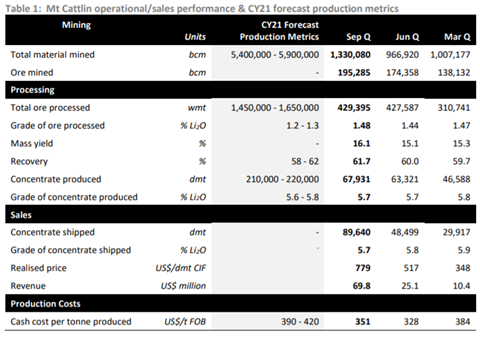

The Orocobre Ltd’s [ASX:ORE] September quarterly showed record production of 67,931 dmt of spodumene concentrate at Mt Cattlin.

This was up 7% quarter on quarter and in line with customer requirements at a unit cash cost of US$351/tonne.

Orocobre Ltd’s [ASX:ORE] share price was exchanging hands at $9.30 per share, up 3.10% at the time of writing.

Evincing the strong interest in the lithium ASX sector, the Orocobre share price is up 235% over the last 12 months.

Orocobre’s September lithium production

ORE shipped a total 89,640 dry metric tonnes of product with a realised average price of US$779/dmt CIF, generating revenue of US$69.8 million.

It should be noted that included in this volume were 30,846 dmt of product relating to sales contracts from the June quarter that were rolled over into July due to shipping delays.

Contracting arrangements are ‘well advanced’ for further shipments of around 38,500 tonnes in the December quarter and 25,000 tonnes in early January 2022 with a target grade of 5.7% Li2O.

Average pricing for these shipments is expected to be around US$1,650/tonne CIF for 6% Li2O, almost double that of the September quarter.

2,802 tonnes of lithium carbonate were produced at Olaroz, 58% of which was battery grade, exceeding the budgeted target of 50%.

2,622 tonnes were sold at a price of US$9,341/tonne FOB, generating revenue of US$24.5 million.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

What next for Orocobre?

Orocobre said demand for lithium chemicals and spodumene concentrate rose significantly during the quarter in all key geographies, responding to high production of lithium-ion battery materials and batteries.

ORE said the sale price of lithium carbonate has increased by over 200% in the last year alone.

As a result, the lithium producer has revised upwards its guidance for the December quarter to around US$12,000/tonne FOB.

Orocobre further revised CY21 production at Mt Cattlin:

‘Due to record production rates achieved, forecast production for CY21 has been revised upwards to 210,000 – 220,000 dmt of spodumene concentrate, from the previous guidance of 195,0000 – 210,000 dmt.

‘As a result, forecast cash costs have been revised down to US$390-$420/tonne, from the previous guidance of US$420-450/tonne.’

If you want extra information on evaluating and comparing lithium miners, I suggest reading our lithium guide released last week.

It’s thorough and takes you through vital factors to consider when pondering the lithium sector.

Additionally, if you’re inclined to read a report analysing a few ASX lithium stocks, check out Money Morning’s report on three exciting lithium miners.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here