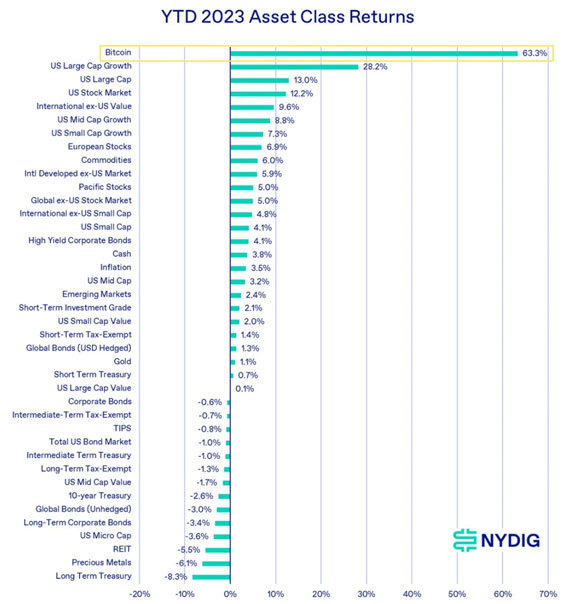

This table of 2023 returns sorted by asset class is very interesting.

Check it out:

|

|

| Source: NYDIG |

Top of the table?

Bitcoin with a 63% year to date return (probably more after this weekend’s surge).

Worst performing asset this year?

US government bonds — the ‘risk-free’ asset that underpins the entire financial system!

Can you believe it?!

I’m pretty sure no one in mainstream finance had this on their 2023 bingo card. They’re probably all scratching their heads right now trying to make sense of it.

And yet, it makes perfect sense when you understand what’s really going on…

A return to scarce money

Get this…

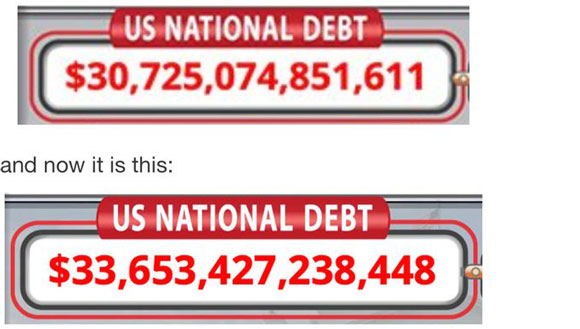

The US government added US$3 trillion in debt — or 10% — to the bill over the past 12 months:

|

|

| Source: Debt Clock |

The trend over time is only going one way.

Up!

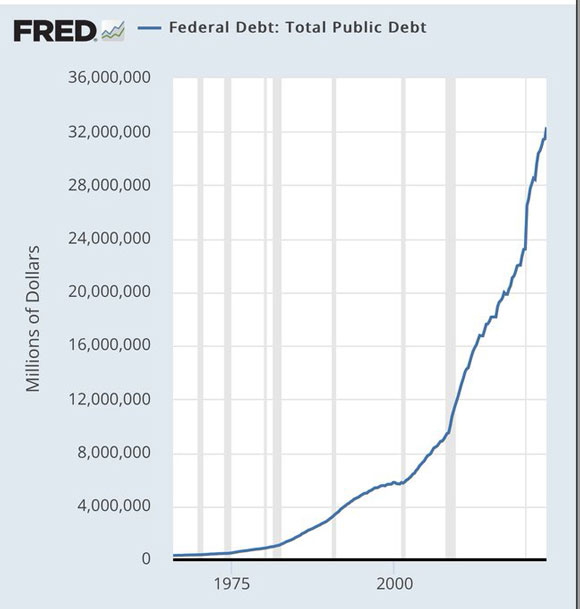

Check it out here:

|

|

| Source: FRED |

There’s no going back…

This debt monstrosity will turn into US$50 trillion, then US$100 trillion, and more…because there’s no political will to rein in budget deficits.

They’re too scared they’ll crash the economy, so they’re trying the sneaky trick of currency debasement to do the job for them.

If you can make your money worth less (more accurately, worthless!), then the debt load falls in real terms too.

But that won’t let us plebs off the hook.

As self-proclaimed ‘reformed hedge fund manager’ James Lavish put it:

‘Because real GDP will not match this exponential rise in debt, the only way to keep up with the interest payments is to fake that productivity through money expansion and inflation. And so, *you* will ultimately pay for it.’

This is a tale as old as time…

The Romans resorted to clipping their metal coins over 2,000 years ago when times were tough, turning 10 coins into 11.

