I feel like I’m in 2020 again!

A panicky day or two, and everybody’s wondering where the virus will take us.

I’m going to do what I did in 2020 — go shopping!

I can already see the bids coming in today, relative to the crash down at the open. It was a sea of red to start.

You might laugh at this, but the stocks showing ‘relative’ strength are Rio Tinto Ltd [ASX:RIO], Fortescue Metals Group Ltd [ASX:FMG], and BHP Group Ltd [ASX:BHP].

You know…those ones that were already carted for six a few months ago.

It’s not hard to suspect why.

BHP is trading on an 8% yield…Rio’s is even higher.

And if there’s one thing we know about China…they’re fanatical about keeping COVID infections down.

I suspect, too — but can’t prove — that the market is now looking beyond the weak iron ore fundamentals to 2022, after the Beijing Olympics.

Keep an eye on all three if you’re interested in dividends.

Because here’s the other thing…

A previous fear rattling around the market was the idea that inflation would take interest rates up.

This latest virus scare is enough to keep central bankers with their fingers on the pause button for that idea.

That could keep interest rates down…again.

However, I do think we’re inching closer to the day they begin to go up.

No stress!

You don’t necessarily have to think that a few rate rises from the RBA is going to kill the property and share markets straight away.

I’ll show you why I say that…

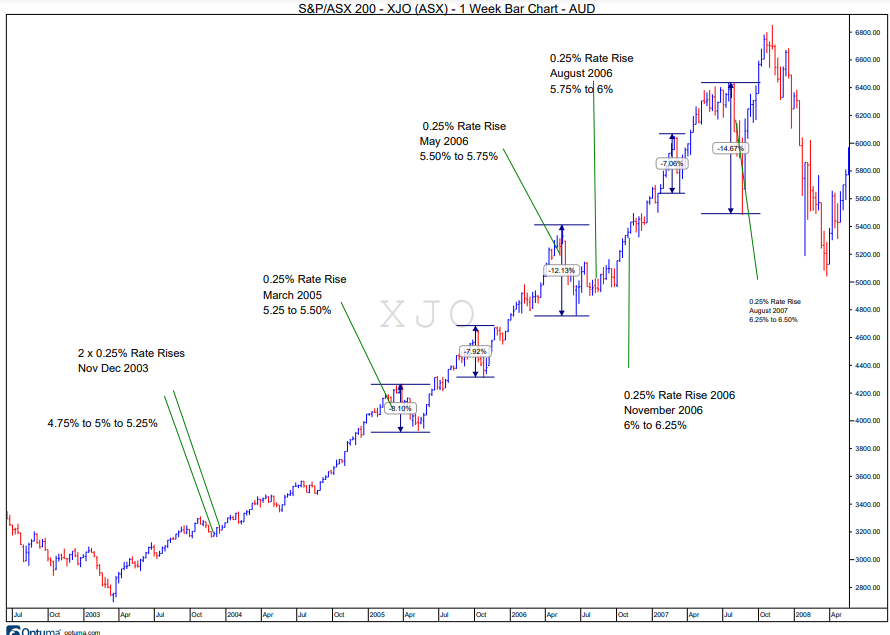

I went back and looked at a long stretch of rate rises between 2003–07.

Here’s what I found:

|

|

| Source: Optuma, Daily Reckoning |

You can see back then the market saw some volatility and selling pressure around each decision, then the market went back to worrying about other things.

That’s not to say the same thing will happen this time around — only that rate rises don’t automatically mean the death of asset markets.

The property trust index rose 90% in the same time frame, by the way.

Let’s be honest…each RBA rate rise, whenever it comes, will be 0.25%.

That’s hardly going to break anyone’s bank.

The danger, mostly, is if the RBA has to really yank rates up aggressively and in short order.

But that doesn’t seem likely anytime soon.

What actually matters the most when it comes to stocks?

Their earnings, of course!

That’s the thing to back over the long term. Fretting about unpredictable variables like interest rates is mostly a waste of time.

I can say that because 10 years ago, the market was fretting about the same thing.

Yes… I remember all the pundits saying ‘QE’ would send them up…and Helicopter Ben would toast the US dollar.

It didn’t happen.

Where in this world can we find earnings growth? Or a stock where a market has mispriced the potential?

You might laugh again…but I’m going to suggest real estate-related stocks.

An overall gloom has come upon the sector. Everybody is worried APRA will take away the punch bowl…that the boom has peaked…and on the worries go.

I beg to differ.

I hardly think Aussie property is going to go out with such a whimper.

Yes…Sydney may run out of steam shortly.

But what about the prospects of Perth and Brisbane? It’s possible to get gross yields above your borrowing rate.

Both cities have attractive infrastructure investment coming up.

Then we have the dash to regional areas as well, as COVID refugees ditch the inner suburbs.

Anyway, land booms normally end on a frenzy of people trying to get rich quick for doing nothing.

Buying appropriately now allows you to take advantage of this discrepancy, in my view.

And if I’m wrong? Well, the market has mostly priced in a glum outlook anyway.

Yes…COVID be damned…there is always opportunity in the share market depending on your time frame.

To hell with all the Jeremiah’s and do-gooders always nattering on about all that’s wrong with the world.

Let me tell you something. I received a letter this morning.

A subscriber took one of my suggested trades last year. He got busy at work and missed my short-term sell alert.

Lo and behold! The stock has since run up 1,000%. In a year.

That little beauty is called Liontown Resources Ltd [ASX:LTR].

Think about that…

The same fear and uncertainty was around when I looked at LTR last year.

But you know what?

The outlook for lithium and electric cars dwarfs the short-term health stresses from COVID.

Either we live with the damn thing or it wipes us all out.

I presume the first is more likely than the latter.

So what other big trend can we find?

Better to look for that, rather than worrying about COVID and its apparent endless variants coming.

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.