Dear Reader,

What a gift I woke up to this morning.

Sure, it’s Melbourne’s first day in lockdown 2.0.

But the US dollar gold spot price cracked above US$1,800 overnight…

Eh, you can’t win ‘em all.

While I’d love to deep dive into what that means for the future gold price today, I’ve got a very special video set to record this morning.

Next week I’ll fill you in on what this means for the gold spot price.

Today, however, I’m digging into the Daily Reckoning Australia archives, and I’m going to share with you something I wrote last year.

Paper beats rock?

We’re going on a little gold bend this week.

See, even though I’ve been talking about the benefits of owning gold, for say, a decade now, many people still don’t know where to start when it comes to swapping their cash for the yellow metal.

In fact, it’s estimated that only 1% of Aussies own physical gold.

That means there’s still a whole bunch of Aussies that have never bought physical precious metals…

…so today, I thought we’d have a look at the basics.

Let’s have a look at paper gold versus owning the physical stuff.

Your paper gold options

Now, long-time readers of the Daily Reckoning Australia know I regularly recommend investors should put a small percentage of their wealth in physical precious metals.

Think of buying physical bullion like swapping one currency for another.

But there are other ways to gain the benefits of a rising gold price, without owning physical gold.

One reader wrote in a few months ago, asking how gold-backed exchange traded funds compare to owning gold miners.

‘Can you please enlighten us all about Gold ETFs. What are they, are they worth investing in on the ASX vs individual Gold Companies? Do they pay good yield? How are they in an environment of price increase of gold as per the last 6 weeks? Thank you.’

Before I get to that, let’s run through the two most common gold ETFs on the Australian Securities Exchange (ASX).

Please note the two gold ETFs I will run through today don’t use leverage.

There are two 100% gold bullion-backed ETFs listed on the ASX:

- BetaShares Gold Bullion ETF [ASX:QAU]

- ETFS Metal Securities Australia Ltd [ASX:GOLD]

ETFS Metal Securities Australia has been listed on the ASX since 2003. With this ETF, one unit (share) represents about a 10th of the spot gold price.

It means that, if you buy one unit of this ETF, it will cost roughly 10% of the Aussie-dollar gold price per ounce.

For example, if the physical gold spot price is trading at $1,740 an ounce. That means one unit of this ETF will be roughly $174 per unit.

If the Aussie gold spot price moves up by one dollar, the value of the ETF units will increase by 10 cents.

Then, there is the BetaShares Gold Bullion ETF, which does have a currency hedge.

This means that, while you are still using Aussie dollars to buy QAU units, the ETF tracks the US gold spot price. Basically, this gives you a ‘purer’ exposure to the USD gold spot price.

One QAU share is a 100th of the USD gold spot price. Again, a one-dollar movement in the USD gold spot price will equate to a one-cent movement in QAU.

If you are looking to increase your exposure to the gold price through an ETF, these Aussie-listed ETFs, which are 100% backed by gold bullion, are a good way to do so.

Gold ETFs or gold miners

The alternative is a gold ETF compiled of gold miners rather than backed by physical gold.

An alternative to a gold-backed ETF, however, is one that derives its value from gold mining stocks.

One of the more popular ones at the moment is the VanEck Vectors Gold Miners ETF [ASX:GDX].

GDX aims to replicate the NYSE Arca Gold Miners Index [GDMNTR], which in turn aims to track the performance of globally listed gold producers.

The weighting of GDX is biased towards gold mining stocks in Canada (52.3%), Australia (16.1%), and the US (17.5%).

The remaining 14.1% is based on gold mining companies located in South Africa, Peru, China, Monaco, and the UK.

Which is better: Physical gold or gold ETFs?

