Shares in junior explorer and aspiring gold producer Oakdale Resources Ltd [ASX:OAR] are trading lower today on the back of its first drilling results from the Lambarson Canyon Gold Project.

The OAR share price exploded in early September upon announcement that drilling had commenced at the Nevada-based project.

Source: Tradingview

However, the share price has remained volatile since.

Today, it seems that the excitement surrounding the Lambarson Canyon Gold Project may have dwindled.

At time of writing the OAR share price is down 7.69% to trade at 2.4 cents per share.

Results pending but share price sinks

The Lambarson Canyon forms part of a larger group of tenements owned by OAR called the Alpine Gold Projects, all located in the state of Nevada.

Nevada is the sixth-largest gold producing jurisdiction in the world and is responsible for 74% of US gold production.

According to OAR, Lambarson Canyon is a potential high-grade gold system with a similar geological setting to the four million-ounce Lone Tree deposit.

Discover why this gold expert is predicting a HUGE spike in Aussie gold stock prices. Download your free report now.

Lone Tree (now closed) was a joint venture owned by Newmont Corp and Barrick Gold.

So, you can see why expectations could be high for such a project.

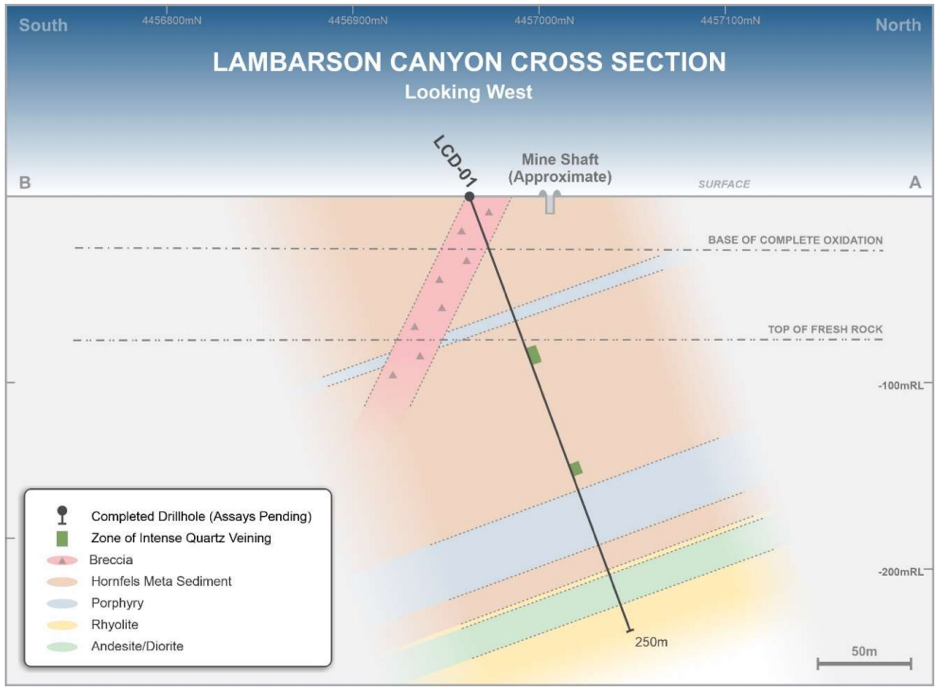

Today, OAR said its first drill hole at the site successfully completed to the target depth of 249.75 metres.

Although, the assay from the lab is still pending.

What’s with the share price then?

There is obviously a bit of disappointment today.

And the more geologically minded may have a better idea as to why.

Let me give you the rundown.

The drill core shows highly broken ground, development of pebble breccias, and multiple porphyry intrusions and zones of quartz veining at depth.

Source: Oakdale Resource

These are all types of formations that can be associated with gold.

But as you can see above, these zones don’t appear to be very large.

Which is what could have caused the share price drop.

Is Oakdale Resources still in with a chance for those four million ounces?

Given this is just the first hole designed to test the structural target zone, which hosts the gold mineralisation, it’s nearly impossible to draw any conclusions.

OAR said initial observations confirm consistency in the target zone.

Drilling is continuing, with hole two now moved 500 metres to the south of the first.

Similar to the first, the second hole will also test geological anomalies.

It’s still early days but if you want to stay updated with developments from some of Australia’s most interesting gold explorers and miners, make sure you subscribe to The Daily Reckoning Australia. It’s a great way to stay ahead of the curve when it comes to Australian gold stocks. It’s free too. Subscribe here.

Kind Regards,

Lachlann Tierney,

For The Daily Reckoning Australia

Comments