In 1862, Hugh Glass was the richest man in Victoria.

A poor Irish immigrant, he made his fortune by speculating on land in a period when the Victorian population was expanding rapidly.

The gold rush brought hundreds of thousands of people from all around the world to try their luck.

And these newly arrived masses needed food, finance, and all the other trappings of civilised society.

This heady mix of wealth, cultures, and industrial activity set Victoria up for its golden age.

It was the era of ‘Marvellous Melbourne’ as one well-known Fleet Street journalist wrote in a series of rave reviews.

‘The whole city, in short, teems with wealth, even as it does with humanity.’

Hugh Glass made hay in this time of opportunity with one report even describing his lavish home:

‘At this time he built Flemington House, valued in the 1850s at £60,000; with its artificial lake and white swans, its Corinthian colonnaded portico supporting a long balcony, its huge ballroom and its landscaped garden sloping down to the Moonee Ponds Creek, it became the showplace of Melbourne.’

Unfortunately for Glass, those ‘white swans’ would soon be on the auctioneer’s chopping block.

Because by 1869, he was bankrupt!

What happened?

Glass speculated on the wrong land at the wrong time, he got into too much debt, and then a couple of good old Australian droughts finished him off.

He died a couple of years later poorer than he started out in the 1840s…

———

I came across this intriguing tale while at my local library with the kids on Saturday.

At the library, I always find myself drawn to the local history section. The stories you find there are amazing, and I highly recommend trying it!

But for me, this story was a reminder that the art of speculating has always been with us.

Whether it’s tech stocks, land, commodities, gold, crypto or any other highly lucrative but uncertain sector.

A certain type of person has always been drawn to such opportunities – I know, I’m one of them!

Because speculation done right can unlock fortunes. But when it goes wrong, it can severely punish you.

Speculation is still very much the story of Australia, just as it was in Glass’ gold rush days. It runs through our veins!

But speculation comes in waves. Right now, few investors have the appetite to speculate, particularly on resource stocks.

In fact, as I’ll show you shortly, a whiff of panic is starting to spread across this sector.

That’s thanks to some steep falls in key commodities.

But, counterintuitively, that could be your big opportunity.

Today, let me show you the case our in-house geologist is making for betting big on a subset of key mining stocks…

Mainstream starting to panic

Let’s start with the action…

The resource sector continued its recent downturn with a big sell-off last Friday.

Market analyst David Scutt posted this at the end of the trading day:

‘Rebar and hot-rolled coil steel futures in China getting smoked again, down 2.7% and 3.6% respectively. Both fresh contract lows. More downside pressure on iron ore and coking coal #ugly’

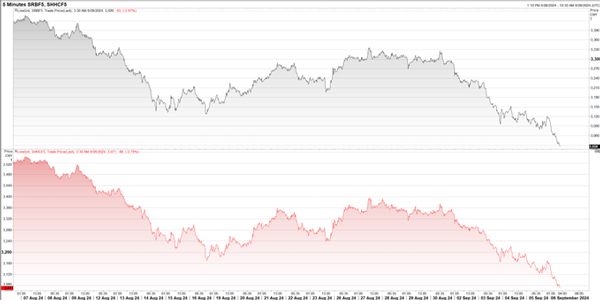

These were the charts he was referring to:

| |

| Source: David Scutt |

As you can see, both iron ore and coal have been selling off sharply this month and the falls have only accelerated over the past two weeks.

The culprit?

A slowdown in China plus a growing fear of a wider global recession.

As Trading Economics put it:

‘Latest data showed that China’s manufacturing activity remained contractionary in August, while services sector growth slowed.

‘Prices of new homes in the country also rose at a slower pace in August amid ongoing property sector woes.

‘Moreover, dwindling profits for Chinese steel mills dampened market sentiment further. Elsewhere, industry data pointed to rising iron ore inventories in key Chinese ports, reflecting soft demand conditions.’

If that’s not bad enough for iron ore…

We’re at a pivotal moment from a psychological point of view, too.

When you zoom out a bit further, you can see we’re sitting bang on a key support level of around US$90/T.

Check it out:

| |

| Source: Trading Economics |

If this price fails to hold, we could see lows in iron ore not seen since the Covid pandemic of 2020.

The mainstream financial press is starting to panic and we’re getting opinion pieces like this appearing in the daily press:

| |

| Source: AFR |

‘A prolonged period of pain looks likely.’

Eek, that doesn’t sound good, does it?

But here’s the thing…

This is music to the ears of every contrarian investor.

It’s only when fear and panic start to set in that you get the kind of once-in-a-lifetime speculative buying opportunities I personally love to invest in.

But in the mining industry, that’s not always an easy task.

There’s so much variation in the type of miner you are buying into.

The key is to separate the quality projects that are actually undervalued from the also-rans that will probably fade away in any general bust.

Luckily, here at Fat Tail Investment Research, we have a professional geologist on our side who can do just that!

James Cooper, our man on the ground, has been closely following the recent iron ore story.

And, like me, he’s starting to sniff out a big contrarian opportunity.

Here’s what he told members of his Diggers and Drillers advisory last week…

What our in-house geologist is saying

James wrote last Tuesday:

‘So, has iron ore bottomed out?

‘That’s not something I can answer.

‘If prices break decisively BELOW the key psychological level of US$100/tonne, a fall to the pandemic lows of around US$80/tonne (red circle above) is possible.

‘But that won’t mean a secular bear market is underway for iron ore.

‘You see, this is not a market sitting on the brink…rather, it’s a sector undergoing a transformative change.

‘What do I mean?

‘Remember, iron ore is the crucial raw material used to make steel.

‘So, when you’re talking about demand for iron ore, you’re basically talking about demand for steel.

‘Last month, I pointed out the shifting demand dynamics in China’s steel market over the last decade.

‘The world’s second-largest economy continues to transition away from a construction-led economy to a mature manufacturing giant.

‘For example…

‘In 2012, construction, including new housing starts, accounted for around 50% of the nation’s steel demand.

‘Today, it’s less than a quarter!

‘Industrial manufacturing is now the most important driver of steel demand in China.

‘That includes mining and agriculture equipment construction, plus the millions of tools and automotive parts shipped worldwide.

‘Yet, most commentators are still stuck in the past.

‘They remain preoccupied by the slow growth in [China’s] new housing starts as the catalyst for Australia’s seemingly inevitable iron ore demise.

‘In my mind, the demand for iron ore and other commodities will persist, yet the drivers of that demand will naturally change as China’s economy matures.

‘This is the truth behind iron ore’s “surprise” resilience.’

This angle really intrigued me as it’s not something I’ve heard elsewhere.

Of course, James doesn’t have a crystal ball, so he may not be right on this.

But as I said, he does have the next best thing – experience in valuing junior miners based on their geological makeup.

Right now, he’s using these geology skills to identify low-cost, high-grade miners, that are close to key infrastructure.

If stocks go lower, he’s ready to bag some quality players in anticipation of the next boom.

So, if you’re a contrarian speculator like me – the bravest kind of investor! – Then do yourself a favour and see what James has to say.

Check out his latest presentation here now.

With a bit of luck, it’ll help you recreate Hugh Glass’ speculative success from the 1850s and not his bout of bad luck in 1869!

Now, I’m off to search Amazon.com for ‘white swans’ for my garden…just in case…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments