At the time of writing, the share price of Orocobre Ltd [ASX:ORE] is trading at $3.00, down .66%.

At the recent general meeting, the company announced the full impact of COVID-19 and progression of the Olaroz lithium project.

Source: Optuma

Key points from ORE AGM presentation

The Olaroz lithium project is located in Argentina. According to the company, Stage 1 is expected to recommence ramp up in FY21.

While Stage 2 is expected to commence production in H2 CY22.

By FY22, Orocobre is aiming to produce lithium carbonate and lithium hydroxide for the battery market.

The global market for lithium-ion batteries is rapidly expanding. Expected to grow from US$44.2 billion in 2020 to US$94.4 billion in 2025.

Here are some key points drawn from the presentation:

- ‘Q4 FY20 costs are down by 22% from Q1 FY20, Stage 2 will drive costs even lower, Orocobre to remain in the bottom quartile of global cost curve

- ‘Brine concentration is higher

- ‘Recoveries are higher Product quality is significantly improved

- ‘Reagent usage is lower

- ‘Established management team and Board have delivered outstanding success in controlling COVID-19 infection at operations

- ‘Fully funded with ~US$255 million cash, of which ~US$60 million has been set aside for finance guarantees’

Perhaps most interesting is their lithium market commentary:

Source: Newswire.com

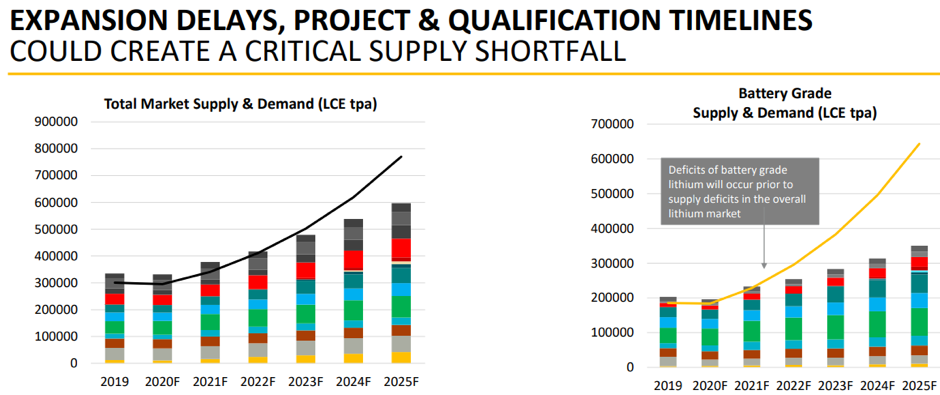

With the company targeting 2022 for Stage 2, ORE could be in the sweet spot from a long-term supply/demand perspective.

ORE share price chart

Looking at the ORE share price chart, the price broke through a long-term downtrend line, usually a positive sign.

Source: Optuma

At the time of writing, the ORE share price hovered just below the resistance level of $3.00.

If it breaks through this, $3.37 may come into focus. If the price tumbles back, then the level of $2.42 may be enough to halt the drop.

If the EV revolution gathers steam, the world will need more lithium — so the market commentary from ORE is particularly interesting.

A supply demand divergence would be a boon for companies like ORE.

If you want our reasoning on why lithium could be due for a strong finish to 2020 (and three lithium companies which could benefit), you can read that report right here.

Regards,

Carl Wittkopp,

For Money Morning

Comments