Resolution Minerals [ASX:RML] today released a joint venture agreement with OZ Minerals [ASX:OZL], sending its shares higher.

In late afternoon trade on Friday, RML shares were up 15%.

Despite today’s jump, the junior explorer is down 40% over the past 12 months.

But does today’s spike indicate a more risk-on attitude is returning to markets?

OZL Minerals and Resolution Minerals [ASX:RML] Enter JV Agreement

Resolution Minerals [ASX:RML] today released a joint venture agreement with OZ Minerals [ASX:OZL], sending its shares higher.

In late afternoon trade on Friday, RML shares were up 15%.

Despite today’s jump, the junior explorer is down 40% over the past 12 months.

But does today’s spike indicate a more risk-on attitude is returning to markets?

Source: Tradingview.com

RML’s ‘Significant Farm-In’ from OZ Minerals

Resolution Minerals on Friday announced that it has entered a farm-in and JV agreement with large copper miner OZ Minerals.

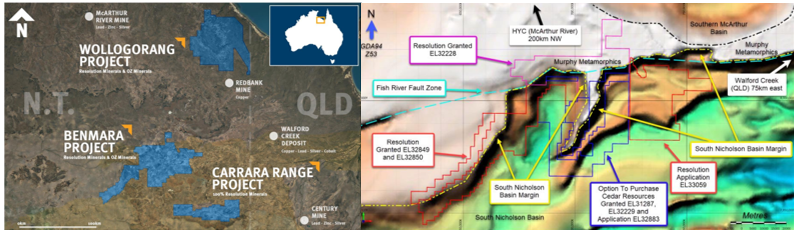

The JV relates to the Benmara Project in the Northern Territory.

Under the proposed terms, OZL can earn a 51% interest in Benmara by spending $4 million over the next five years.

For context, in its most recent half-yearly report, RML reported having only $2.8 million in cash.

The proposed injection of cash from OZL is likely to bolster RML’s operations and capital expenditure.

RML can retain a 49% stake in the project if it elects to participate in the sixth year.

Should RML decide not to participate, OZL has the option to earn a 75% interest by sole-funding and delivering a positive final investment decision to mine.

If OZL doesn’t spend $4 million within the allocated five-year term, Resolution then earns back 100% interest.

Source: RML

RML share price outlook

RML CEO Christine Lawley said:

‘The new farm-in and JV agreement with OZ Minerals, is validation of Resolution’s exploration strategy, which identified the potential for large-scale base metal deposits analogous to the worldclass McArthur River Mine in this under-explored region during the 2021 field season.

‘This development should excite Resolution’s shareholders. The agreement makes it possible for Resolution to advance three major projects simultaneously; two having external funding from copper producer OZ Minerals at both Wollogorang & Benmara Projects. This minimises dilution for Resolution shareholders and creates three major opportunities for shareholder upside.

‘While all eyes will be on drilling activities in June on our flagship 64North Gold Project in Alaska, do not underestimate the value creation being undertaken in Australia with significant drilling activities planned closer to home on our Northern Territory Projects in 2022.’

Undertaking a partnership with OZ Minerals grants RML access to much needed cash to operate the project, even though it will cede majority interest in the project if all the terms are met.

Now, commodities are on many investors’ minds at the moment.

The war in Ukraine and snarls in the global supply chain have sent many commodity prices soaring.

But with inflation still high and interest rates rising, how should investors play the current environment?

Someone who has an idea is Jim Rickards, a veteran strategist with decades of experience…and smart calls.

Recently, he recorded an investment presentation on some of his best ideas to tackle the current investment environment.

To hear more from Jim, click here to access ‘What would Jim Rickards be buying right now?’.

Regards,

Kiryll Prakapenka,

For The Daily Reckoning Australia