‘History doesn’t repeat itself, but it often rhymes.’

Mark Twain

Shopping is one of my least favourite ways to spend time.

Retail therapy…who are you kidding?

It’s ‘retail torture’.

But, in acknowledging the reality of ‘happy wife, happy life’, I know mental strength must be summoned to endure the anguish of visiting stores (plural!).

And our quest for new furniture begins.

Expecting to be confronted with too many choices, I steeled myself for a long day.

But no (to my pleasant surprise), this wasn’t the case.

Why?

Because almost every furniture store had chairs covered in Bouclé fabric…like this one:

|

|

| Source: Est Living |

In the end, we would ask the salespeople, ‘have you got anything NOT covered in Bouclé?’.

Everything old is new again.

Bouclé was invented in the late 1940s by the Finnish American architect and industrial designer, Eero Saarinen. The fabric was used on the ‘Womb chair’ he designed.

If you’re old enough, you may recall Bouclé made a resurgence in the decade of flared jeans and long hair…the 1970s.

Then, it faded from our consciousness.

Now Bouclé is back and, it’s…everywhere.

Furniture. Fashion.

Every decade has a new ‘in’ thing.

But it isn’t really new…just a revamped version from an earlier era.

Trends come and go and come again.

Much like…finance.

To borrow from John Denver’s hit song…‘some decades are diamonds, some decades stone’.

The decade that was, is not the decade that is…

The decade from 2010–21 was an exceptional one in the world of finance.

Definitely a diamond.

An era of ultra-low rates made it fashionable to own…cryptos, tech stocks, IPOs. NFTs, meme stocks…anything you touched went up.

Believing you could turn the investment equivalent of ‘cows’ ears’ into ‘silk purses’ was so on trend.

The ‘worthless’ were considered ‘priceless’…heck, even NFTs (for a moment in time) became ‘collector pieces’.

But that era of delusion — or as Harvard Finance Professor Mihir A Desai calls it, ‘Magical Thinking’ — is over:

|

|

| Source: NYT |

To quote from the article:

‘The end of magical thinking is upon us as cryptocurrencies and valuations are collapsing — and that is good news…Hopefully, a revitalization of that great American tradition of pragmatism will follow.’

While recent action on Wall Street and the ASX 200 appears to be signalling, ‘business as usual’, DO NOT be deceived.

The narrative is ‘the worst of inflation is over’.

Time to party again.

Perhaps.

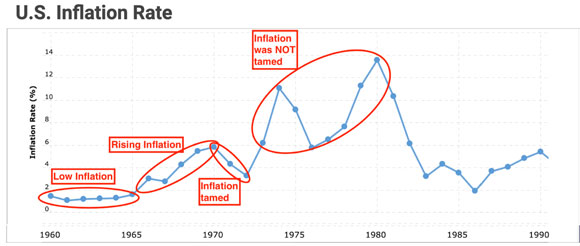

But could we see history rhyme again…bringing back the inflation fads of the late 1960s and 1970s?

Low inflation followed by higher inflation.

Phew, inflation tamed.

Wrong. The inflationary pressures within the system are too great:

|

|

| Source: Macrotrends |

Global conditions today are vastly different to the 2010–21 period of rampant speculation.

How so?

- Persistent low inflation replaced by the potential for higher inflation (more on why this could be the case shortly).

- Prolonged period of ultra-low interest rates replaced by longer periods of higher (compared to what we had) interest rates.

- Globalisation replaced by localisation and covert trade wars.

- Just-in-time supply chains replaced by just-in-case warehousing.

- Decades of relative peace replaced by outbreaks of ‘hot’ and ‘cold’ wars.

- Jobs gradually replaced by artificial intelligence (machine learning, robotics, and automation). Increased social tension and political instability (on the left and right) is likely.

- Over the past decade, global debt has ballooned to US$350 trillion (in 2008 it was US$140 trillion). How is this ‘mind-blowing’ level of debt going to be serviced in a higher interest rate world? Something will have to give. And, when it does, we might see a temporary fall in inflation. Possibly even deflation.

However, it’s unlikely to remain there.

Why higher inflation is a likely fixture

Recently, I wrote, ‘we’re facing “wars” on three fronts’.

I was wrong. There are four wars:

- Geopolitical War

- Russia versus Ukraine and NATO.

- China versus Taiwan and its Western Allies.

- Middle East…Israel versus Iran.

As noted Economist Nouriel Roubini recently stated (emphasis added):

‘… the US, Europe, and NATO are re-arming, as is pretty much everyone in the Middle East and Asia, including Japan, which has embarked on its biggest military build-up in many decades. Higher levels of spending on conventional and unconventional weapons (including nuclear, cyber, bio, and chemical) are all but assured, and these expenditures will weigh on the public purse.’

- Climate War

A war against ‘climate change’ is being waged.

This is also a costly war.

Not just in terms of the trillions of dollars being spent on renewable projects, but also the cost to economic productivity from disrupted and intermittent (and increasingly more expensive) energy supply.

- Pandemic War

More public money is being spent on preventative measures and healthcare systems to cope with the prospect of future pandemics and the impacts on an ageing society.

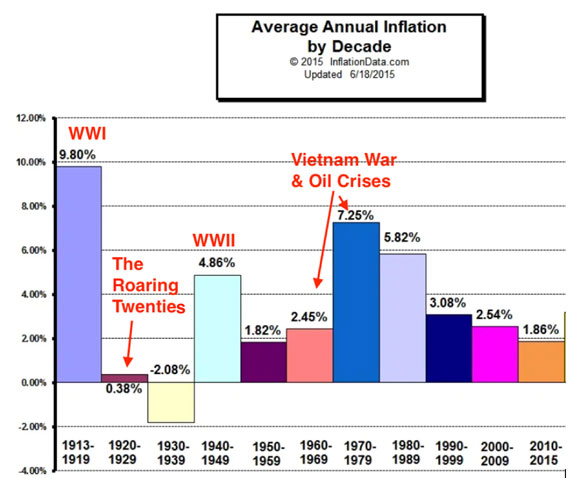

If history is any guide, the combined cost of these ‘wars’ (measured in tens of trillions of dollars) is destined to be inflationary:

|

|

| Source: Inflation Data |

Funding geopolitical wars is an expensive exercise.

It’s no coincidence US inflation increased during periods of conflict.

The switch from low-cost to high-cost energy — oil crises in the 1970s — also created significant inflationary pressures.

The future we face has…geopolitical war/s, higher energy costs, AND the political pressure to fund greater demand for first-world healthcare.

Plus, there’s a fourth war:

- Social Inequality War

Placating the disenfranchised. Quelling social unrest. Making sure ‘idle hands don’t do the Devil’s work’. And calming the nerves of retirees by topping up pension funds decimated by a collapse in asset markets. Those ‘temporary’ pandemic stimulus payments (which, in our nation’s case, inflated our public debt to more than $1 trillion) are likely to be reintroduced as permanent welfare fixtures.

How do governments the world over pay for all these ‘wars’?

No country collects sufficient tax revenues to fund these ‘wars’.

Any talk of balanced budgets is pure fantasy…not going to happen.

Financing these various ‘wars’ will be tasked to the central bank printing press.

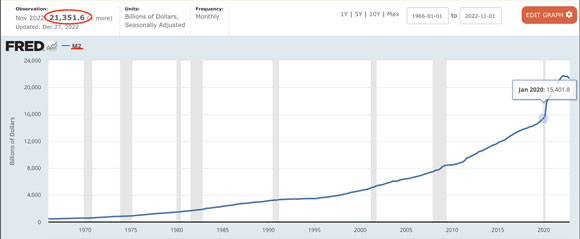

We know what happened to inflation in the US when Money Supply (M2) and Public Debt went almost vertical after 2020.

US M2 money supply has increased by US$6 trillion in just three years:

|

|

| Source: Federal Reserve Economic Data |

US Public Debt has now hit the debt ceiling with the addition of US$7.7 trillion in three years:

|

|

| Source: Federal Reserve Economic Data |

The same story is being told in Australia, Europe, Canada, NZ, etc.

Politically there is no way out of these ‘wars’.

Does NATO and its allies say, ‘we can no longer provide financial and military aid to…’?

Do the political class (and all the climate change hangers-on) say, ‘we were wrong. It was all a con. Let the markets sort this transition to cleaner energy out’?

Do the politicians say, ‘we no longer have the capacity to fund a modern, well-resourced and professionally staffed healthcare system’?

Do we accept a growing level of social unrest from those who feel left behind and/or have too many idle hours to spend on social media looking for ‘fellow pi*sed off tribe members’ OR do we buy social harmony with hush money?

Do increased debt servicing costs force governments to default on debt obligations OR do they print money to keep their AAA credit ratings?

If, like me, you think the political class will do what it always does — take the soft options — then inflation is going to be a persistent issue…much like the 1970s.

If so, the new financial fashion trend is stone.

Get used to seeing it everywhere.

Check out my ‘Digger Defence’ strategy if you’re wanting actionable solutions for safeguarding your wealth from what is to come.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia