The Orocobre Ltd’s [ASX:ORE] share price is up 3.8% today on lithium price upgrade following strong market demand for Olaroz lithium carbonate.

ORE shares were up as much as 4.9% in early trade.

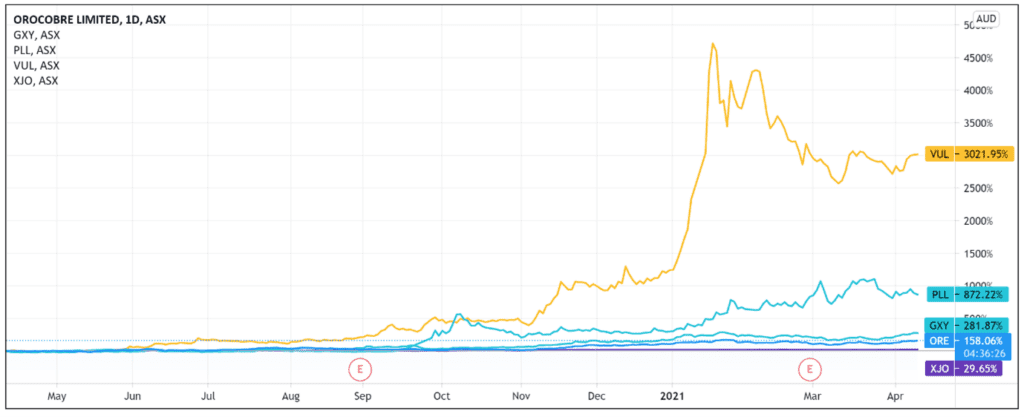

Year-to-date, the ORE share price is up 26% and up 155% over the last 12 months.

Orocobre lithium price upgrade

During the March 2021 quarter, ORE reported sales of 3,032 tonnes at US$5,853/tonne FOB, with pricing up more than 50% on the December 2020 quarter.

Orocobre stated that ‘strong market demand’ for its Olaroz lithium carbonate contributed to lithium prices received by Olaroz being up nearly 90% in the last six months.

Its Olaroz lithium facility is in northern Argentina, a material JORC resource in the adjacent Cauchari Basin.

The company expects prices for the June 2021 quarter to be about US$7,400/tonne FOB, subject to shipping schedules.

As Orocobre explained, free on board (FOB) pricing excludes insurance and freight charges included in cost, insurance, freight (CIF) pricing.

As a result, Orocobre’s reported prices are net of freight, insurance, and sales commission.

According to the company, the US$7,400/tonne FOB pricing will be the ‘highest pricing received since June 2019.’

ORE expects this to result in H2 FY21 pricing to be approximately 20% higher than prior guidance.

Orocobre will release full details of its March 2021 quarter performance on 21 April 2021.

Three Ways to Invest in the Renewable Energy Boom

ORE share price outlook

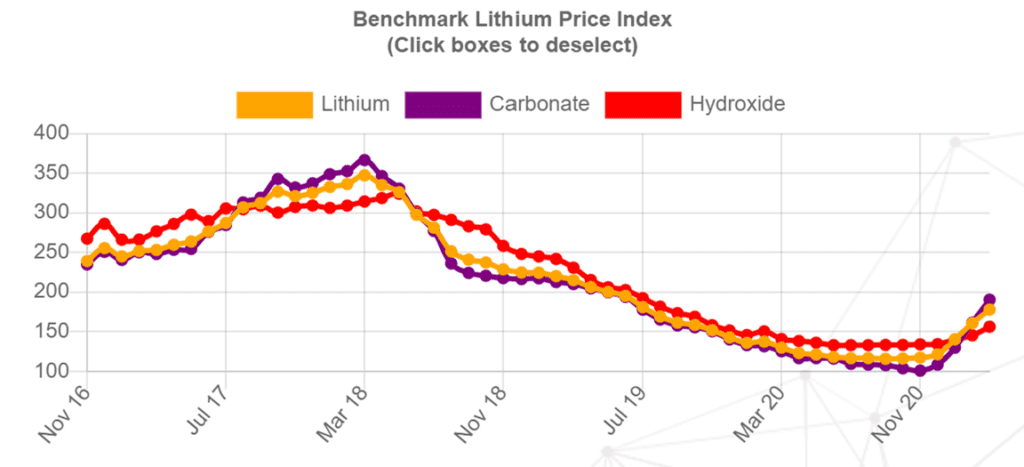

Benchmark Minerals — which sets the lithium industry’s reference price used in negotiating supply chain contracts — has seen its Benchmark Lithium Price Index continue to rise.

Source: Benchmark Minerals Intelligence

Source: Benchmark Minerals Intelligence

And Fastmarkets — the price reporting and intelligence service — reported that in the week ending Thursday, 1 April:

- Lithium prices in China rose on restocking while supply remained tight.

- Seaborne Asian lithium prices rose on ‘persisting tight availability.’

- European and US prices recorded further gains for technical-grade material.

Major automakers like Volkswagen are setting ambitious electric vehicle targets.

And Europe, the US, and China are all crafting policies to incentivise electric vehicle adoption.

For instance, US President Biden’s proposed $2 trillion infrastructure plan includes $174 billion to boost the electric vehicle market.

So electric vehicles are no longer a futuristic oddity, they are here to stay.

And lithium stocks are currently benefiting.

ORE itself reported today that its forward sales enquiries for all grades of Olaroz lithium carbonate ‘remain strong and all budgeted FY22 production is fully sold.’

The company thinks its variable pricing of budgeted FY22 production will benefit from ‘expected continued improvement in market conditions.’

Bullish investors will likely also note that ORE expects additional production to become available when its Olaroz Stage 2 begins production in the second half of CY22.

That said; investors might seek further information and data from ORE’s upcoming March quarterly performance update when assessing ORE’s ability to serve the rising demand for lithium carbonate long term.

Lithium is on a lot of investors’ minds. But with so many news items coming out almost daily, it is hard to keep up and know where to look for lithium investment ideas.

I think this free report on ASX lithium stocks is a great place for anyone who wants further information and ideas.

Regards,

Lachlann Tierney,

For Money Morning