I wrote a piece last week for subscribers of my Crypto Capital service entitled ‘On the Precipice.’

In it, I pointed out several charts that showed how bond markets were on the verge of collapse.

This is so important to understand.

So, today I’m going to take the bulk of this subscriber only content out from ‘behind the paywall’ and share it with Money Morning subscribers too.

Warning: You may find the conclusion startling…

Charts that have markets nervous

As you might be aware, bond markets are in turmoil right now.

Most are completely oblivious to this as the stock market hasn’t tanked…at least, not yet.

But if these charts are right, that could be coming soon.

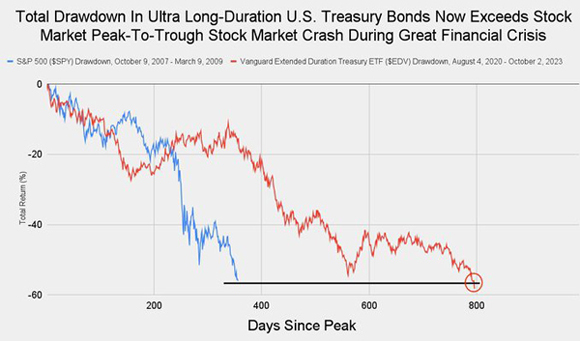

Let’s start with this one:

|

|

| Source: Magoo PhD |

It might’ve taken a bit longer but long-term US Treasury bonds — the pristine asset that underpins global financial markets — have now lost more value than stocks did in the 2008 GFC.

This is a direct consequence of the record-breaking rise in interest rates this year.

The math is pretty simple to work out. When interest rates rise, bonds lose value because they’re paying a comparatively lower rate of interest.

The problem here is that US Treasury bonds are often used as security for other loans. It’s the top of the fiat Ponzi.

As famous venture capitalist Balaji Srinivasan tweeted:

|

|

| Source: Twitter |

With the value of such bonds falling fast what happens if lenders start calling in their loans?

Economic strategist Jeff Schneider noted on Friday that this is already happening, saying:

‘The collateral markets are starting to freeze. Euro dollar system is flashing red alarms and it’s time to pay attention.’

You can read his whole thesis here.

But it gets worse…

It’s getting very expensive for the US government to borrow and at the same time the debt pile is absolutely surging.

Interest on US government 10-Year Notes just hit 4.7%, the highest level since October 2007.

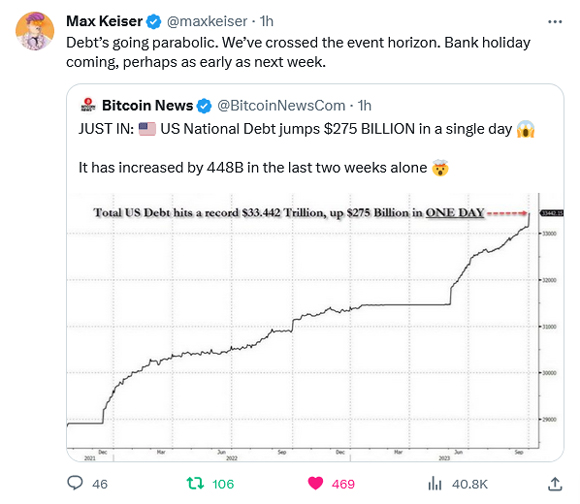

Renegade investor and Bitcoin [BTC] OG, Max Keiser thinks we’re at the point of no return:

|

|

| Source: Twitter |

Put another way, the US just added 10 million Bitcoin worth of debt IN A SINGLE DAY!

Remember there are only 21 million Bitcoin that will ever exist, so that’s nearly half that figure.

And it goes to highlight once again the immense scarcity value of Bitcoin versus unlimited fiat toilet paper.

Let’s face it, it’s a dog’s breakfast out there in fiat land.

Interest rates are surging, US government debt is exploding, and the value of ‘risk-free’ bonds is plummeting.

All the ingredients are there for an imminent credit event.

Which makes this next chart remarkable…

A new safe haven asset?

Check out this chart:

|

|

| Source: Trading View |

This chart shows the relative performance of Bitcoin versus commodities, gold, and the stock market for the month of September.

Bitcoin is up nearly 10% while all the others are trending down.

Are people finally realising that Bitcoin isn’t a risk asset at all, but in fact the only safe haven from the fiat Ponzi?

I’m sure the bulk of the mainstream would still scoff at such a notion.

Despite the rock-solid fact that Bitcoin is the best performing asset over any meaningful time frame (and up 65% this year).

But this next chart suggests some people are certainly thinking this way:

|

|

| Source: Glassnode |

Bitcoin is flowing out of exchange addresses and into the wallets of private holders. This is often a good sign of accumulation.

And exchange balances are approaching lows not seen since 2016 — just before the 2017 bull market run.

Interestingly enough, an ex-BlackRock director noted last week that he expects a Bitcoin ETF to be approved in the next 3–6 months saying at a recent finance conference it is a ‘done deal.’

This could lead to swathes of institutional capital heading into Bitcoin just as bond markets and stock markets collapse.

As reported in The Street:

‘Steven Schoenfield, the former managing director at BlackRock and current CEO of MarketVector Indexes, told crowds at the Digital Asset Summit in London on Tuesday that the impending approval of a spot bitcoin ETF might bring $200 billion to bitcoin investment products in the short-term.’

If he’s right, you’re talking about buying in through Bitcoin ETF’s representing 40% of the current market cap of Bitcoin.

This level of demand would result in some insane moves higher for the price of Bitcoin.

On that note, hedge fund investor and BitMex founder Arthur Hayes put out a new price prediction last week of U$750,000–US$1 million for one Bitcoin!

He explained his rationale in an interview with Tom Bilyeu saying:

‘As we get to some kind of financial disturbance and people realize that real rates are negative, if governments are growing nominal at 10%, 5%, 6%, people at the market will start buying other stuff. Crypto is one of those things.’

After the next financial crisis — related to the bond issues we talked about at the start — Hayes thinks the aftermath will lead to a new ‘crack up boom’ in 2025/26.

Hayes again:

‘I think it will be the biggest boom in financial markets we have ever seen in human history. Bitcoin will have a ridiculous price, Nasdaq will have a ridiculous price, S&P will have a ridiculous price. Pick your stock industry…’

Look, you can never be certain about these things. And especially with Bitcoin, you have to steel yourself against possible price volatility at all times.

But in these chaotic times, for me personally, I’ve never felt more comfortable holding my stack of Bitcoin.

It could be the only life raft off this sinking ship…

Good investing,

|

Ryan Dinse,

Editor, Money Morning