We begin today with a big announcement.

I’ve just put the finishing touches on a resource I believe every Fat Tail member should read.

It’s called Small Caps, Big Comeback: Three ASX Minnows Set to Revive in ’25.

It’s a projection based on historical data and experience.

And my current track record (81% average gains across all current open positions.)

No one knows exactly what the future holds. It’s still just a solid projection.

But here are some objective facts…

- The US Federal Reserve began cutting rates (or ‘easing’) in September. Consensus is the RBA will follow suit as early as Tuesday, 10 December.

- Aussie small caps have outpaced their large-cap cousins by an average of 8% after the Fed cuts rates for the first time. Asset management firm Janus Henderson puts that relative outperformance factor at 10%.

- Today, the valuation gap between small caps and large caps is the widest it’s been in approximately 25 years. In technical terms, this has created an opportunity for what’s called ‘mean reversion’…

In other words:

A Great Resurrection in small cap stocks

Director of Research Matt Weinschenk at The Stansberry Digest explains the current set-up perfectly…

‘An easy way to look at it is just to think about individuals.

‘So, if you’ve got a multimillionaire and you’ve got a student who’s waiting tables – who’s going to feel the impact of an interest-rate rise on their credit cards?

‘Their credit card goes from 18% to 25%, a millionaire might not even notice. The person who’s living paycheque to paycheque waiting the tables, they’re going to notice that thing.

‘The same sort of dynamic is in play with large companies and small companies.

‘Small companies, they generally need capital to grow. Large companies have huge war chests. They’re not as sensitive to changes in interest rates…

‘The stock market generally sells small-caps when rates rise, and that kind of makes sense – because a small company is going to be more sensitive to changes in their debt structure.

‘Similar – or the exact opposite − when rates fall and that’s what we’re seeing right now, that is when small-caps have tended to outperform.’

The prices of the three stocks I’m recommending in my report, Small Caps, Big Comeback, are — in my belief — still trading at massive discounts…

Be one of the first to learn about them by clicking here…

Introducing Dimensional Fund…

Today I’d also like to briefly introduce you to Dimensional Fund Advisors. I just discovered them myself.

They manage $55 billion in funds from Australia’s super system. They are based in Texas.

Dimensional appeared in the Australian Financial Review this week, in part, because they trade their gargantuan portfolios every day using a systematic approach.

Here’s the key quote from their CEO, Gerard O’Reilly – at least as far as I’m concerned.

‘Market prices are the best prediction of the future that we have.’

Indeed. Consider this comes from a man whose operation computes 45 million data points a day.

Let’s see this observation in action.

In case you haven’t noticed, but US stocks — as represented via the S&P500 Index — are having a barnstorming year.

The S&P500 is up 22% year to date. That’s a $9 trillion lift — a tidy return in anyone’s book.

What did Bloomberg just report?

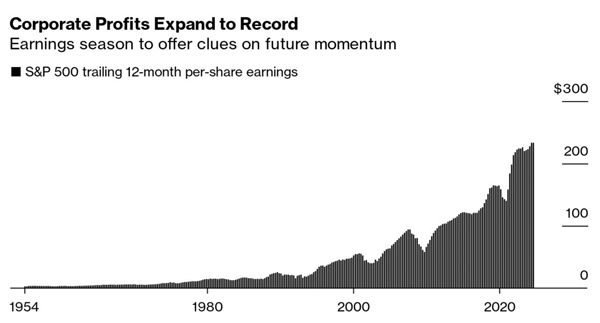

| |

| Source: Bloomberg |

US corporate profits are booming.

In other words, the stock market lift earlier this year told you this bit of news was likely…and investors saw this rise in profits coming months ago.

In other words, ‘market prices are the best predictor of the future we have’.

I bring this up because we just surveyed the members of my small cap advisory. I got many letters thanking me for the recent gains.

But there were the inevitable ones too. You can probably guess.

Quite a few said they’ve missed the recent rally, because worries held them back.

Don’t get me wrong. I’m just as human as the rest of us.

It’s natural to worry about the state of the economy, and the state of the world, for that matter.

But at some point you must go with the market when it comes to some of the common issues that hold us all back.

Yes, debt is a worry. So is Ukraine and the Middle East. And we could go on and on.

At the start of the year I, like most, ran with the idea that the market would become more volatile before the US election.

The reality is that Aussie market volatility has been quite subdued…even as we are 7 days from the vote.

You can talk yourself out of the market all the time.

And yet an attentive look at market prices this year would indicate clearly that the market had priced in the current state of play…and was going up anyway.

Back in early July I wrote to my readers…

‘Occasionally you get a week when you see nothing but reasons why shares will soar…or tank.

‘Right now the odds of a major bull move look screaming high to me.

‘Take note that inflation is higher than expected in Australia…and some economists think the RBA should raise rates.

‘The ASX is holding the line against this regardless…

‘This is probably because the market still sees rate cuts in 2025. Tax cuts right now will neutralise one more rate rise…if it even happens.

‘My colleague Greg Canavan tells us that the Australian bank index increased a whopping 28% in 2024.

‘Banks are the lynchpin of the financial system. Clearly the market is no longer worried about bad debts or mortgage distress crushing our lenders.

‘Australian household wealth increased by $1.5 trillion in the last year, according to the latest Australian Bureau of Statistics review.

‘That’s bullish — no two ways about it.’

There’s been plenty of profitable opportunities across multiple sectors since that update.

How else can we see share prices suggesting market positioning?

Here’s one idea.

Temple & Webster [ASX:TWP] is an online furniture retailer. They just released their latest trading update.

Overall, sales growth is high but slowing in recent trade.

What was notable about this?

The shares held steady, despite the slowdown.

This suggests that the market has long since priced in the cost-of-living crisis, the rise in rates and the dismal retail trade figures lately.

The market is hunting the structural growth potential of TPW in future years.

I’m not telling you to buy TPW. It’s not a recommendation of mine. I don’t know enough about it to say either way.

But the trading action in the stock suggests the market is looking to 2026, 2027, and beyond for this business.

Investors may be wrong about TPW. It may not be a winner in two- or three-years’ time.

But it’s the market thinking right now that comes through the recent price action. The market is prepared to back their growth prospects…despite the worries that preoccupy many of us.

Do you see the implication?

You should be considering high growth shares today with the same timeframe in mind. That is what professional investors are doing.

Don’t let today’s news hold you back.

Small cap shares like TPW are primed to move up because investors are going “risk on” again after 3 years of sheltering in bonds, blue chips and deposits.

I can see this in other ways.

On another note, one of my recommendations, Nuix, is now up 600% as of yesterday…in under 18 months.

It’s typical, in a way, of the current resurrection happening across the market. The bad news that pummelled Nuix took it way down…new developments are now taking it back up.

And while there are never any guarantees in this space, there could be so much more market action like this to come.

A 600% gain sure doesn’t come along that often. And there’s only one sector that can really deliver a return like this…certainly in that timeframe.

That’s the small cap sector.

Which brings me back to my new presentation on this opportunity — released today: Small Caps, Big Comeback: Three ASX Minnows Set to Revive in ’25.

You see, I believe Nuix is one example of many primed-to-move small cap stocks on the ASX right now.

Nearly one year ago I stood on stage at the Windsor Hotel in Melbourne in front of 160 investors and made this call. I was early. In hindsight, it proved to be the bottom.

Now, the ‘small cap comeback’…the resurrection!…is well and truly in motion.

And it’s time to sit up, take notice, and if you’re inclined, make your move.

For more on why now’s the time to consider allocating here, and 3 ways to play it, check out my JUST RELEASED presentation by clicking here.

Best,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Comments