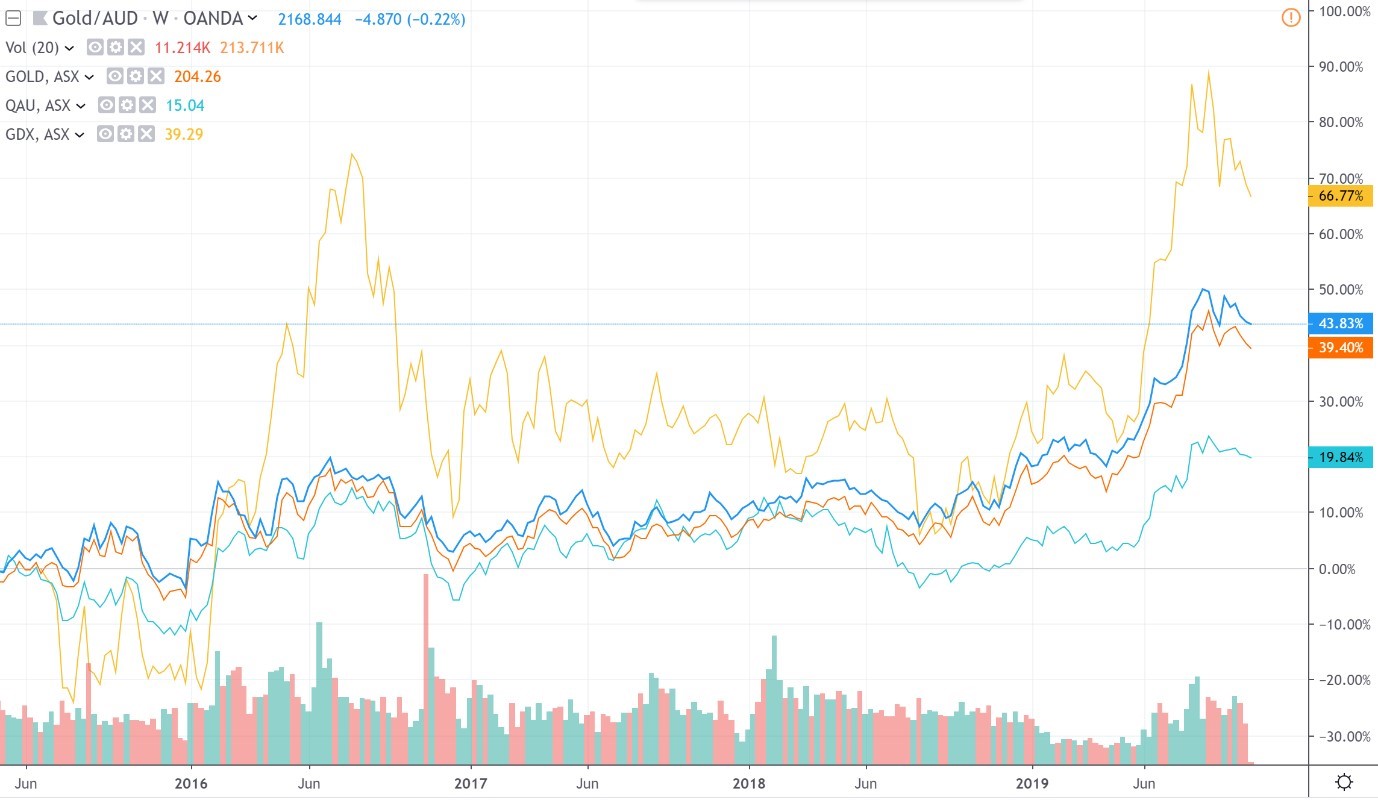

Now let’s compare these three to the physical price of gold in Aussie dollars:

Gold ETFs versus Aussie dollar gold spot price

|

|

| Source: Trading View |

What we can see here is that QAU (light blue line) has lagged behind the rising Aussie dollar gold price.

The reason for that?

Simple. QAU is based on the US dollar gold spot price. That doesn’t mean that QAU is underperforming or a bad investment. It simply means that QAU will only follow US dollar gold price movements.

In contrast, there is GOLD (orange line), which has moved in lockstep with the Aussie dollar gold price (dark blue) and has increased in value.

The difference between the two is a great example of how fluctuations in the Aussie dollar — strengthening or weakening against the greenback — can greatly affect investor returns.

Then, we have GDX (yellow line), which has slightly outperformed the Aussie dollar gold price in the past year.

However, you’ll notice GDX is much more volatile than both gold ETFs and the physical Aussie dollar gold price.

Again, this is where it’s important to remember that GDX is based on gold miners around the world.

Essentially, GDX is a mashup of international company share prices plus various currency movements.

Not only that, the underlying basis for GDX is the world’s biggest gold mining companies.

Here, companies like Barrick Gold Corporation [NYSE:GOLD], Newmont Corporation [NYSE:NEM], Newcrest Mining Ltd [ASX:NCM], and Franco-Nevada Corporation [NYSE:FNV] are all major constituents of GDX.

I believe the surge in GDX can be attributed to the Barrick Gold-Randgold and Newmont-Goldcorp decisions to merge.

Remember, if you choose to invest in GDX, it’s essentially an easier way to gain exposure to individual gold miners.

As for individual Aussie-listed gold miners? Well, that’s my bread and butter.

Stay safe!

| Until next time, |

| Shae Russell, |

Comments