The results are in, and it looks like we’ll have a Republican victory in the US.

Not surprisingly, markets reacted dramatically to the news.

Check out the huge (downward) move in the Aussie Dollar during yesterday’s trading as soon as Trump’s victory looked assured:

| |

| Source: TradingView |

Meanwhile, copper fell hard overnight due to fears over what a Trump administration might deliver.

Why? Tariffs.

There are deep concerns about how tariffs and China’s manufacturing-led economy will impact commodity demand.

Hence, yesterday’s big sell-down in the AUD.

So, will tariffs become a major blow to commodity demand, or is this an unwarranted fear in the market?

Let’s see.

But a key factor to consider is that tariffs contradict one of Trump’s other big election promises…

That is, keeping inflation low.

So, what will it be?

Accept cheap global goods from China or implement stiff tariffs, driving up the cost of imported goods…and ultimately, inflation in the US economy?

My guess is he’ll lean to whichever policy juices markets the most…

Chest-beating on China certainly grabs voters’ attention, but I doubt this real estate tycoon wants to see a return of high inflation in the US economy.

I suspect we’ll see a vastly trimmed-down version of his hard-hitting election promises on China in the months ahead.

Yet, there is one avenue available to Trump…

Where he can have his cake and eat it too:

Lowering the cost of energy.

This could offset inflationary pressures born from tariffs.

So, how can Trump achieve that?

Well, the US holds the world’s largest oil and gas reserves.

Flooding the global economy with cheap energy could be an inflation-busting strategy.

In fact, this has been another one of Trump’s primary election promises, where he borrowed the line from former Alaskan governor Sarah Palin…Drill, Baby Drill!

The slogan that promises a push for new oil and gas development across the US.

But there’s a problem with that strategy, too…

New supply can’t be turned on with

the flick of a switch

Whether it’s a new mine or an O&G field, finding, developing, and activating a new operation takes years.

Often more than a decade.

In other words, any attempt by Trump to swamp the global market with new supply will come years AFTER his term in office.

Lowering energy prices by increasing supply is not a quick fix.

Whether it’s a mineral deposit or an oil and gas field, new sources are becoming harder to find.

They’re also getting deeper and more difficult and more expensive to develop!

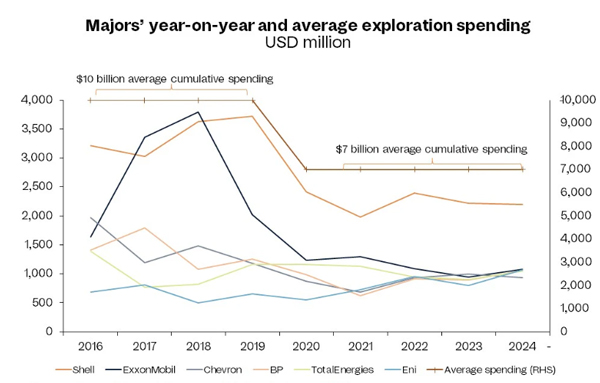

And to make matters worse, spending on exploration in the O&G industry has been in steep decline for years:

| |

| Source: Rystad Energy |

Over the last eight years, average cumulative spending on oil and gas exploration has fallen from US$10 billion to US$7 billion.

As deposits get harder to find, we’re spending less on exploration!

Relatively accessible onshore reserves are being depleted. Future reserves will predominantly be offshore in deepwater basins.

These are far more capital-intensive to develop and operate.

In fact, the only way to make these operations viable is if oil and gas prices rise!

So, why does this present a

monumental challenge?

Despite some attempts to increase supply over the last few years, discovery rates continue to decline in the O&G sector.

According to Rystad’s latest report discovery volumes fell to their lowest level in 2023. That was according to Aatisha Mahajan, vice president at Rystad:

‘Upstream companies [oil producers] are facing a period of uncertainty.

They are eager to capitalise on the increased demand for fossil fuels and find additional resources, but recent results have been lacklustre.

If exploration efforts continue to yield unimpressive results for the remainder of the year, 2023 could be a record-breaker for the wrong reasons.’

All this comes back to the problems I highlighted earlier… Discovery is becoming more difficult.

Flooding the US economy with ‘cheap energy’ to counter inflationary pressures from China tariffs is not a viable option.

But what about robots, won’t they find

us the oil we need?

Okay, let’s make a wild assumption…

Suppose technology and artificial intelligence will rapidly uncover new oil fields over the next few years and deliver Trump’s promise of cheap energy!

Well, even in that unlikely scenario, supply shortages loom.

According to Western Australia’s Department of Energy and Mines, developing new oil fields typically takes at least 10 years.

That includes factoring in permitting, applying for a production license, negotiating with native title parties, negotiating compensation agreements with landholders, feasibility, and financing.

Given the regulatory hurdles against new oil and gas developments, a 10-year development horizon is likely the best-case scenario.

But only once that new deposit has been found!

So, what’s the solution?

In short, there isn’t one.

To make matters worse, Goldman Sachs believes oil demand will rise considerably over the next 10 years, placing further pressure on established oil fields.

According to the investment bank, emerging growth in Asia will increase global oil demand by around 110 million barrels per day by 2034.

Will that be interrupted by tariffs? Well, unless consumerism ends, goods will need to be produced somewhere!

Whether that’s India, Southeast Asia or somewhere else.

In the meantime, capex spending by the world’s six major oil producers, including ExxonMobil and Chevron, has fallen by around $3.8 billion this year.

No doubt, poor appetite toward new developments is being driven by a push to go green. This global mandate has seen capital flood out of O&G exploration and development.

A Trump re-election will certainly make it easier for new developers to access the necessary approvals.

But really, that’s all Trump can do. And that alone won’t drive more supply into the global market.

The promise of cheap energy could come eventually (think a decade or more), but as I said, new supply can’t be turned on like a switch!

So, what’s the solution as an investor?

As the clock ticks and global leaders run out of solutions, you, as an investor, have an opportunity to potentially capitalise on this monumental blunder of ignoring the importance of oil and gas as our primary energy source.

Investing in unloved O&G stocks remains a solid long-term strategy despite promises of flooding the global economy with new supply.

But you can go one better…

Look at those select few companies that have invested in exploration and new development.

As supply runs dry, untapped oil fields could become liquid gold (again)!

As an investor and geologist, that’s what I’m targeting. And there could be some big discounts coming up!

To find out more, click here.

Enjoy!

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments