Since its dark days of March 2009, Wall Street — ably assisted by its central bank benefactor — has soared to levels beyond anything we could ever have imagined.

Nasdaq has clocked up a 16-fold gain and the S&P 500 a more ‘modest’ seven-fold increase. Contrary to what people might think, compound returns of this magnitude ARE NOT normal.

However, the longer something goes on, the more ingrained the belief becomes in its permanency.

This headline from the 4 July 2023 edition of The Wall Street Journal captures the current mood of eternal optimism…one-fifth of investors age 85 or older have gone all-in on the market…WOW…

|

|

| Source: The Wall Street Journal |

I recall Buffett saying something like, ‘when others are greedy, you should be scared…’.

Are this cohort of bullish seniors aware of just how overvalued the US market is?

Instead of being greedy, shouldn’t they be scared?

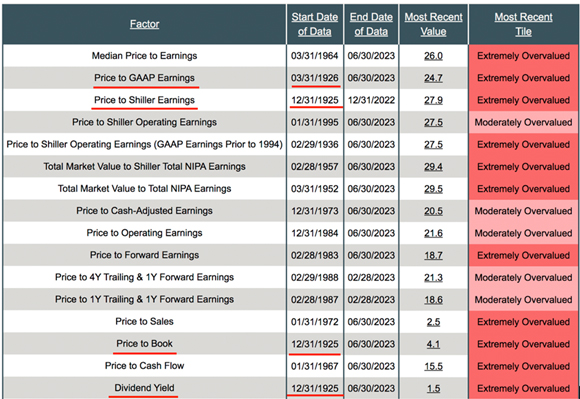

As of 30 June 2023, 16 valuation metrics — four of which have data points dating back to 1925/26 — are ALL registering readings of…Moderately to Extremely Overvalued.

Nothing is cheap out there.

|

|

| Source: NDR |

You know what the opposite of Extremely Overvalued is?

Yep…Extremely Undervalued.

And, you know how we get there?

Yep…by way of a massive reversal in fortunes.

The reason this rather distressing prospect is dismissed so easily is because for 14 years, the Fed has not let anything bad happen to Wall Street. Every stumble has been met with more stimulus measures.

But life tells us artificial pricing mechanisms are NOT sustainable.

Eventually, something breaks.

And, with every passing day, we’re getting closer to that breaking point.

As witnessed in the hollowing out of markets in 2008/09, these ‘over-the-cliff’ moments determine whether investor fortunes are fleeting or enduring.

There’s a subtle difference between ‘getting rich’ and ‘being rich’.

However, knowing the difference is crucial, not just to financial success, but to living a life that’s both rich and rewarding.

‘How to get rich’ and ‘How to be rich’

There might only be one different word between the two sentences, but the meanings are worlds apart.

For example, Sam Bankman-Fried (SBF) got rich but had no clue about how to be rich.

In a scene from the movie All the Money in the World (about the kidnapping of John Paul Getty’s grandson), Getty is talking to Fletcher Chase (Getty’s Mr Fix It) about a book he’d written titled…How to Be Rich.

Getty told Chase the publishers wanted to change the title to How to Get Rich.

Getty said (words to the effect), ‘any fool can get rich, but to be rich means learning how to handle freedom.’

Very true.

How to be rich requires discipline.

Determining which choices add real value to your life and ignoring those that lead you to a path of personal and financial destruction…like, do you go all-in on an Extremely Overvalued market?

That one word, ‘be’, has the power to frame your thinking on the responsibilities that come with managing your personal wealth.

Getting rich (creating sufficient retirement capital) can be the product of hard work, savings, and — in some cases — good old-fashioned luck…being in the right place at the right time, lotto win or inheritance.

Staying rich…well that poses a whole set of new challenges.

It’s these challenges we must do our best to prepare for…trying to anticipate the events that can undermine our endeavours to create genuinely rich lives.

Wealth is not just about money

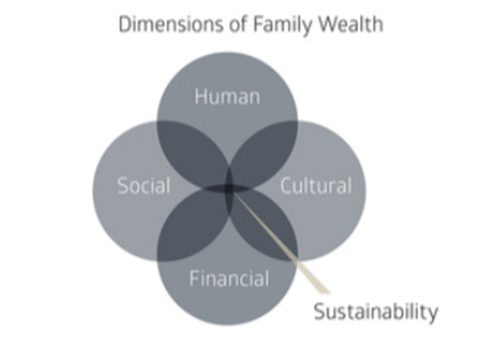

If you have a family, money is only one part of a much larger picture.

|

|

| Source: Publitas |

In a family unit, the dimensions to wealth we need to pay attention to are:

- Human wealth

- Cultural wealth

- Financial wealth

- Social wealth

Human wealth constitutes of our family members.

The continual development of their skills, abilities and emotions enables them to lead full, interesting and rewarding lives. The more content they are within themselves…the greater the chances they’ll make a positive contribution to the family. Why is that important? If you’ve ever known a family with a ‘problem’ child/children, you’ll know just how emotionally and financially draining that can be for the parents. Hmmm…why does SBF come to mind?

Cultural wealth is the identity of the family. What do we stand for? What are our values? What won’t we fall for? How do we see ourselves? How do others see our family? How do we communicate with each other? How do we make decisions together?

The PwC scandal is a classic case of how a toxic culture of dishonesty can ruin a business. The same can happen in a family. Creating and maintaining cultural wealth is vital to your family’s success.

Financial wealth is stewarding your capital in a responsible and prudent manner. Teaching the next generation — by your actions and communications — how to be responsible custodians of money. Responsible debt management. The value of living within your means. Understanding when it pays to be under or over-weight in a particular asset class.

Social wealth is the contribution the family makes to society…charitable causes, local community, church, and professional organisations. Giving back is an excellent way to express your gratitude for being fortunate enough to have accrued wealth. Assisting those who are less well-off can keep you grounded. Humility is a common character trait that exists in families that have succeeded in being wealthy.

Getting rich and being rich are two very different mindsets.

Decisions we make create our lives

Our lives are the sum of the decisions we make…the better those choices, it then stands to reason, the better the quality of your life.

If investors who’ve gotten rich courtesy of the Fed’s recklessness, want to be rich, they’ll need to make some decisions on how to limit their downside risk from the inevitable collapse on Wall Street.

Alternatively, they could decide valuation metrics can remain forever entrenched in ‘Extremely Overvalued’ territory.

Hmmm…has that ever happened before in history?

Nope.

Your choice.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia