Another morning, another rally.

The Aussie market seems to believe in the power of governments and central banks once more.

The US market screamed higher overnight, up 7%.

And our market has followed suit.

These rallies, I suspect, are largely to do with governments and central banks throwing everything they have at the problem.

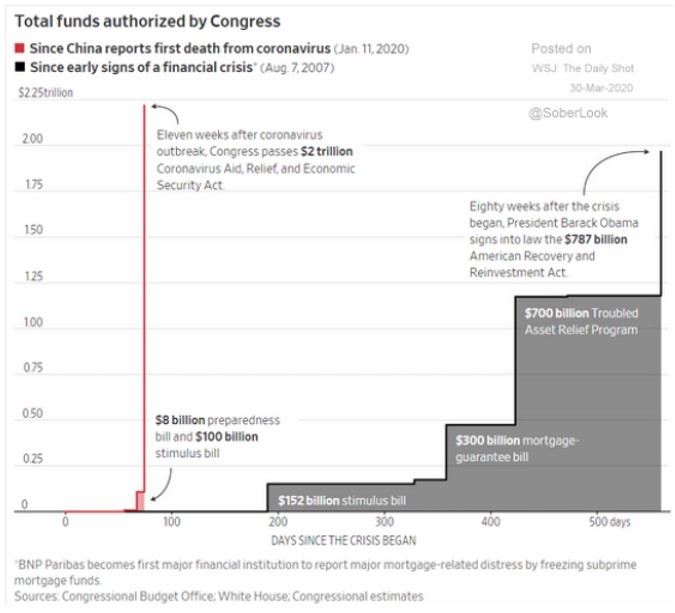

Check this out:

US government response to 2008 crisis versus 2020

|

|

| Source: The Daily Shot |

This is a snapshot of how many days it took for the US government to respond to the past two crises.

On the right, we can see the US government didn’t start creating stimulus packages for the market until 200 days into the financial crisis.

And even when they did, it was a staggered approach.

Compare that to now. Where the US has proposed a whopping US$2 trillion stimulus package, in less than 100 days since the first coronavirus death in China.

The magnitude of the response this time around is remarkable.

The markets might be rallying on the back of this market intervention, but can the government really pump in everything the virus has taken out?

That will take a little while to reveal itself. And we’ll talk about that in more detail later in the week.

Before I hand you over to Jim today, I want to introduce you to a new face here at The Daily Reckoning Australia.

Starting tomorrow Selva Freigedo will be joining the family.

You may have seen her over at our sister publication, The Rum Rebellion.

Well, I can assure you Selva is a natural fit.

Her passion for economics begun around the family dinner table. Her father was an economist for the Argentinian government.

Growing up in Argentina means Selva’s witnessed firsthand destructive monetary policies and what debt defaults mean for people, not just a central bank balance sheet. To boot, she’s lived in various countries right as their asset bubbles have popped. But I’ll let her reveal those stories…

For now, it’s over to Jim.

And I’ll see you again on Thursday.

| Until next time, |

| Shae Russell, |

[conversion type=”in_post”]

The Fed Fired Their Bullets

|

It didn’t take long for the coronavirus crisis to turn into an economic and financial crisis.

The causes of the economic crisis are obvious.

The world has shut down.

The impact of the coronavirus fell most heavily on China, Germany, France, Italy, and the US, which happen to be five of the eight largest economies in the world (the UK, another one of the big eight, is not far behind in terms of infections).

The shutdown does not simply involve overseas travel. It includes restaurants, movie theatres, shops, concerts, office buildings, and gatherings of all kinds in excess of about 10 people.

Unemployment claims and layoffs are piling up at an unprecedented rate.

The world economy is headed into a recession (even a depression) that’s worse than 2008. In situations like this, the standard policy response is for the central banks to cut rates.

But they missed the target (as usual)

The problem is that these programs won’t work as a form of stimulus.

The central banks are doing a good job of keeping the plumbing going in terms of liquidity and the payments system.

They’ve cut rates to zero in much of the world.

Many have guaranteed or offered credit facilities to banks, primary dealers, money market funds, the municipal bond market, and commercial paper issuers so far.

Now the Federal Reserve has even taken the unprecedented step of committing to buy as many US government bonds and mortgage-backed securities as needed to keep the market functioning.

Still, as described by CNBC, they may have done things exactly backward.

Mohamed El-Erian, chief economic adviser at Allianz, says that the Fed should have focused on payment system problems and liquidity first, but should not have cut rates.

Interest rates were already quite low.

Once the Fed goes to zero as they did, they are incapable of cutting rates further (leaving aside negative rates, which also don’t provide stimulus).

El-Erian argues the Fed should have saved their rate cuts in case they are needed more acutely in the weeks ahead.

Too late now. The interest rate bullets were fired. Now the Fed’s bazooka is empty.

Don’t mess with Chairman Xi, you may never be heard from again…

The leader of the Communist Party of China, Chairman Xi Jinping, likes to project a genial and sophisticated face to the world. His suits are perfectly tailored and he moves confidently among world leaders at multilateral summits and other gatherings.

But beneath this façade he is a murderous and ruthless dictator of the worst kind. Xi has gathered up millions of Uighurs (a Turkic minority from north-western China) and forced them into concentration camps along with Christians and other minorities who do not adhere to Communist Party doctrine.

Some of these concentration camp prisoners are subject to forced organ removal without anaesthetic, to supply China’s organ transplant industry.

The victims’ bodies are then cremated to destroy the evidence.

That kind of treatment of the poor and weak is to be expected from a communist dictator.

But what about the rich and connected? Surely, the oligarchs are protected?

Not according to Fox News.

Ren Zhiqiang is a Chinese real estate tycoon and one of the richest men in China. He wrote an essay that criticised China’s handling of the coronavirus (COVID-19) pandemic and called Xi ‘a clown stripped naked’.

Ren is connected to some of the top leaders in the Communist Party of China and may have felt immune from retribution. He was wrong.

Ren disappeared on 12 March and has not been heard from since.

Based on the history of other Xi critics (infamously including former Chongqing party boss Bo Xilai, now serving a life sentence), Ren Zhiqiang may either be dead, or secretly incarcerated and subject to torture. The disappearance of Ren Zhiqiang comes as no surprise.

What is surprising is why Americans do any business with China at all.

| All the best, |

|

| Jim Rickards, PS: Learn why a recession in Australia is coming and three steps to ‘recession-proof’ your wealth. Click here to download your free report |

Comments