Origin Energy [ASX:ORG] will divest its Beetaloo Basin interests to reshuffle assets for the energy transition.

Origin said the divestment reflects its strategy to ‘lead the energy transition’.

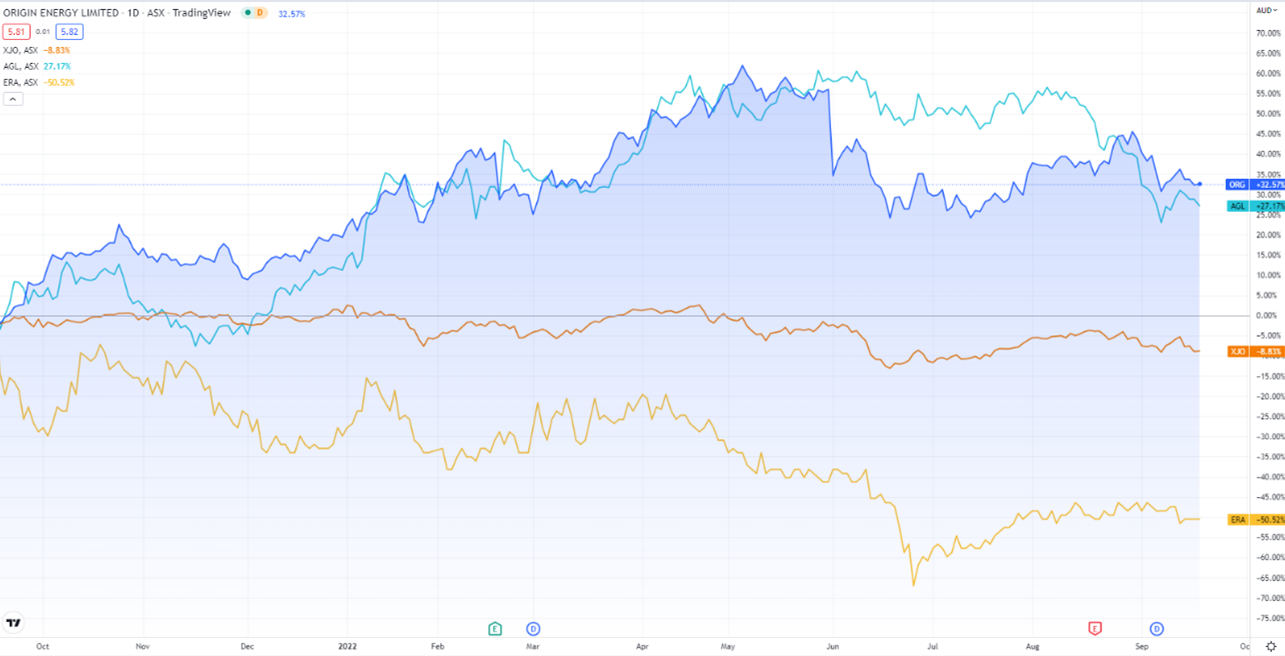

ORG shares were flat on the news but are up 30% over the past 12 months:

www.TradingView.com

Origin divests Beetaloo

Origin intends to sell its 77.5% interest in its Beetlaoo Basin joint-venture with Falcon Oil & Gas (22.5%), exiting eight-year-old upstream exploration permits.

Origin has revealed its agreement with Tamboran Resources means it will sell-off its interest in the Beetaloo Basin Project, located in the Northern Territory, in exchange for a $60 million upfront consideration, as well as a 5.5% royalty for future production.

The sale of ORG’s gas holding — 36.5% PJ a year, over 10 years — has also gone to Tamboran, provided a final investment decision is successful.

This could be the first of many changes, as Origin intends to review its portfolio of remaining exploration permits, like with Australia Pacific LNG.

Due to the economic date having been set at the start of July, Tamboran will be reimbursing Origin for necessary Beetaloo costs incurred over the period.

The company says its offloading Beetaloo won’t impact other aspects of its gas segments, with a hydrogen project and other ‘carbon offset projects’ in the pipeline.

Frank Calabria, Origin’s CEO, stated:

‘The decision to divest our interest in the Beetaloo and exit other upstream exploration permits over time, will enable greater flexibility to allocate capital towards our strategic priorities to grow cleaner energy and customer solutions, and deliver reliable energy through the transition.

‘We believe gas will continue to play an important role in the energy mix and it remains a core part of our business.

‘Ultimately, we believe Origin is better placed prioritising capital towards other opportunities that are aligned to our refreshed strategy.

‘The suite of agreements executed with Tamboran allow Origin to realise value created by our investment and exploration activities to date, and ensures another operator present in the area and committed to developing its resources, can continue to take the venture forward.’

Origin’s sacrifice for energy

It appears Origin is beginning to seriously rethink it strategies as net zero 2030 looms closer.

Frank Calabria said:

‘Gas will continue to have an important role in our business, particularly through our interest in Australia Pacific LNG and role as upstream operator in that venture, and in the broader energy mix as we look to underpin reliable energy supply to customers and accelerate our investment into the energy transition.’

Origin says that it will be closely working with Tamboran to ensure a smooth change in ownership, after all, Falcon has a ‘pre-emptive right’ to acquire Origin’s 77.5% interest in Beetaloo.

The bear market and the stock market

We’re still in a bearish macro environment, and many businesses have been doing it tough.

This makes for a difficult time to discern next steps.

Our Editorial Director, Greg Canavan, has seen a bear market or two.

He uses that experience in creating value-focused investing tactics for times like this.

Greg has put together a report on how to survive a bear market while still gaining on mispriced opportunities.

Learn about Greg’s ‘Stocks You Should Own in a Bear Market’ right here.

Regards,

Kiryll Prakapenka

For Daily Reckoning