Energy sits at the heart of national security.

That’s why oil has played centre stage in global conflict and geopolitical tension.

It’s been the most contentious commodity for over a century…responsible for bloody wars in the Middle East, authoritarian dictatorships in Northern Africa, and economic warfare between the US and those nations that don’t abide by its terms.

That’s why some suggest that an end to oil could lead to global peace.

Unfortunately, that’s unlikely.

Shifting into renewables CHANGES demand into a new type of ‘energy’ commodity…critical metals.

But one metal in particular is set to become far more contentious.

That’s because it sits at the heart of the green energy transition…

As I explained last week, I believe COPPER is set to become the NEW crude oil.

You can revisit that article here.

So, in a similar vein to oil…will future wars be fought over this critical metal?

That’s certainly possible.

Copper reflects many of the supply issues typical of crude.

Just like crude oil, much of the world’s copper reserves are isolated within geopolitical hot spots.

Peru, the world’s second-largest producer of copper, has witnessed riots and the threat of civil war…

Political instability forced numerous mine closures throughout 2022.

Meanwhile, Chile — the world’s largest copper producer — continues to threaten nationalisation with higher royalties against multinational operators.

That’s a major deterrent for foreign capital needed for mine development and new discovery.

Chile’s production faces other threats too…prolonged droughts across the north and declining grades across the world’s largest copper mines, including the BHP co-owned Escondida.

Then, there’s the Democratic Republic of the Congo (DRC), touted as holding the next generation of high-grade copper mines…

Many see the DRC as picking up the slack from declining production in South America.

Yet the DRC is one of the least stable nations on the planet!

Decades of war in the east, dictatorships, corruption, and a history of mine nationalisation, makes this place un-investable for miners looking to meet their ESG obligations.

Global tension won’t end with oil. Instead, the problem will shift to new locations and quite possibly elevated levels of conflict in the search for valuable metal reserves.

But it isn’t all bad news!

In fact, this is an enormous opportunity for investors that understand the issue at play here…

Australia set to become a major copper producer…if it wakes up to the potential!

No doubt you’ve seen the anxiety among Australian political leaders with the inevitable end to coal exports and how that’s set to impact our economy in the years ahead.

But with just a little foresight, politicians could open their eyes to the incredible opportunity presenting…

Sitting below their feet lies the world’s SECOND-largest reserve of copper.

That’s right, Australia has vast copper potential!

That’s according to the global authority on the matter…the US Geological Survey (USGS).

Right now, Chile and Peru are the world’s two most important copper producing nations…making up a staggering 40% of global supply.

But why hasn’t Australia tapped into its copper potential?

After all, there’s a long history of copper mining here. Cornish miners sailed from Britain as far back as 1845, plied their trade in this new frontier, and established some of the largest copper mines in the world (at the time).

One of these mines, located in the small town of Burra, South Australia, accounted for around 5% of global supply.

Despite its long history of copper mining, though, Australia is now just a minnow compared to the South American production giants.

Australia — the iron ore, coal, and gas producing behemoth — has failed to recognise its copper potential.

But that could be down to the geology…I’ll get to that point in a moment.

So, where does the bulk of Australia’s untapped copper sit?

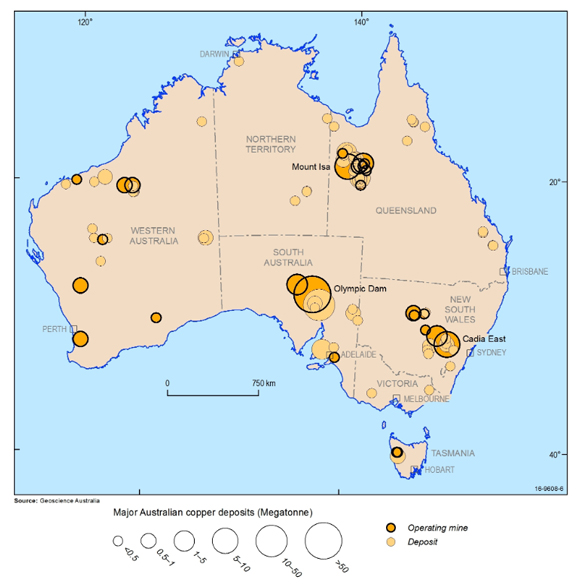

Well, according to Geoscience Australia, South Australia holds the greatest share of the nation’s copper, followed by Queensland in the Mt Isa region, and Cadia in NSW.

