Earlier this week, I wrote to my subscribers that small-time investors like you and me are the pesky flies that sit on the wall of big-time players and mining executives…

Usually, we play ball on managements recommendations to shareholders.

As deals get brokered…mergers and acquisitions (M&A) take place…investors are fed the corporate spin…

But rumblings are growing in the industry.

Are these deals always in the best interests of shareholders?

Given much of the recent M&A activity has involved majors taking over mid-tier mining stocks, one has to ask: Is now really the time to be selling?

With so many metrics pointing towards supply deficits and unprecedented demand arriving in the form of a dramatic energy transition, it seems we truly are embarking on a new era for commodity stocks.

Fundamentally, the outlook for mining has never been stronger.

Take yourself back to the early days of the China-fuelled commodity boom around 2003/04, and we perhaps have a sense of what lies ahead.

The cycle is on course to repeat — not exactly, but with similar outcomes.

But this time it’s the political elite leading the charge. Why?

They’ve signed the death knell for the oil and gas industry.

Termination of exploration rights, strict ESG requirements that cut investment to the industry from retail funds, and an open commitment to destroy their business model…

That’s why new oil and gas discovery is at its lowest level in 75 years, according to the research firm Rystad Energy.

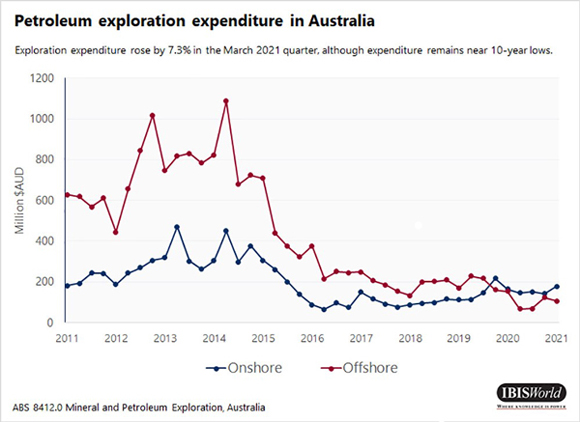

The situation is similar in Australia. Oil and gas expenditure for new discoveries is hovering around 10-year lows.

See for yourself below:

|

|

|

Source: IBIS World (data ABS Australia) |

Government mandates have successfully killed corporate motivation to find replacement fossil fuels.

That has some very real consequences for our future energy security, when we ALSO consider mineral exploration has also suffered from severe underinvestment for more than a decade.

It paints a VERY bleak picture for a SMOOTH energy transition.

That’s the reality we now face. There’s no turning back now.

With all that said, why are shareholders eager to give up their stock in a junior to a major mining corporation as part of a buyout offer?

After all, it’s these mining conglomerates that are sounding the alarm bells over supply deficits.

As Bloomberg reported late last year (emphasis added):

‘Glencore CEO Gary Nagle referenced estimates that global copper demand is expected to hit 50 million tonnes a year by 2030. In 2022, current world copper demand sits at around 25 million tonnes.

‘In short, Nagle believes that the combined forces of copper miners globally will not be enough to make up the shortfall soon enough to avoid an international copper supply deficit.’

Nagle would know…as the boss of a major international mining conglomerate, he sits at the coalface in terms of global copper production.

With an international copper supply deficit looming, it seems bizarre — if not downright reckless — mining boards would recommend to shareholders that they accept an offer from a major.

But that’s what the Oz Minerals [ASX:OZL] board did.

A deal that was finally cemented last week.

An insurmountable challenge awaits

Forget about the exponential increases for metal supplies needed to bring about an end to oil…

Maintaining current demand will be a challenge.

The world’s most influential mining executives are acutely aware of this seemingly impossible task.

Yet they have also compounded the problem…

You see, the majors — burned by exuberant acquisitions at the peak of the last mining boom — have underinvested in project development and exploration for more than a decade.

Instead of bringing new projects online, they’ve zipped the purse strings and carried on plunging machinery through marginal low-grade rock — material that would otherwise be considered waste.

I’ve seen first-hand the slow-death effect of companies refusing to spend on project development while feeding marginal ore through processing facilities, pushing ageing facilities well past their use-by-dates.

As Bloomberg reported earlier this month, the world’s largest copper-producing nation, Chile, just posted its LOWEST monthly copper output in six years.

The state-owned copper conglomerate Codelco expects production to fall a staggering 7% this year.

I’ve been warning my readers for months that Chile was staring down the barrel of a massive cut to its copper output.

This reality is now hitting the headlines.

It’s a key reason why one of our advanced copper explorers is up more than 60% since we recommended the stock four months ago.

Lack of investment equals lack of supply.

It’s a trend that will get worse, just as the world demands more copper.

And not just copper, many other critical metals have suffered a similar fate…years of underinvestment.

It brings me back to the question of acquisitions.

Mines are a depleting asset.

The world’s biggest miners desperately need to resupply their ageing mines.

Lack of project development, inability to make meaningful investment in greenfield or brownfield exploration, rules out organic growth.

But for stockholders of mid-cap miners holding quality high-grade deposits, this represents a long-term opportunity.

Given the state of play, I firmly believe Oz Minerals shareholders will be kicking dirt for years to come…reeling from their missed opportunity, having given up their prized copper assets to BHP.

But Oz should serve as an important lesson to ALL investors.

The majors know what is at stake here.

BHP co-owns the world’s largest copper mine, Escondida, in Chile.

Last year, the big miner claimed lower ore grades, supply chain disruptions, and a reduced workforce due to COVID-19 impacted its FY22 copper production in Chile.

But lower ore grade is the key. You can’t change the geology of a deposit.

You also can’t find replacement ore in a snap.

Higher prices will mean little for the likes of Glencore, Rio Tinto, or BHP if they can’t resupply their ageing mines.

Prepare your portfolio for a fierce bidding war as the majors try to get their hands on the next generation of deposits.

That’s what we are doing at Diggers and Drillers…

Adding small- to medium- mid-cap mining stocks holding large, high-grade deposits.

It’s these PRIZED assets that sit in the crosshairs of the world’s largest mining stocks.

Using my industry experience and geological knowledge, I’ve been able to zero down on some of the best projects.

Most of these stocks remain a BUY in the Diggers and Drillers portfolio.

You can access all the details here.

Next week, I’ll give you the name of one stock in our portfolio that is ALREADY the subject of a buyout offer from a major.

I’ll also detail my strategy that led to the recommendation just a couple of months prior to the offer coming through.

Until then, have a great week.

Regards,

|

James Cooper,