Jerome Powell and his fellow Fed heads are hunkered down for their big meeting today and tomorrow. Caught between a rock and a hard place, the Fed has to decide. Consumer prices are rising at a politically uncomfortable rate — almost 8% per year. But the stock market is wobbly…and threatens to crash.

What to do?

Nothing! Or as close to nothing as it can get away with. This week, the Fed will almost certainly announce a tiny 0.25% increase in its key lending rate…bringing it (adjusted for inflation) to MINUS 7.4%.

To get our bearings, we note that if you’re going to stop price increases, you have to lend money at a higher rate than the inflation rate, not below it. An inflation-killing move equivalent to what Paul Volker did in 1980 would put the Fed rate at PLUS 10% — or 1,740 basis points higher than it is today. And if the Fed continues its baby steps to nowhere approach, raising the key rate by a quarter-point per trimester, it will take 17 years to get there…or until 2039. By that time, the dollar and the world’s US-dominated money system will be long forgotten.

‘Inflate or Die’? On a scale of 10, we rate the Fed’s chances to mount a serious fight against inflation at one.

Fed Chief Jerome Powell says he is just being cautious. What with a war going on and all…he didn’t want to introduce more ‘uncertainty’.

What to make of it? Sarcasm offers the only relief.

Gladiators, fight!

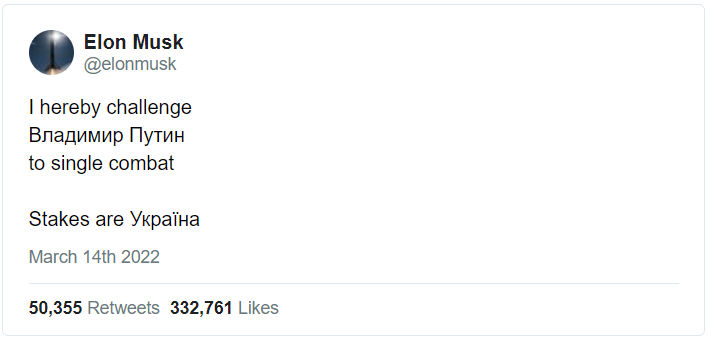

Elon Musk has proposed what must be the best solution to the Russo-Ukraine war. He challenged Putin to a ‘single combat’ to settle the issue:

|

|

| Source: Twitter |

It is absurd, of course. But it would be a great way to end the war. Imagine the box office! Billions could be raised from selling tickets to the event or online viewing. The money then could be used to repair the damage.

And if Putin wins, he gets what he wants without more bloodshed. If Musk wins, whatever he wants…well, who knows? But it’s not likely to be worse than what is happening now.

So far, no word from the Kremlin about whether the challenge has been accepted. So, the bombing, shelling, killing, sanctioning, and spending goes on…in Ukraine, in Yemen, in Afghanistan…and all over the world.

But why? Why is money taken from Americans to be used to kill Russians, Yemenis, or Afghanis? Why is money taken from Russian civilians without due process? (What kind of kangaroo court would condone taking money away from people who had done nothing wrong?)

Here at the Letter, money is our beat. Money is made by producing goods or delivering services — such as providing gas to Europeans — and thereby satisfying customers. But politics intrudes…and the money vanishes.

‘You’re either with us or against us’, George W Bush said of the War on Terror. There was no middle ground…no room for compromise…no other side to the story.

You’re either vaccinated…or you’re causing the ‘pandemic of the unvaccinated’, said Joseph Biden, even though vaccinated people — such as your editor — got the COVID too.

And now…even suggesting another side to the story marks you as a ‘Russian asset’.

Yesterday, the Financial Times cited the case of India. The fact that it has not come out four-square in favour of the ‘Western allies’, could ‘imperil relations with the US’.

Holy fantasies

This train is bound for glory; everyone is meant to get onboard. But getting on-board with the sanctions war against Russia means getting off-board with other fads and fashions of the elite. Until a few weeks ago, for example, fossil fuels were the devil’s work and investors were proudly displaying their contempt for weapons manufacturers.

‘A nasty business…with nasty clients…and nasty results’, we put words in their mouths. In the ESG (Environmental, Social, Governance) world, investing in energy or weapons was a no-no. Making the world a better place was the goal, even if it meant lower profits.

But now they’ve all signed on to the ‘Ukraine-as-Holy Land’ fantasy and suited up for battle. Suddenly, the war on CO2 has disappeared from the headlines, and ‘defence’ is no longer a bad word:

‘“Ukraine is one of the most important ESG issues we’ve ever had,” said Philippe Zaouati, chief executive of Mirova, the $30 billion sustainable-investing unit affiliated with Natixis Investment Managers. “It’s a vital issue for energy and human rights, and questions whether we still want to live in a democracy or not.”’

Really? Is that what it’s all about? Is that what we’re fightin’ for?

Is democracy at stake? Is that the reason to switch from saving the planet to saving the Ukraine?

But Mr Putin has shown no sign of wanting to end the Ukrainian democracy; instead, he seems to want to increase it by allowing the Eastern provinces to elect their own leaders. As for the rest of it, he insists only that it remains neutral. Thinking strategically, he doesn’t want any NATO missiles hard against his southern flank. How this poses a risk to democracy, we don’t know. Was Mexico to announce that it was allowing China or Russia to put their missiles on the south side of the Rio Grande…how long would it take the US to launch an invasion? Mexico’s democracy be damned!

But that’s the nice thing about politics. Nothing is ever marked to market. You can believe anything you want. And since you can fool most of the people most of the time, you’re almost always able to get the yahoos behind you.

Alas, fooling people causes foolish people to do foolish things.

Tune in tomorrow for more on the foolishness surrounding us all.

Regards,

|

Bill Bonner,

For The Daily Reckoning Australia