Orocobre Ltd’s [ASX:ORE] share price has dropped despite the announcement of merger with Galaxy Resources and stable FY21 earnings report.

ORE shares are currently trading at $9.04 per share, a drop of 1.53% at the time of writing.

However, over the course of 12 months, the stock has jumped from $2.83 per share to $9.04, representing a whopping 219.43% increase.

ORE FY21 overview

The attributed group EBITDA is up to US$2.9 million, recovering from a loss of US$3.9 million with prices more than doubling in the second half.

The higher sales volumes and costs were reduced by 12%.

The company notes that the group could benefit from the stronger pricing environment materialised since the third quarter of the financial year.

The flip side and the probable cause for today’s decline may be quite simple.

ORE logged a statutory consolidated net loss after tax of US$89.5 million compared to a loss of US$67.2 million in FY20.

This was balanced by an underlying net loss after tax for the group of US$20.8 million, reflecting a range of things — adjustments for tax change rates, inflation, and Argentine peso devaluation.

This number includes US$18.8 million of non-cash depreciation and amortisation.

Pleasingly for ORE holders, production of lithium carbonate was up 6% to 12,611 tonnes.

Battery-grade lithium carbonate production climbed to 66% of the total production for the June quarter and 48% for the full year, a hike of 24%.

The company is sitting on a cash pile of US$258.3 million, which can be used for further expansion.

Lastly, the Naraha Lithium Hydroxide Plant is almost complete with its Stage 2 Expansion of the Olaroz Lithium Facility touching 60% completion rate.

Operational improvements in Olaroz Lithium Facility

Despite a whole year of COVID-19 related cost fluctuations, Olaroz managed to bring the full-year cost down by 12% to US $3,860/t.

The competitive advantage that Olaroz has is that it remains among the lowest-cost producers of lithium chemicals in the world.

Gross operating cash margins of 23% equated to US $1,123/t, despite lower prices.

Orocobre’s Managing Director and CEO Mr Martín Pérez De Solay, said:

‘Orocobre has continued to deliver positive operating margins, despite COVID-19 and weaker market conditions throughout the first half of the financial year. This has been achieved through strong sales performance and a focus on costs and operating excellence.’

Merger with Galaxy Resources

The company announced on 19 April this year that it has entered into a merger implementation deed with Galaxy Resources Ltd [ASX:GXY].

The two companies are joining together to become a heavy hitter in the lithium market.

Under the agreement, 0.569 Orocobre shares will be issued for every Galaxy share.

As of today, all the requirements and approvals are obtained, and the merger is in full swing.

This merger will create a business for Orocobre that has the potential to be a ‘top 5 global lithium chemicals company.’

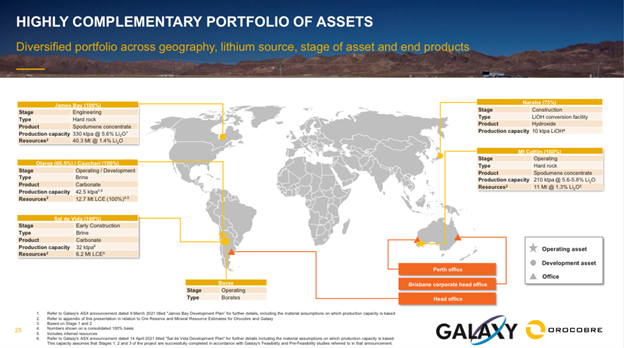

The company says that this will create a highly-complementary portfolio of assets delivering geographical and product diversification across brine, hard rock, and vertical integration across the supply chain.

Martín Pérez de Solay said:

‘The completion of the merger today brings together assets and teams with highly complementary skills and knowledge. I would like to welcome Galaxy shareholders, employees and other stakeholders to Orocobre which subject to shareholder approval we will be rebranding to Allkem Limited and changing the ASX ticker to AKE.’

PS: We reveal four little-known small-cap stocks that cannot be ignored…Download your free report now.

What’s next for the ORE share price?

To tackle the increasing demand for Lithium, Orocobre is heavily investing and diversifying its portfolio.

Source: Company’s presentation

Source: Company’s presentation

In the short run, the stock may have taken a hit. But if you zoom out, you will observe the massive increase the share price has made.

Slowly but surely, we’re witnessing a boom in electric vehicles (EVs).

ORE and GXY together aim to take a significant share of the global lithium market in this EV-driven world.

I’d also note that GXY as of the merger date has a relatively significant amount of cash at the bank with which to grow its business, despite the reported loss today.

If you like the look of Orocobre, and it’s on your radar as a company that has the potential to cater the rising demand for lithium, I suggest

Inside, you’ll find the details on three potential lithium stars of the future. One is an established producer, one is developing a project in Europe for their massive EV push, and one is a more speculative explorer with a good patch of land in WA’s lithium district.

Regards,

Lachlann Tierney

For Money Morning

PS: This free report reveals three stocks that could surge on the back of renewed demand for lithium in 2021. Click here to get your copy now.