Energy and gas giant Origin Energy [ASX:ORG] posted better-than-expected results this morning, recovering from losses last year in part thanks to favourable prices in energy markets.

The share price of the Origin was up by 1.26% this morning, trading at $8.46 per share, as the market awaits regulatory approval of the $18.7 billion takeover bid by Canadian private equity giant Brookfield.

Early talks began in November last year and culminated in a binding agreement in late March with minor adjustments.

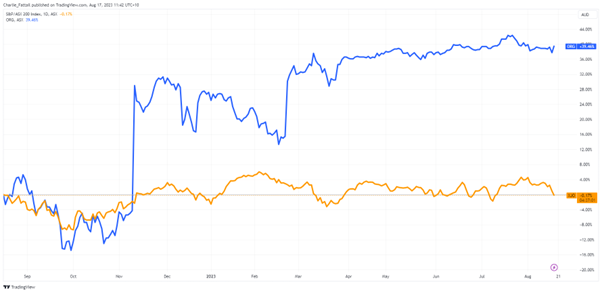

However, Origin’s share price has remained below the offer price for most of the year. Hedge funds and investors considered regulatory risks for the deal despite the share price seeing a 40% gain.

Deliberations at the Australian competition watchdog (ACCC) continue, with an expected ruling by the end of September. But what do today’s results signal for the future and how likely is the deal to be approved?

Source: TradingView

Origin Energy Earnings

Origin Energy moved out of the red in its latest earnings report as liquefied natural gas prices rose throughout the year and gains from the Energy Markets improved.

Origin posted a net profit of $1.055 billion in the 12 months to June, a marked improvement from the $1.43 billion loss a year ago.

Granted, these numbers appear stronger than the underlying due to previous write-downs of $2.2 billion last year.

The underlying net profit for Origin rose to $747 million for the year ended June 30, higher than some analysts were forecasting. The figure was up from $407 million a year earlier.

A strong result had been expected by shareholders as the company had upgraded earnings guidance in May, citing solid results from Octopus Energy in the UK and favourable energy prices.

After a recent acquisition, Octopus has become the second-largest UK energy retailer by customer accounts and is continuing to see strong growth.

Total group revenue rose by 14% to $16.48 billion, primarily driven by higher oil prices on LNG export contracts, with a realised oil price of US$103 billion in FY23 compared to US$74 billion in FY22.

Chief Executive, Frank Calabria, said:

‘The outlook for FY 2024 is for further growth in Energy Markets Underlying Ebitda, with Australia Pacific LNG production expected to rebound and cash flow remaining strong.

‘Looking further ahead to FY 2025, we expect electricity gross profit in Energy Markets to be lower than FY2024.’

The company announced a 20-cent fully franked dividend, up from 16.5 cents a year earlier. The total for the year ended 30 June was 36.5 cents per share.

Outlook of looming takeover deal

Today’s results illustrate why Brookfield is interested in Origin, but the deal still has some hurdles to clear.

The takeover bid for Origin, by Brookfield and US-based bidding partner EIG, is still being examined by the ACCC, which is due to release its decision on the mega-deal on 28 September.

The watchdog recently delayed the decision from earlier in the month after securing an extension from the bidders.

Chairman Scott Perkins said the proposed deal ‘continues to progress through the necessary regulatory steps’ and that an independent expert assessment of it is underway.

In its preliminary view made public in July, the ACCC said it had concerns about the deal because the Canadian asset manager already owned grid company AusNet.

Some submissions concerning EIG’s side of the deal have also been made public, as EIG’s MidOcean Energy arm lines up to buy the LNG portion of the business, including Origin’s 27% stake in Australia Pacific LNG.

MidOcean lines up for a pure LNG play as Brookfield and EIG bet large on green energy transitions.

Only once the ACCC approves the deal would shareholders get a chance to vote on it at a meeting expected to occur early next year.

Overall, Origin’s results are a positive sign for the company and its shareholders. The company is in a healthy position as the deal nears the 11th hour. Some concerns exist for competition within the Aussie energy retail space, but broadly the chances of the deal look promising.

Our global energy system is changing

China is a massive player when it comes to renewable energy…but also oil.

And a few years back, the Shanghai International Energy Exchange launched a yuan-denominated oil futures contract.

Having commodities priced in yuan gives China more pricing power.

In a way, that’s how the US dollar became dominant.

So, the fact that China wants the Yuan to become more prominent in international trade is a big deal.

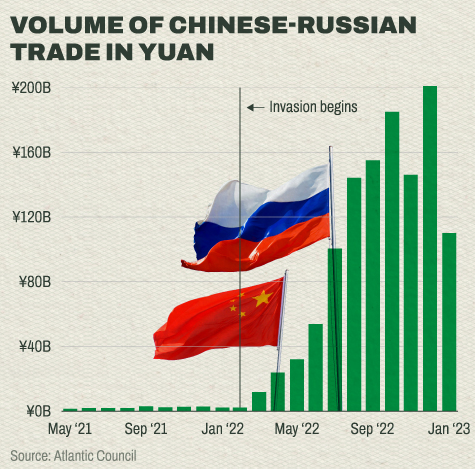

The volume of trade that China is doing in Yuan has increased significantly in recent years.

Source: Visual Capitalist

The de-dollarisation of the world economy is a clear trend happening as we speak.

It may not happen overnight…but it looks like some countries are already preparing.

As you’ve probably heard, central banks have been buying huge amounts of gold in recent years to diversify their assets from the US dollar — at the fastest pace seen since 1967.

And there’s been a lot of talk that the BRICS (Brazil, Russia, India, China and South Africa) could be developing a joint currency.

My colleague, Brian Chu, thinks that countries looking for alternatives to the US dollar bring ‘a huge opportunity’ for Australian investors today.

It’s why he’s created a game plan.

You can hear more about Brian’s plan of action here.

Regards,

Fat Tail Commodities