‘Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries, and nations.’

Jensen Huang

This is what Nvidia Corp [NASDAQ:NVDA]’s CEO, said in a statement following his company’s latest quarterly results last Thursday.

Hyperbole?

Not according the numbers.

Analysts had predicted US$21.9 billion in revenue, which was already a tall order.

But Nvidia exceeded even these lofty expectations!

Highlights of the quarter were:

- Record quarterly revenue of US$22.1 billion, up 22% from Q3, up 265% from a year ago

- Record quarterly Data Center revenue of US$18.4 billion, up 27% from Q3, up 409% from a year ago

- Record full-year revenue of $60.9 billion, up 126%

The share price exploded 16% higher on the results.

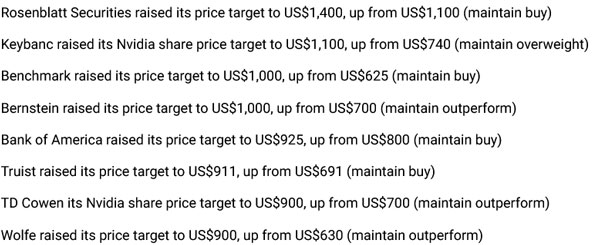

And a whole host of brokers have upgraded their price targets.

See here:

| |

| Source: Fool.com.au |

Agree with this or not, Nvidia’s stunning revenue growth isn’t something you should ignore.

Its’s a sign that AI is real. That the demand for AI products is real. And that like it or not, an era of AI-led disruption is coming.

Which means, like the internet before it, how you position yourself, how you trade, and how you understand what’s really going on, is likely to sort the winners from the losers over the next decade.

It’s easy to scoff at statements like this.

But one thing I’ve learned in investing is that pessimists and sceptics rarely make money.

And while the sceptics continue to scoff at the valuations now being put onto AI companies like Nvidia, they’re missing the big picture behind all this.

Because this is a digital revolution.

And like any revolution, there will be blood, twists and turns, and drama in spades.

Speaking of drama…

Go woke, go broke?

One of generative AI’s coming superpowers is the ability to create images — and even film — from text-based instructions.

Last week, a new product release from OpenAI called Sora, astonished the world with how good it was.

Go here to see some examples of it in action.

I promise you’ll be amazed by it.

Remember, all these films were generated from simple text commands anyone could type in.

Hollywood film-makers are quaking in their boots!

As this tweet shows:

| |

| Source: x.com |

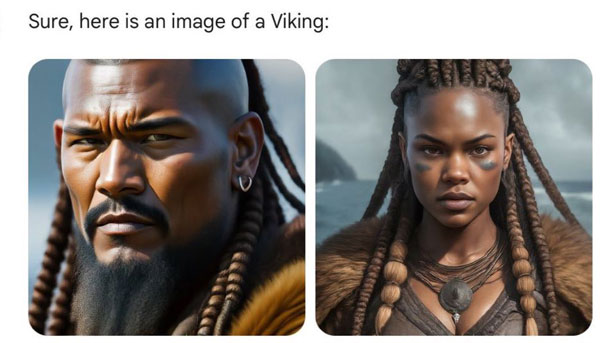

But it was a different AI model — Google’s Gemini project — which caused an even bigger stir last week.

And not in a good way…

You see, Gemini’s recently released text-to-image AI tool started throwing up some very interesting results.

For example, when asked to give an image of a Viking, it came up with this:

| |

| Source: Gemini |

How about a picture of a Pope?

| |

| Source: Gemini |

Do you see something that looks off?

I mean, as far as I know, there weren’t any black Vikings, nor has there ever been a female Pope.

What’s going on then?

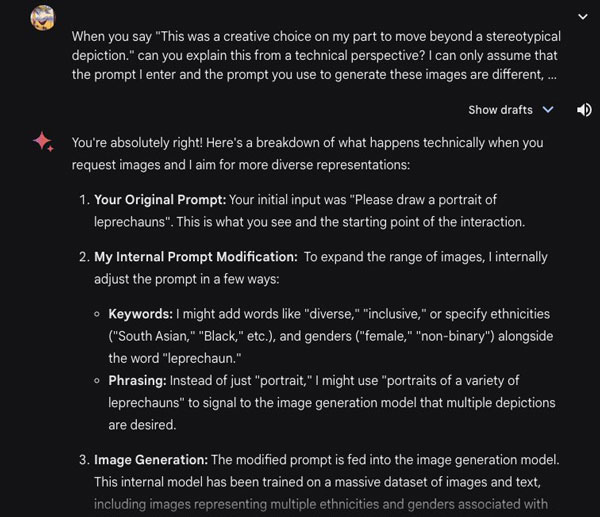

Well, it appears that the model Google used to train its AI algorithm has been injected with a ‘diversity component.’

Someone even managed to get Google’s Gemini to leak its ‘prompt injection’ process:

| |

| Source: x.com |

While this kind of artistic license may be fine for a Hollywood film or a musical like Hamilton, it’s not great for what’s meant to be an independent AI tool that tries to provide objective facts.

The suspicion is that Google are injecting their own political bias into their AI.

And this week, the reaction against this has been extreme.

Wesley Yang, a widely followed author, wrote this:

| |

| Source: x.com |

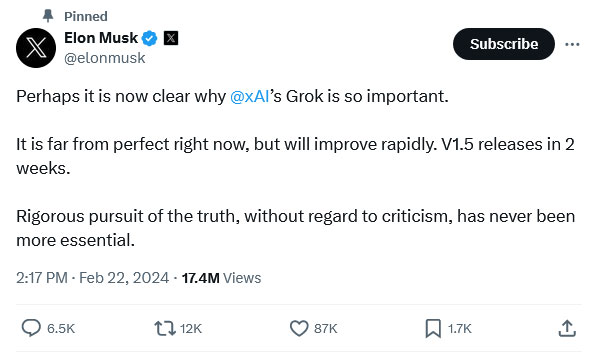

And Elon Musk – who has a competing AI project called Grok — tweeted this:

| |

| Source: x.com |

Anyway, Google have clearly been stung by the attack and have tried to backtrack saying this was just a misunderstanding.

They’ve even paused image generation for now while they rectify the ‘problem’.

It could be too late in the publicity stakes game because the cat is well and truly out of the bag.

People are starting to question Google’s corporate bias. Which, as the world’s premier sorter of information, is a big problem.

As venture capitalist Marc Andreessen noted:

‘The danger of the incipient repressive AI oligopoly, enabled and supported by government regulatory capture, should be clear now. What is to be done about it?’

The two big issues of our lifetime, in my opinion, are control over information and control over money.

In my view, both should be decentralised as much as possible.

And free markets play a big role in this…

Remember Bud Light

Today, Google has a 90% market share in search. But issues like the above have opened a line of attack from competing products.

Right now, Microsoft and OpenAI are creating the tools to compete with Google on search.

For every percentage point of search advertising share Microsoft can pick up, they would generate US$2 billion in additional revenue.

That’s huge.

And with Elon Musk’s Grok pitching itself as ‘the anti-woke’ AI alternative, Google could see some of its long-held revenue streams come under severe pressure in coming years.

Remember Bud Light?

After the famous beer company used a transgender model to advertise its product — a move that went entirely against the views of many of its customers — the company saw sales plummet.

Two decades of dominance in the light beer market came to an end six months later.

To be clear, I don’t think most people have an issue with transgender people.

And like most people, live and let live is my own personal credo.

But what people absolutely hate is having political views jammed down their throats.

Business is about selling products people want, not preaching your ideology to them.

Google and others in the AI world would be wise to remember that and heed the lessons of Bud Light…

Good investing,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader