Novatti Group Ltd’s [ASX:NOV] share price is up 5% after its integration with Ripple is now live and generating transactions to the Philippines.

Today’s announcement marks the first monetisation of Novatti’s partnership with Ripple.

Novatti stated that discussions are also underway to add further South East Asia clients to the service.

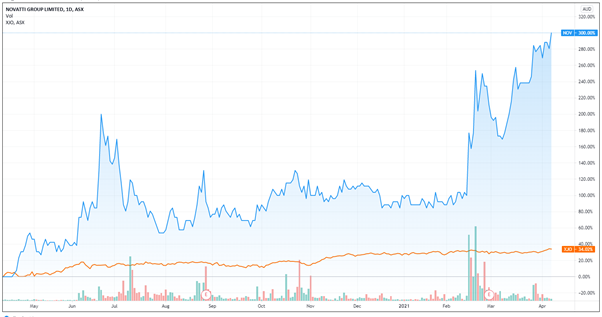

The NOV share price is up 100% year-to-date and up 300% over the last 12 months.

Novatti and Ripple background

Novatti is a digital banking and payments company. It offers fintech, billing, and business automation platforms.

Its payment services include card issuing, merchant acquiring, payment processing and settlements.

Ripple is an enterprise blockchain company specialising in payment solutions.

Ripple’s decentralised financial network — RippleNet — allows users to process global payments instantly.

RippleNet uses distributed ledger technology to deliver its financial products, which range from bi-directional messaging, settlement, liquidity management and lines of credit.

Three Ways to Invest in the Renewable Energy Boom

RippleNet also provides access to the digital asset XRP, a cryptocurrency currently valued at over US$40 billion.

Novatti and Ripple integration live in the Philippines

Announced last December, the partnership between Ripple and Novatti is now live.

As Novatti explained, the initial objective of the partnership was cross-border transactions between Australia and the South-East Asia region, focusing on the Philippines.

Novatti today confirmed that this focus is now delivering new customers, with the company partnering with iRemit through RippleNet.

According to Novatti, iRemit is the Australian subsidiary of the Philippines’ ‘largest non-bank, Filipino-owned, remittance service provider.’

Novatti expects to process ‘several thousand’ transactions per month through RippleNet as a result of the partnership.

The company pointed out that in addition to Ripple, Novatti’s other partnerships include Visa, Apple Pay, Alipay, UnionPay International, Google Pay, Samsung Pay, Marqeta, and Decta.

Novatti share price outlook

When the company first announced the partnership with Ripple, Novatti Managing Director Peter Cook said that ‘we aim to deliver increased transaction volumes and revenue growth for Novatti’s core payment processing business.’

As Afterpay’s rise can attest, rapid transaction volume and revenue growth is crucial for junior fintech stocks.

Investors may overlook bottom line performance if they can see continuous top line growth.

In its latest half-year update, Novatti recorded a sales revenue of $7.35 million, up 49% year-on-year.

Its core payment processing business, referred to by Managing Director Peter Cook, delivered $4.3 million of half-year sales revenue, a modest increase of 12.5% on the previous half but more than 59% year-on-year.

Investors will likely welcome partnerships with global firms such as Ripple and today’s share price jump suggests investors are positive on Novatti’s progress.

That said, investors may be monitoring how lucrative of a revenue stream the Ripple partnership proves to be.

Today’s release did not cite any concrete transaction figures, only mentioning that the Ripple integration is ‘generating transactions to the Philippines.’

Novatti also stated that ‘revenue from this partnership is dependent on take-up of the services.’

Fintech is a growing sector, bringing together new technologies to offer new payment solutions.

If you are interested in fintech and the potential of fintech stocks, then I recommend reading this free report.

It discusses Novatti and two other innovative Aussie fintech stocks with exciting growth potential. Download the free report here.

Regards,

Lachlann Tierney,

For Money Morning

Comments