And England’s Henry the 8th was almost as famous for his currency manipulation as he was for his many wives.

He earned the nickname ‘Old Copper Nose’ after reducing the silver content of the country’s coins, replacing it with much cheaper copper.

The problem?

Henry’s nose protruded slightly off the edge of the coin resulting in the silver façade being gradually rubbed off in people’s pockets.

And eventually Henry’s nose turned from silver to copper, exposing the lie!

Anyway the point is, there’s no real difference between the Romans, Henry the 8th and what the US government is doing today.

These days, they use accountancy tricks, but it’s the same goal — to debase the value of money.

And it’s why Bitcoin — a decentralised currency with a fixed supply of 21 million that can’t be debased — is soaring in comparison.

Over the weekend it surged back above US$30,000 (AU$47,000).

And the chart is shaping up nicely:

|

|

| Source: Coingecko |

But it’s not the only asset surging as fiat money fails …

Money flows into gold too

The original money, gold, has also been on a tear of late.

Gold priced in Australian dollars hit fresh record highs on Friday.

|

|

| Source:Trading View |

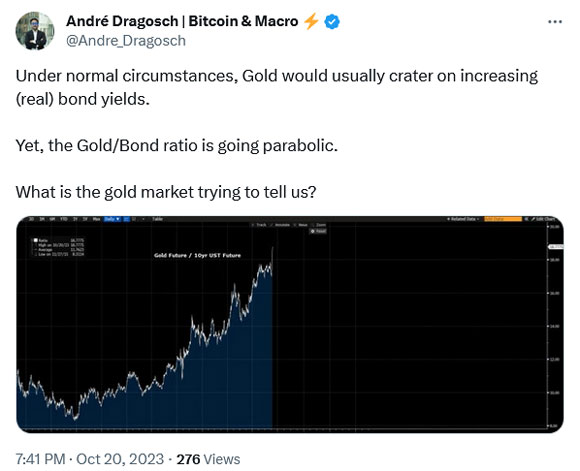

The move in gold has surprised traditional finance almost as much as the move in Bitcoin.

Rising rates usually see a fall in gold by comparison.

Not this time.

|

|

| Source: Twitter |

What indeed!

My take?

I think we’re seeing trust in fiat currency falter on the back of unsustainable US debt.

I mean, who cares about a 5% return if the money supply of US dollars is growing at 10% per year.

By comparison, Gold and Bitcoin represent alternate monetary paradigms defined by scarcity.

And we’re seeing investors all over the world start to dump fiat currency for real money.

The World Gold Council reported that central banks themselves bought 38% more gold in August than July.

China, Poland, and Turkey headed the list of buyers.

It only makes sense that investors are looking for ‘safer’ assets to put their excess funds into.

And Bitcoin is now on at that list too.

Amazingly, even the head of Blackrock, Larry Fink, was on TV last week calling Bitcoin ‘a flight to quality’ asset!

Not something I expected to hear in 2023.

Incidentally, Blackrock have been the driving force behind a spate of new Bitcoin spot ETF applications this year.

And as I wrote to subscribers of my Crypto Capital service last week, it shows the tide is changing on Bitcoin in the mainstream finance industry:

‘The ‘Larry Fink’s’ of the world are slowly starting to get it.

‘They know fiat is in terminal decline.

‘And while they’ll try to eke out every last dollar they can from the existing system, they also want to make sure they have a seat at the table for what comes next.

‘The flight to quality — to Bitcoin — has begun in earnest…!’

In my opinion, the mirage of fiat money is slowly fading. People are realising they need real money that can’t be debased.

And that story will underpin both gold and Bitcoin through 2024 in my opinion.

But people are also realising they need real assets too.

And at its core that means energy assets…

Even the US government are bailing out

On Friday, the Department of Energy announced they’d buy crude oil at US$79 per barrel through to May 2024.

With oil trading at US$90 as I type, I’m not sure that bid is high enough to do the trick.

And where is that money coming from, you might ask?

More debt!

As macro-analyst Luke Gromen put it, the US government are trying to dump their worthless fiat for real assets just as much as anyone else.

He tweeted:

|

|

| Source: Twitter |

Here’s the thing…

When money becomes worthless, the price of real assets like energy soar.

So in a weird way, the worse things get in the economy, the more probable oil goes higher.

Believe me, an oil price surge into a slowing economy would surprise everyone.

But as 2023 showed, when fake money slushes around a market for too long, eventually real assets start to command a premium.

And right now, that means Bitcoin, oil, and gold are three key assets to own going into 2024 in my opinion.

Good investing,

|

Ryan Dinse,

Editor, Money Morning