In today’s Money Morning…we’re at a tipping point in intergenerational power dynamics…Gen Z will create the future…you are what you eat…and more…

Here’s a very interesting stat…

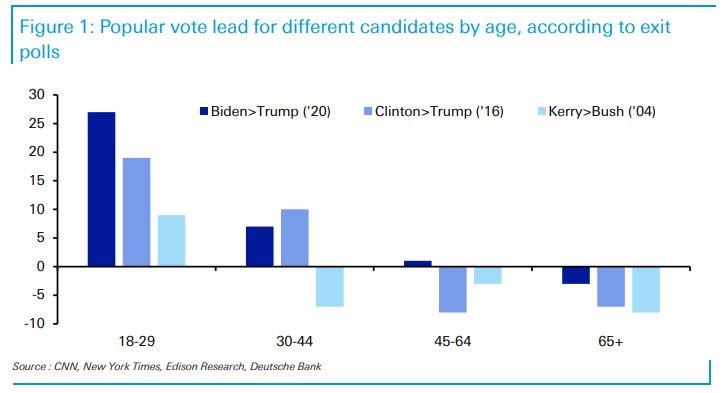

If only people aged over 29 voted in the US election, then we’d have a President Trump right now.

The chart below explains why:

|

|

| Source: CNN, Edison Research |

This exit poll data shows voters divided by age group across three recent US elections and how much more they’d vote for each candidate.

While young people have always favoured parties from the left, this chart shows support for the Democratic nominee this time around has never been higher in the 18–29 bracket — the Gen Y (millennial) and Gen Z demographics.

It’s no exaggeration to say that this overwhelming support was key in getting Biden over the line.

Make no mistake, we’re at a tipping point in intergenerational power dynamics.

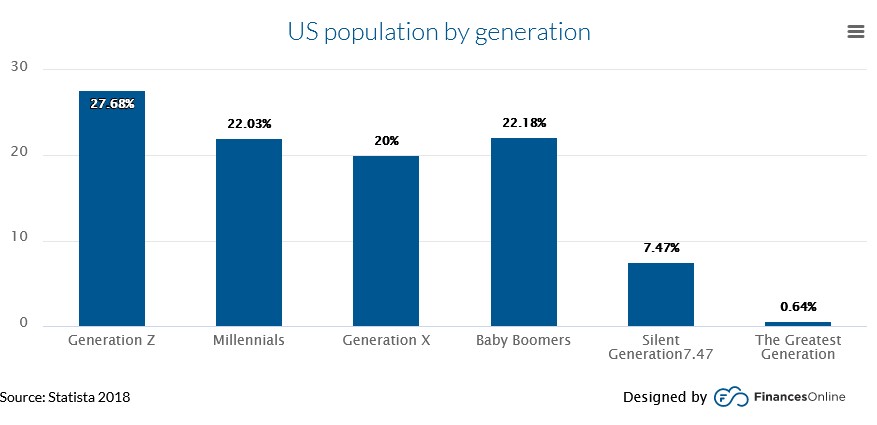

As you can see below, Gen Z are the new ‘swing’ voters.

|

|

| Source: Epsilon |

Like it or not, more and more it’ll be the decisions of younger folk who steer the direction of society over the next decade.

And that could turn out to be a very important thing for investors to realise.

Even for you boomers (I say this as a relatively unimportant Gen X-er who never had much influence in the first place!).

Let’s see what that could mean…

Gen Z will create the future

Gen Z are the group that come after the much talked about millennials (or Gen Y).

So, people in their teens and early 20s today.

While it’s important to avoid stereotypes — after all no generation is made up of carbon copies of each other — as a group you can definitely see some common features.

First up, they’re technology natives.

Jason Nazar, CEO of Comparably, says:

‘“Gen Z is the generation that was born using the internet and grew up with all the conveniences of modern technology and social media, from the iPhone to Netflix to Instagram,” Nazar says. “As a result, they’re whip smart, quick, and savvy. In my years of experience hiring both Gen Z and younger millennials, they are the most confident, socially aware, and entrepreneurial generation of our time.”’

A second big point to note is that they’re entering adulthood during very turbulent times.

There’s the coronavirus pandemic, the subsequent economic crisis, and society seems more politically polarised than ever.

In this flux, young people are questioning many previous societal ‘norms’.

What will work look like?

Where will they live?

Who should they vote for?

And how will they get ahead in life?

These are all topics up in the air for Gen Z.

And how they ultimately decide to proceed will dominate everyday life in the decades ahead.

For example, one big, new idea they’re backers of is Bitcoin [BTC].

As you might know, the price of bitcoin has been in the headlines of late as it closes in on new all-time highs.

Which is good news for Gen Z.

You see, a staggering 20% of Gen Z have invested in cryptocurrencies, compared to only 3% in the general population.

Cryptocurrencies like bitcoin represent a merging of technology with a fast-changing economic landscape.

So, it’s a natural fit for them.

In fact, the entire field of financial services is changing fast in response to the demands of our tech-savvy youth.

And companies that are tapping into this are benefitting already.

Late last week Square Inc [NYSE:SQ] reported that almost 80% of its revenue from its popular CashApp came from bitcoin purchases.

It’s no wonder Paypal Holdings Inc [NASDAQ:PYPL] just FOMO-ed into the space last week and announced they too were getting into crypto.

Beyond crypto you’ve got apps like stock trading app Robinhood growing exponentially due to their popularity with younger investors.

Robinhood reportedly added three million users alone over the first quarter.

As I’ve talked about a lot over the past few years, we continue to see the big banks be unbundled by smaller, nimble tech competitors.

And it’s usually younger customers driving this trend.

You are what you eat

A more leftfield industry that could be disrupted by Gen Z is food.

According to many surveys, they’re extremely health conscious and also more likely to buy plant-based foods — the idea behind the fake meat trend.

This could spell opportunity for companies like Beyond Meat Inc [NASDAQ:BYND] who are an early front-runner in this food fad.

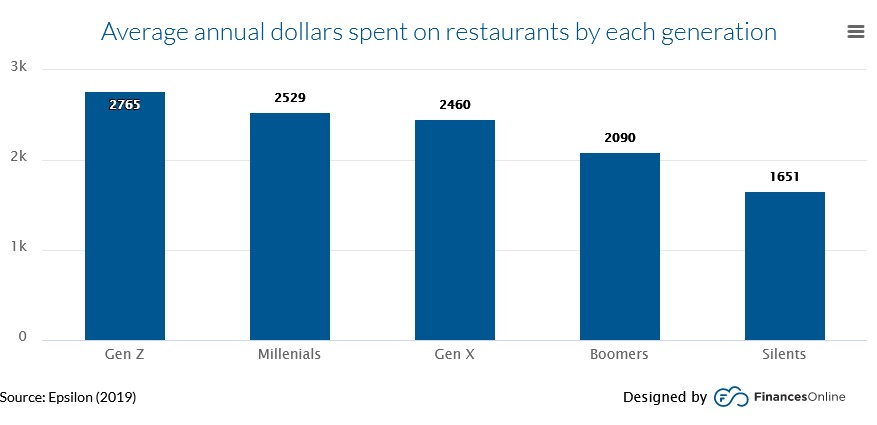

Our young friends also like dining out.

And I mean a lot!

|

|

| Source: Epsilon |

It would appear the old joke about them not being able to afford a house because they’re too busy dining out on smashed avocado breakfasts might have a ring of truth to it!

But if you think beyond investing in an avocado plantation, you could find opportunities in technology companies providing things like restaurant management software.

Or even companies like DoorDash and Uber Eats.

The point is this…

As the election showed, there’s a transition of power taking place. And Gen Z could be the swing voters in a lot of what comes next.

At the political and economic levels.

And whether you like it or not!

But as an investor, the key will be to go with the flow and tap into these new trends as they develop.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments