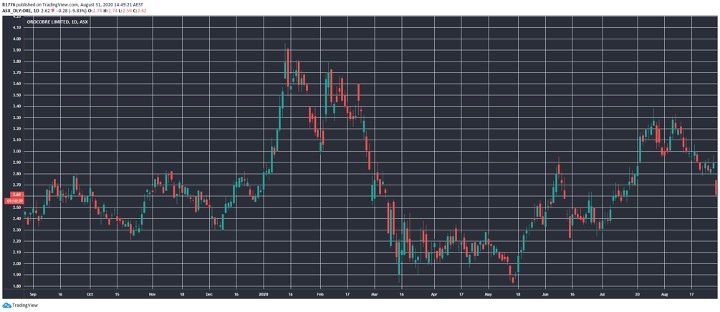

At time of writing, the share price of Orocobre Ltd [ASX:ORE] is down 10%, trading at $2.61.

After a strong run from the low in mid-May, the ORE share price gapped down in today’s trading:

Source: tradingview.com

Here are the details of ORE’s latest capital raise:

ORE share price retraces on $126 million capital raise

As with many capital raises, the ORE share price is retracing as new shares are issued:

- Institutional placement of 50 million new shares

- Issue price of $2.52 a share

- Represents a 13.1% discount to last traded price on 27 August

To go with a $30 million Share Purchase Plan at the lower of:

‘• the Placement Price (A$2.52 per New Share);

‘• a 2% discount to the 5-day volume weighted average price of Orocobre shares up to the SPP closing date; or

‘• a 2% discount to the volume weighted average price of Orocobre shares on the SPP close date’

While retail investors sometimes groan at the thought of another capital raise, they are an unfortunate part of business, especially in the tricky lithium industry.

The funds will be used by ORE for the Olaroz project through to Stage 2.

For those familiar with ORE, Olaroz is a lithium project in northern Argentina with a design capacity of 25,000 tonnes of lithium carbonate per year.

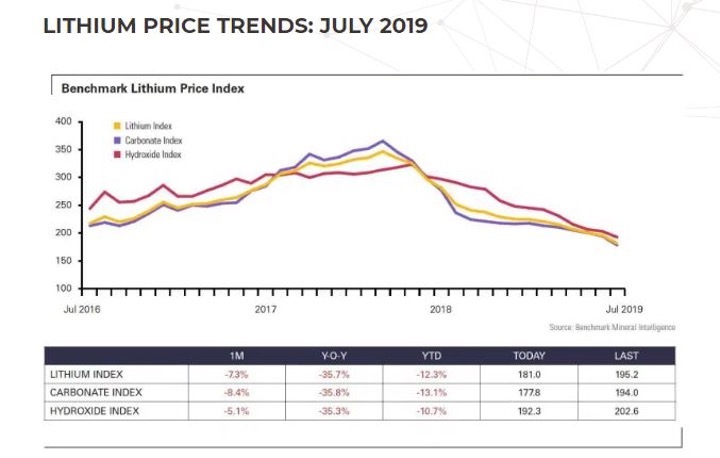

You can see the prices for lithium remain stubbornly low:

Source: Benchmark Mineral Intelligence

This trend could continue in part due to stockpiling and I’ve previously suggested that the demographics of those in ASX-listed lithium stocks may be skewed towards younger investors.

Outlook for the ORE share price

The ORE share price may continue to retrace over the coming days as the capital raise is digested.

ORE has significant milestones to knock down in the coming years as well.

But in the near-term ORE’s latest investor presentation highlights the growth in EV sales emanating from Europe.

In my view, Europe is where it’s at for EVs as these governments are showing the most commitment to the push.

If you want our reasoning behind 2019 being the bottom of the lithium market, you can catch that here.

You will get the names of our three favourite lithium companies on the ASX as well.

Regards,

Lachlann Tierney

For Money Morning

Comments