Origin Energy [ASX:ORG] announces $250 million share buyback and accelerates its renewable energy strategy.

Yesterday, Origin — the Australian gas and electricity company — unveiled plans to repurchase $250 million worth of shares in April.

In an investor presentation, ORG also proposed a pathway to achieve its goal of becoming a net-zero business by 2050.

CEO Frank Calabria said the company hoped to leverage its strong balance sheet in investing in new growth opportunities in decarbonisation, including cleaner energy and customer solutions.

Source: Tradingview.com

ORG shares were down 2% at midday trade on Thursday. ORG stock is up 25% over the last 12 months.

Let’s go over Origin’s strategic update in a bit more detail…

How will Origin Energy’s $250 million buyback strategy work?

Origin CEO, Frank Calabria, said:

‘Origin is in a strong financial position, with a robust outlook for the business and a capital structure comfortably within our target range.

‘This means we are now in a position to increase shareholder distributions with a share buy-back of $250 million.

‘Going forward, we will continue to balance expected increased cash flow available for shareholder distributions with growth investments.’

Origin said it may consider further capital management initiatives over time, subject to operating conditions and capital allocation alternatives.

In FY21, Origin had $1.14 billion in free cash flow.

Origin’s renewables and cleaner energy strategy

Origin is pivoting hard to cleaner energy.

Last month, ORG sought approval to shut Eraring, Australia’s largest coal-fired power plant, a whole seven years early.

Explaining the rationale, the CEO said (emphasis added):

‘Origin’s proposed exit from coal-fired generation reflects the continuing, rapid transition of the NEM as we move to cleaner sources of energy.

‘The reality is the economics of coal-fired power stations are being put under increasing, unsustainable pressure by cleaner and lower cost generation, including solar, wind and batteries.’

In Wednesday’s investor presentation, Origin reiterated its green pivot.

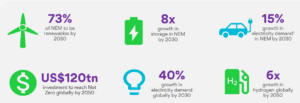

The company said the global energy transition creates ‘significant growth opportunities’.

Source: Origin Energy

Origin seeks to participate in the transition via a range of initiatives.

One, ORG is targeting ‘domestic green hydrogen supply from mid 2020s and to export the supply from late 2020s’.

Two, Origin is proposing a 460MW stage 1 battery at Eraring and a further 240MW stage 2 battery at Eraring.

ORG’s clean energy focus isn’t all about environmental conscientiousness.

As the CEO, Frank Calabria, pointed out last month, the economics of traditional fossil fuels is becoming untenable.

In yesterday’s presentation, Origin returned to that theme.

ORG presented data showing customers are ‘increasingly installing rooftop solar and purchasing less grid energy in the middle of the day’.

Grid-scale renewable energy is itself increasing too, further reducing the need for baseload power.

All up, Origin reckons baseload coal-fired power is ‘becoming uneconomic’.

How to value businesses in today’s volatile markets

Origin’s strategy includes chasing a net cash cost reduction of between $200 million and $250 million from a 2018 financial year baseline through to the 2024 financial year.

Now, while the Origin share price could rise in the months ahead, our analysts see plenty of other quality stocks on the market trading at bargain prices right now after the recent sell-offs.

The question is, how can you assess which stocks offer you the maximum value…at a huge discount?

In an illuminating new 2022 investing guide, leading ASX veteran Greg Canavan aims to show you how.

You’ll also discover a modern twist on the time-tested traditional strategy of valuing a business for today’s volatile markets so that you can feel more confident in your stock portfolio in 2022.

To get the free report now, click here.

Regards,

Kiryll Prakapenka,

For Daily Reckoning Australia

PS: How do you find bargain-priced ASX superstars after a big sell-off?