You can see where the deposits are concentrated on the map below:

|

|

| Source: Geoscience Australia |

But as a geologist, born and bred in South Australia, I’m all too familiar with the difficulty of tapping into the state’s vast copper potential.

You see, South Australia is mired by a thick layer of barren cover that has traditionally made discovery difficult.

But that could be about to change, which I’ll explain below.

An opportunity beckons…

New techniques in geophysics are allowing geologists to penetrate the thick overlying sediment allowing them to uncover the potential that sits below.

And thanks to its deeply buried treasure, South Australia is perhaps one of the last great frontiers for copper discovery.

The region will be a key focus as competition for this critical metal heats up over the coming years.

With investment starting to trickle its way back into exploration, the next big discovery could be around the corner.

The last major discovery in the state was around 20 years ago…Prominent Hill…now owned and operated by Oz Minerals and set to fall into the hands of the world’s largest miner, BHP.

But it wasn’t a major miner that made the discovery…it was a tiny 10-cent explorer.

Derek Carter, a legend in geological circles, discovered one of Australia’s largest high-grade copper deposits through his exploration company Minotaur Resources.

He was awarded AMEC’s Prospector of the Year Award (jointly) in 2003…

Prospector of the Year Award is a bit like the Oscars for geologists!

Yet he sold his company’s stake in the project just a few short years after the discovery…why?

Carter believes the best value in mineral deposits comes from discovery.

In his own words:

‘The sale of the Prominent Hill project allowed Minotaur to return and hunt for the next BIG ONE.’

This geologist wasn’t interested in mining, he had discovery in his blood.

As investors we can ride that type of success by partnering with proven explorers like Derek Carter.

He led Minotaur and its shareholders toward a financial windfall.

In fact, PROVEN discovery among a company’s management team is a key metric I use in assessing explorers that have a high probability for success.

Not only that, but I also focus on exploration stocks where geologists run the show.

Surprisingly, relatively few exploration companies are actually led by geologists.

In a similar vein, investment firms that specialise in mining and exploration stocks aren’t led by geologists…they’re overseen by money managers and finance specialists.

But at the heart of every exploration stock sits the geology.

Its assets sit in the ground, not in financial statements.

Therefore, it pays to have someone who understands both the science and operational requirements that lead to discovery.

Investing in discovery is the most exciting place to be

As a geologist, I’ve worked through all phases of the mining life cycle, from early exploration to project development.

I’ve spent years in the field working for the tiny 10-cent explorers to the mining giants like Barrick Gold and Northern Star.

But my thinking aligns with Derek Carter…early exploration is the most exciting place to be. As a geologist or an investor, discovery is where the greatest value is born.

That’s why I’ve just put together a presentation for investors…a free demonstration that outlines my strategy with real-world examples.

And it airs tonight, at 7:00pm AEDT.

So now is your last chance to put your name down so you don’t miss it.

As I’ve touched on previously, I believe we’re on the precipice of entering a more speculative phase in this commodities cycle…

That’s the time to consider adding explorers to your portfolio.

But of all the commodities that have strong supply and demand fundaments…copper presents as one of the most exciting opportunities.

This, alongside higher prices and advances in technology, are set to unlock new discoveries in Australia’s untapped copper frontier.

Australia truly is the mineral-rich equivalent of oil abundant Saudi Arabia.

But never has this been so true now that copper is set to become the NEW CRUDE OIL.

Regards,

|

James Cooper,

Editor, The Daily Reckoning Australia