And away we go for another week here at The Daily Reckoning Australia.

The same dynamic confounding most is in play. How can you get a housing boom in the middle of a pandemic?

The magic of credit creation, that’s how! Bank lending creates new money just as repaying loans destroys money.

And what do the latest credit figures tell us?

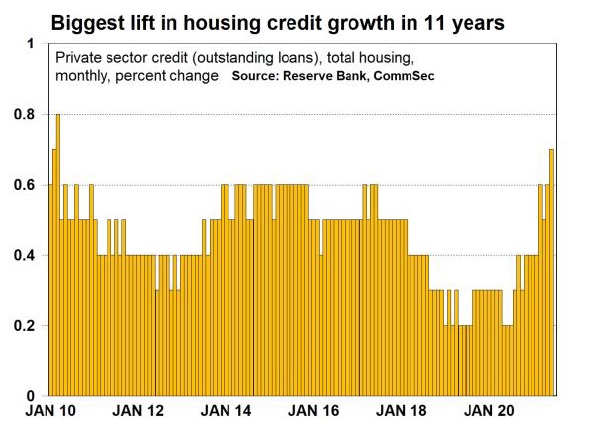

Credit is going up! Housing credit is up 5% on a year ago, and the rise in June was the biggest monthly gain in 11 years.

Hey, you don’t have to believe me, this is official data. See for yourself:

|

|

| Source: CommSec |

All that new money pretty much has one destination: property. The economic effects filter out from there.

What’s one of those?

Taller buildings, for example. The credit pumps up locational values and therefore land value costs for developers.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

The way to make projects pay is to build higher on the same available land.

The Australian Financial Review ran a story that shows this in action:

‘The only way is up for industrial and logistics developments in inner Sydney, where rising land prices have finally pushed the economics past the tipping point on multi-level developments…

‘Industry leaders Goodman Group and Charter Hall are working on several multi-level projects, while others are expected to follow as demand for last- mile delivery sites increases.’

But surely house (read: land) prices can’t keep going? You bet they can.

Are you paying attention to what’s happening in Western Australia?

Take a listen to one of the corporate executives over there presenting at the resource industry’s Diggers & Dealers conference:

‘Mr Leahy, who floated his MLG Oz Limited on the ASX in May, said the excitement was tempered by very tight labour and housing markets.

‘“The unemployment rate locally is effectively zero and housing shortages are becoming a real issue. They are the limiting factors to exponential growth here at the moment, housing and labour,” he said.’

Hello!

COVID is like a lid on top of a pressure cooker. Perth property could explode with the wealth coming out of the mining industry.

And do you need to worry about the Australian government and the RBA taking away the punchbowl anytime soon?

It doesn’t look like it. The Reserve Bank has told us that it won’t lift interest rates to choke off the housing boom. A green light there.

And what’s this little tax item from the Labor Party recently?

You need to know this because I doubt there’s anyone else that will point it out to you.

First, the story…

‘Billions of dollars in tax relief for wealthy Australians is locked in regardless of who wins the next election, with federal Labor officially vowing to support the final stage of tax cuts after months of internal party debate.

‘The “stage 3” tax cuts will see everyone earning between $45,000 and $200,000 paying 30 per cent in tax from 2024.

‘The changes scrap the 37 per cent tax bracket for those earning above $120,000, making those earners the biggest winners from the cuts.’

I saw a story that suggests the Labor Party doesn’t want to go against ‘aspirational’ voters and have therefore backed the cuts.

Hey, we all like tax cuts. Who’s complaining? Not me.

However, I’m not an idiot either. The property market will absorb this extra spending power as those that benefit from it use it to leverage further into property to chase the unearned windfalls to be had there.

There is no doubt in my mind this will turbocharge the property cycle when they come into effect after July 2024.

Of course, these tax cuts will not be presented (or understood) in such a manner.

The government will wax lyrical about their edifying effect on consumer spending, confidence, job creation…and blah blah.

Few understand the economic system.

However, 2024 is some time away.

There is no doubt the lockdowns and Delta strain of COVID will impede the upward march of property for the immediate future.

But credit creation and tax cuts are likely with us for a lot longer than either of those.

So it’s property up, up and away. Make sure you come on board with us at Cycles, Trends & Forecasts. This party is just getting started.

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.