capita income (2015–19) of US$27,352.

Commissioners did not vote on any aspect of Piedmont Lithium’s plans on Tuesday night’s meeting.

Local outlet WCNC Charlotte reported that a ‘majority of residents opposed the mine’, while a ‘small number did express their support of the plan and the benefits that could come.’

‘We’re sitting on a goldmine, quite literally we’re sitting on good dirt,’ one resident said.

Gibbs Law Group launches class action investigation

Coverage sparked by Reuters’ reporting prompted Gibbs Law Group to reach out to Piedmont investors impacted by the news.

Gibbs Law, which represents investors in securities litigation, put out a call encouraging concerned Piedmont shareholders to contact them and ‘discuss how you may be able to recover your losses.’

The legal firm didn’t provide much further detail and it’s unclear how its investigation will progress or if anything will come out of it.

It could be this is nothing more than Gibbs Law hitching a ride on a trending story to raise its profile given that some of Piedmont investors’ losses were recouped today.

Piedmont responds to media coverage

Wishing to address any issues raised by the Reuters article, Piedmont released an announcement responding to the coverage today.

The company noted that it announced last month it would start a pre-application consultation with Gaston County to update it on Piedmont’s plans for the project, with formal engagement commencing yesterday.

PLL also wished to clarify ‘misunderstandings in recent media reports.’ Piedmont CEO Keith Phillips provided the following comment on the matter:

‘Although we received important federal permits for our project in 2019, Piedmont’s upcoming state mining permit and county rezoning applications could only advance once our definitive plans were established.’

A shift to more environmentally-friendly technology over the last four years slated for the project resulted in ‘adjustments to our plans.’

What next for the ASX PLL Share Price?

The news coverage triggered by Reuters certainly got the attention of Piedmont investors.

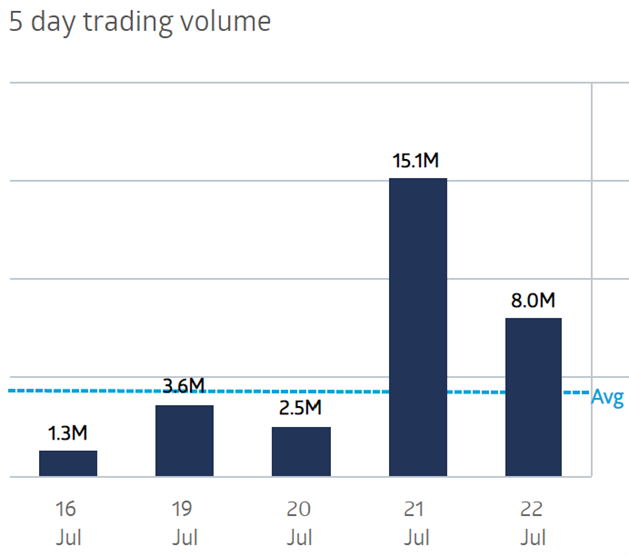

As the chart below shows, trading volume in PLL shares skyrocketed when the news dropped.

Yesterday’s trading volume was about three-times higher than Piedmont’s average:

But what should we make of all this?

Well, it seems to me the issue is not necessarily that Piedmont is yet to apply for crucial mining permits.

Rather, as the local coverage reveals, it looks like the issue is the vocal opposition to Piedmont’s project by Gaston County residents.

If the prevailing mood in Gaston County was receptive and positive, an unlodged permit application wouldn’t matter as much.

Maybe Piedmont’s tardiness in applying for a permit is a canary in the lithium mine. No doubt, the company was aware of rumblings from Gaston Country residents.

So in pushing out its permit application, Piedmont was giving itself time to win over the locals and persuade them of the project’s benefits.

Hence the appeal to 500-plus Piedmont jobs at US$90,000 a year, and environmental initiatives to minimise emissions, noise, traffic, and water usage.

So, what’s the risk the permits will be denied?

Something to keep in mind is the commissioners told Reuters they ‘may block or delay the project’ on the grounds that Piedmont did not tell them how they will preserve water, air, and noise quality in the area.

This leaves room for Piedmont to persuade the commissioners its plans sufficiently account for residents’ environmental concerns.

Something that may help Piedmont make that case is the company securing the Clean Water Act Section 404 Standard Individual Permit from the US Army Corps of Engineers (USACE) for the project in late 2019.

USACE’s Environmental Assessment, undertaken in conjunction with six state and federal agencies, resulted in a ‘finding of no significant impact’ for the project.

Piedmont said the Section 404 permit is the only federal permit required for its proposed mine.

More relevant to Gaston County, Piedmont also obtained a CWA Section 401 Individual Water Quality Certification from the North Carolina Division of Water Resources, as well as an air quality permit from the North Carolina Department of Environmental Quality.

Today, the company said it plans to submit the state mining permit application in August 2021, with a definitive feasibility study expected to be finalised the following month.

If you’re looking for more lithium investment ideas, I’d recommend checking out Money Morning’s free 2021 lithium report.

It details what’s happening in the sector right now, and how investors can make the most out of this lithium boom. Including three lithium plays to take note of.

Regards,

Lachlann Tierney,

For Money Morning

PS: Energy expert Selva Freigedo reveals three ways you can capitalise on the $95 trillion renewable energy boom. Download your free report now.