US$125 billion per minute…

That’s how much Fed Chairman Jerome Powell’s 10-minute speech cost investors on Friday.

As he spoke from the annual meeting at Jackson Hole, Wyoming, all major US markets tanked.

The blue-chip S&P 500 fell 3.4%.

The tech-focused Nasdaq fell 4%.

Bitcoin [BTC] fell a whopping 9%…

Steel yourself for the Aussie market to follow suit today.

It could be brutal.

So what happened?

Powell talks tough, but can you believe him?

Well, the market finally believed Powell was serious about raising interest rates.

He said in no uncertain terms:

‘Restoring price stability will likely require maintaining a restrictive policy stance for some time.

‘The historical record cautions strongly against prematurely loosening policy.

‘Committee participants’ most recent individual projections from the June SEP showed the median federal funds rate running slightly below 4 percent through the end of 2023.’

With many already calling this rally a bear market rally anyway, it seemed this was enough to spark a rush for the exits on Friday.

Reading through the speech, there was no inch given on the inflation target of 2% — some had guessed this would perhaps be revised higher to 4%.

And if you take him at face value, we’ll see another 1.5–2% of rate hikes soon with no cuts, even over 2023.

The speech had the desired effect. I’d wager he would’ve been very happy at the market reaction.

As I said last week, in a weird paradox, he needs everyone to think the Fed is serious. Otherwise, he might actually have to do what he says he will!

He even admitted as much, noting:

‘If the public expects that inflation will remain low and stable over time, then, absent major shocks, it likely will.

‘(But) the longer the current bout of high inflation continues, the greater the chance that expectations of higher inflation will become entrenched.’

See the psychology in play here?

But despite all this, one particular market is still sceptical that Powell will actually follow through.

If it’s right, then this is all just tough talk…

Bonds call his bluff

Remember last year when Jerome Powell said inflation was going to be transitory?

That turned out well, didn’t it!?

I’m bringing this up again to point out that despite its immense influence over global markets, the Fed is not all-powerful.

It can’t control what everyone else does, no matter how hard it tries.

And it doesn’t get it right all the time; indeed, it often makes costly mistakes. Costly for us, that is, not for them.

After getting it so wrong on inflation, I can’t understand how Powell is still in a job.

Anyway, my point is that what Powell, or any central banker, says they will do, compared to what they actually do, can be two very different things.

And as an investor, you need to consider that at least.

That’s what the bond market thinks already.

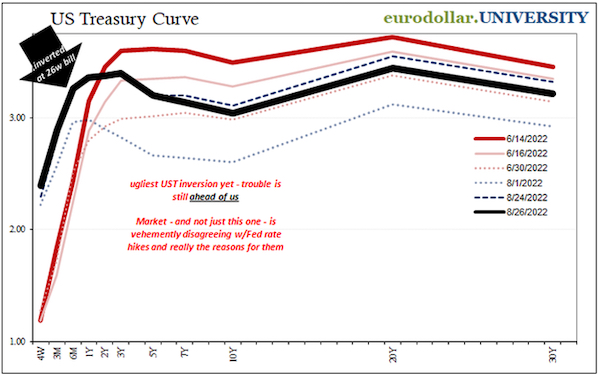

To illustrate the point, Chief Strategist at Atlas Financial, Jeffrey Schneider, shared this chart over the weekend:

|

|

| Source: Eurodollar.university |

This chart shows (black line) how bond markets expect interest rates to fall sharply very soon (as soon as six months) if the Fed keeps raising.

As Schneider explained:

‘Powell was perfectly clear that he plans on rate hiking aggressively. And market is perfectly clear his plans will be changed for him. Soon. There’s no room for a soft landing in these other plans.’

It’s easy to see why this could be the case.

Despite stubbornly high inflation worldwide, rocketing energy prices in Europe and elsewhere are bound to affect demand at some point.

And economic conditions continue to deteriorate fast.

Last week, there was a slump in UK factory activity while the EU, US, Australia, and Japan also saw contractions.

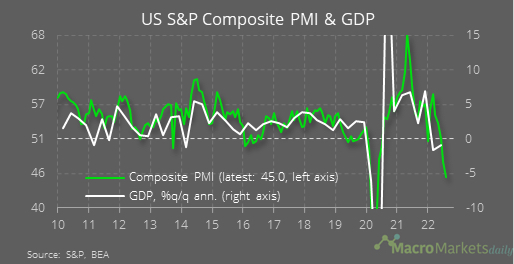

We’re already at recession levels in factory activity, as you can see in the PMI (Purchasing Managers’ Index) data:

|

|

| Source: Macro Markets Daily |

The PMI is a monthly survey of supply chain managers, and they’re clearly worried about the future.

That’ll mean a raft of job cuts and profit warnings soon.

Meanwhile, another big indicator of economic growth, US new home sales, fell to the slowest pace since 2016.

Add rising rates to this mix, and it’s not looking pretty…

What next?

If I could summarise my investment strategy in one sentence, it would be, ‘Brace yourself for opportunity’.

Meaning, I think the short term could be bad, but it’ll be so bad that we’ll see a massive reversal in policy sooner than the Fed is saying.

At some point, the risk of going too far becomes obvious — maybe something breaks in the system before the Fed realises it, or perhaps inflation just falls sharply.

Whatever it is, the next step will be to turn the liquidity taps back on.

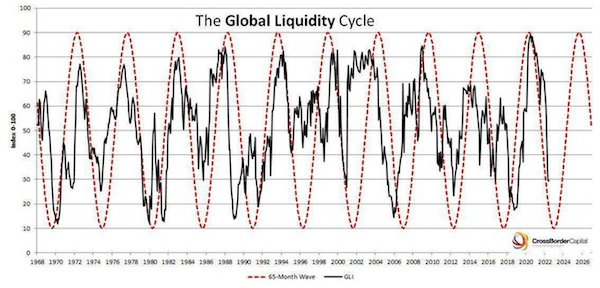

This chart is a general guide on when that might happen:

|

|

| Source: Cross Border Capital |

It’s incredible how this chart of global liquidity — i.e. access to US dollars — corresponds with market cycles.

It’s almost like everything is just a function of fiat liquidity (spoiler alert: it is!).

As you can see, after shooting higher during the ‘COVID cash pump’, the black line is now falling sharply and might have a little further to run.

But make no mistake, it’ll turn back up at some point.

And with it, the value of ‘risk-on’ assets.

The trillion-dollar question is:

How can you take advantage of the next few months before it does?

I’ll have more to say about this in the weeks ahead…

Good investing,

|

Ryan Dinse,

Editor, Money Morning