The Nuix Ltd’s [ASX:NXL] share price fell as Nuix reported a 107% drop in net profit after tax on a statutory basis.

NXL shares are currently trading at $2.59 per share, down 9.76%.

The stock has lost much of its value since its ASX float in December 2020.

NXL shares climbed to an all-time high of $11.05 per share on 22 January, before falling to $2.59.

NXL FY21 performance

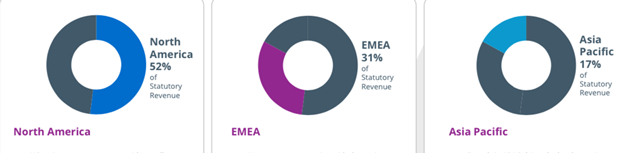

Statutory and Pro Forma Revenue climbed a mere 0.1% to $176.1 million from $175.9 million on a functional currency basis, and 7.4% on a constant currency basis.

New businesses contributed $27.6 million to the revenue while subscription-based revenue rose 93% of the total revenue.

Statutory and Pro Forma Gross Profit increased 1.3% to $157.2 million from $155.2 million.

Statutory EBITDA was down 52.1% to $30.2 million while statutory NPAT sank a substantial 107%.

This meant Nuix reported a net loss after tax of $1.6 million, down from a net profit of $23.6 million in FY20.

NXL did manage to end the financial year with $70.9 million in cash, up from $38.5 million in FY20.

The company also boosted gross margin increased to 89.3%, up from 88.2% in FY20.

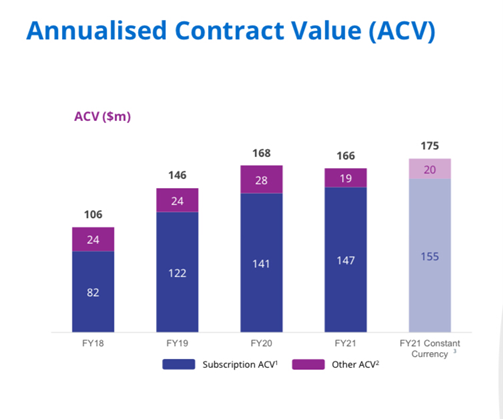

Annualised Contract Value (ACV) also grew by 4.1% on a constant currency basis.

PS: These five AI stocks could potentially follow in the footsteps of BrainChip’s meteoric 3,133% price spike. Click here to learn why.

Subscription ACV, generally recurring in nature, rose 10.3% on FY20 in constant currency.

This rise was complemented by a strong rise in consumption (including SaaS) licenses.

Due to increasing customer demand, consumption ACV grew by 22% in constant currency, with SaaS consumption ACV up 20% in constant currency.

Total SaaS customers had increased to 112, up from 71 in the prior corresponding period.

Customer churn continued to track lower, to 3.7% for the full year, highlighting the ‘stickiness of Nuix’s diversified customer base.’

Nuix attracted 100 new customers over the course of 12 months, with average order value rising to $240K.

This was primarily driven by higher value wins through a focus on enterprise sales.

Furthermore, customers continued to willingly enter into multi-year deals, with these contracts climbing to 36.3% of revenue for the full year.

Total expenditure dedicated to Research & Development (R&D) stood at $44.3 million, or 25% of revenue.

It is predicted that R&D spend will increase in FY22.

What’s next for the Nuix Share Price?

Nuix said today that further investments will be made to the ‘cloud beyond the Discover SaaS offering’.

Nuix also plans to pace-up its product development pipeline backed by increased investments in R&D.

The company plans to build and enhance its Sales and Distribution capability.

Source: Company’s presentation

Source: Company’s presentation

Now, while Nuix is under selling pressure this year, it is clear that the disruptive uses of technology like AI and machine learning is only set to grow.

The key rests in finding businesses best placed to leverage these technological advancements.

That’s why I recommend reading the latest briefing from our resident market expert Murray Dawes.

He just put out a report profiling seven ASX small-caps he thinks have great potential to disrupt large industries with their innovative ideas.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here