In today’s Money Morning…the doomsayer playbook…the digital alternative to gold…the opportunity coming from our landscape…and more…

If you’ve ever heard of Peter Schiff, you probably won’t be surprised by what I’m about to tell you.

It’s no secret that he is an avid critic of the state of monetary policy. A financial commentator and trader who has built his legacy on calling crashes and backing gold.

He is a quintessential bear investor.

Granted, he is far from the only one. There are plenty of big names who love to sing the praises of the precious yellow metal. Declaring it the only salvation from a rort financial system that is doomed to collapse.

Earlier this week, that is exactly what Schiff did…again.

In his own words:

‘The Federal Reserve has never been right.

‘Everything they have said about the efficacy of their policies, what their policies would create, and their ability to reverse them or unwind them, has been wrong. And it’s amazing how consistently wrong they have been.

‘We are headed for a US dollar crisis and a sovereign debt crisis.

‘The magnitude of this crisis will be unlike anything we’ve ever experienced. Because this is not just mortgages blowing up. This is the credit of the United States government. This is the risk-free asset becoming the most toxic asset on the planet.

‘And it’s not just US Treasuries that are going to collapse, but it’s the entire US-denominated bond market which is built on top the foundation of US Treasuries. So, Treasuries go — it all goes — corporate bonds, muni bonds, mortgages.

‘Any debt instrument that is denominated in US dollars is going to collapse.’

The doomsayer playbook

Now I’ll admit, Peter Schiff is certainly a polarising figure.

His way of looking at and portraying the financial system is pretty bleak. An insight that often diverges to the extreme from the mainstream. And for that reason, you’ll likely either love him or hate him.

Personally, I can get behind Schiff’s key ideology.

I agree that central bankers have lost control when it comes to monetary policy. Unable to learn from or even resolve the mistakes from the past.

Instead they are all walking down the road of low interest rates, QE, and more. A scenario that could see many developed economies follow in the footsteps of Japan. A low-growth, low-inflation hell that has proved seemingly inescapable.

It is a very real concern.

However, Schiff does take it to hysterical extremes at times. Which is somewhat to be expected, he is a commentator first and foremost after all.

Does that mean we’ll see a collapse in the US economy, or globally for that matter? Absolutely.

Booms and busts are an integral part of economics. It is naïve to think that we can avoid them.

As for how big and when it will occur though, the answer is far murkier.

History would suggest that we are due for a big collapse. Something the pandemic looked likely to create. But then the central bankers stepped in and inflated the bubble even more.

That’s why Schiff is so horrified. Because with each passing day he sees the eventual bust growing in magnitude. One that will wipe out the value of ‘money’ as we know it.

Therefore, as his logic goes, everyone should buy gold.

But gold isn’t the only way to invest outside of the current monetary system…

The digital alternative to gold

See, Schiff’s conclusion to his central banker teardown is only gold. As he puts it:

‘The world is going to return to gold-backed paper money.’

But I don’t agree with this. I don’t think a gold-backed currency — US-based or otherwise — is feasible in our modern world.

The logistics of it were a nightmare in the past, and they’d be even more of a nightmare today. I’m sure Schiff would argue that it is a far more appealing nightmare than total monetary disorder, though.

Which is true…if there weren’t other alternatives.

And this is where my view, and many others’, diverges heavily from Schiff’s. Because for those that understand Bitcoin [BTC], it is (on paper) a far better alternative. One that directly aligns with the same argument for gold-backed currency, just with a digital slant.

Famously though, Schiff is no believer of bitcoin. Or any cryptocurrency for that matter.

He, like many other gold bugs, can’t grasp the intangible value behind them.

Which to be fair, is understandable. Trying to wrap your head around how a blockchain works for the first time can be aneurysm-inducing. A complex system of cryptography, computer science, and hard logic.

It is totally alien to any monetary system to date.

But it does work, and it is constantly improving.

Everyday development on bitcoin and crypto continues. Systems that will, I believe, one day play a much more direct part in a global monetary system.

For that reason, just like gold, it is something that everyone should consider investing in. After all, bitcoin has been steadily closing the gap. With a market size that is roughly 2.4% of gold right now.

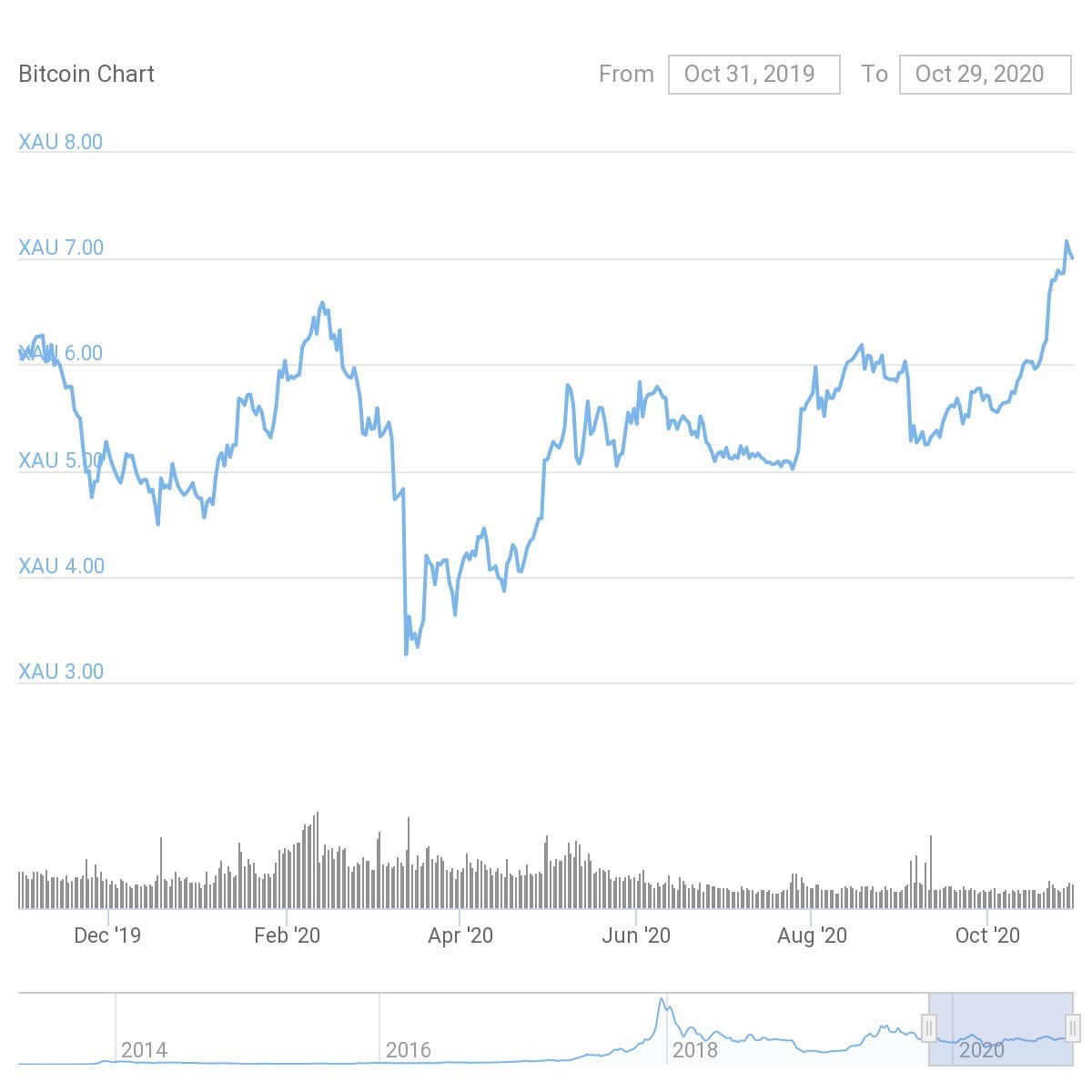

But, as the following chart shows, bitcoin’s price relative to gold is on the rise. With one bitcoin now worth roughly seven ounces of gold:

|

|

| Source: CoinGecko/CoinTelegraph |

So, whether Schiff is right or wrong, the crypto markets are stirring once more. A sign that perhaps another boom is on the horizon.

Whether that is because of central bank mismanagement or speculative hype, is in the eye of the beholder. In the long run though, I know which side of history I would lean toward. And I believe Schiff would too.

Just something to think about should the collapse come sooner than expected.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Comments